Attorney-General's Department documents released under FOI22/171

Page 1 of 48

Attorney-General's Department documents released under FOI22/171

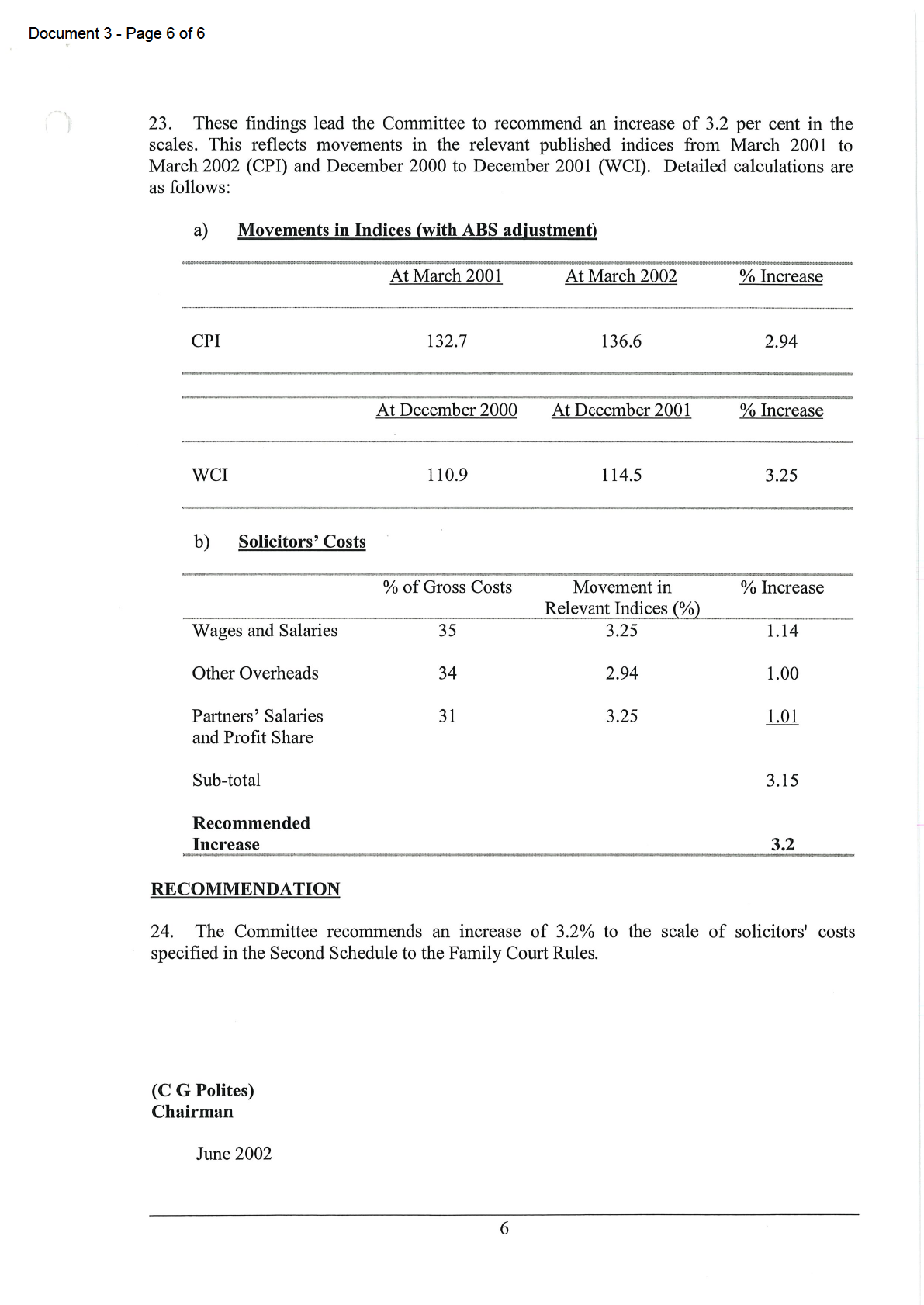

Page 2 of 48

Attorney-General's Department documents released under FOI22/171

Page 3 of 48

Attorney-General's Department documents released under FOI22/171

Page 4 of 48

Attorney-General's Department documents released under FOI22/171

Page 5 of 48

Attorney-General's Department documents released under FOI22/171

Page 6 of 48

Attorney-General's Department documents released under FOI22/171

Page 7 of 48

Attorney-General's Department documents released under FOI22/171

Page 8 of 48

Attorney-General's Department documents released under FOI22/171

Page 9 of 48

Attorney-General's Department documents released under FOI22/171

Page 10 of 48

Attorney-General's Department documents released under FOI22/171

Page 11 of 48

Attorney-General's Department documents released under FOI22/171

Page 12 of 48

Attorney-General's Department documents released under FOI22/171

Page 13 of 48

Attorney-General's Department documents released under FOI22/171

Page 14 of 48

Attorney-General's Department documents released under FOI22/171

Page 15 of 48

Attorney-General's Department documents released under FOI22/171

Page 16 of 48

Attorney-General's Department documents released under FOI22/171

Page 17 of 48

Attorney-General's Department documents released under FOI22/171

Page 18 of 48

Attorney-General's Department documents released under FOI22/171

Page 19 of 48

Attorney-General's Department documents released under FOI22/171

Page 20 of 48

Attorney-General's Department documents released under FOI22/171

Page 21 of 48

Attorney-General's Department documents released under FOI22/171

Page 22 of 48

Attorney-General's Department documents released under FOI22/171

Page 23 of 48

Attorney-General's Department documents released under FOI22/171

Page 24 of 48

Document 5 - Page 1 of 6

FEDERAL COSTS ADVISORY COMMITTEE

NINETEENTH REPORT ON SOLICITORS' COSTS

UNDER THE HIGH COURT RULES

PRELIMINARY

1.

This is the Nineteenth Report of the Federal Costs Advisory Committee on solicitors'

costs in the High Court of Australia.

2.

The present scale is contained in the Second Schedule of the High Court Rules. The last

amendment to this scale took effect on 1 October 2002 following the adoption of the

Eighteenth Report by this Committee which recommended an increase of 3.2 per cent in the

scale of costs. The recommendation took into account the Consumer Price Index (CPI) at

June 2003; and the Wage Cost Index (WCI) at June 2003 published by the Australian Bureau

of Statistics (ABS).

3.

The Committee is comprised of the following members:

a) The Hon Brian Lacy (Chairman),

b) Mr D A Crawford,

c) Mr D C D Harper,

d) Mr B McMillan,

e) Mr M Minogue, and

f) Mr W D K Teasdale.

4.

By an advertisement placed in the

Australian Financial Review on 1 August 2003 and

in

The Weekend Australian of 2 August 2003, the Committee invited interested persons and

organisations to forward written submissions to the Committee Secretary by 22 August 2003.

The Committee did not meet in 2003. The Committee held a public hearing on 1 September

2004.

SUBMISSIONS

5.

The Law Council of Australia (LCA) made the only substantive submission to the

Committee. The LCA made a submission in August 2003, and a subsequent submission on

26 August 2004. The LCA made an oral submission to the Committee in the hearing on

1 September 2004. The LCA welcomed the new chair and expressed its appreciation for the

tremendous contribution made by the former Chairperson, the late Senior Deputy President

Polites, in the Committee’s proceedings and work over many years.

1

Attorney-General's Department documents released under FOI22/171

Page 25 of 48

Document 5 - Page 2 of 6

The LCA’s substantive submissions are summarised below:

a) Approach

The LCA recommended the Committee maintain the current approach for the

adjustment of fee scales.

b) Weightings

The LCA recommended the following formula weightings:

Salaries and Wages

38%

Other Overheads

32%

Partners’ Salaries and Profit Share 30%

c) Calculations

The LCA:

(i)

supported the continued use of the ABS WCI for salaries and wages and

partner’s salaries and profit share and the net income components of

solicitors’ costs

(ii)

supported the continued use of the ABS WCI ‘ordinary-time hourly rates

of pay including bonuses’ index

(iii) supported the continued use of the CPI as the primary index for the

adjustment of the “Other Overheads” component

(iv) opposed discounting of the CPI by reference to the Constant Tax Rate

Measure (CTRM) adjustment of the CPI.

d) Superannuation Guarantee Levy (SGL)

The LCA sought an adjustment by reference to the 1% increase in the SGL

effective from 1 July 2002.

e) Professional Indemnity Insurance

The LCA asked that the Committee note the potential impact of increasing

professional indemnity insurance premiums on solicitor’s overheads. The LCA

referred to a report commissioned by the Australian Government from the

Australian Competition and Consumer Commission entitled ‘Public Liability and

Professional Indemnity Insurance – Third Monitoring Report’ (July 2004) and

recommended an increase of 2.04% to the Other Overheads component to reflect

the increase in professional indemnity insurance premiums.

f)

Adjustment

The LCA recommended an increase of 10.2% in the scale of fees.

2

Attorney-General's Department documents released under FOI22/171

Page 26 of 48

Document 5 - Page 3 of 6

TERMS OF REFERENCE

6.

The Committee noted the revised terms of reference approved by the former

Attorney-General on 29 April 2002, noting the inclusion of the Federal Magistrates Service,

the exclusion of ACT Courts, and the incorporation of Bankruptcy Costs into the general

Federal Court scale.

CONSIDERATION OF THE ISSUES

Scope of the Committee’s Power

7.

The Terms of Reference of the Committee confine it to advising Commonwealth Courts

on:

“. . .variations in the quantum of costs for solicitors (including expenses and fees for

witnesses) which should be fixed in the rules and regulations for which they are

respectively responsible.”

8.

The Committee noted, as it had in the past, that any increase in scales will impact on

consumers of legal services. However, the terms of reference of the Committee contain the

following provisions:

a)

that the Committee is to have regard to the reasonable expenses incurred by

solicitors in the conduct of their practices and the need for them to recover, in

full, increases in these expenses; and

b)

the need for solicitors’ costs to be consistent with a reasonable return on

capital and to provide appropriate recognition of professional skills.

General Approach of the Committee

9.

The Committee considered it should maintain its longstanding approach to adjustment

of the Scales of Costs in accordance with a formula reflecting movements in salary and

wages, other overheads and an appropriate return for principals in legal practice.

Weighting of Components

10. The Committee accepted the submission by the LCA that ABS statistical information

supports a change in the weightings allocated to components of the formula for the purposes

of calculating recommended increases in fee scales. The validity of changing the weightings

was confirmed to the satisfaction of the Committee.

11. The weightings are:

a) Salaries and Wages:

38%;

b) Other Overheads:

32%; and

c) Partners’ Salaries and Profit Share:

30%.

3

Attorney-General's Department documents released under FOI22/171

Page 27 of 48

Document 5 - Page 4 of 6

Formula Indices

Wage Cost Index

12. The Committee agreed to continue with the use of the WCI for calculation of the wages

& salaries and profit share component of the formula. The WCI, reflecting ordinary time

rates of pay including bonuses, was adopted in the Sixteenth Report. The Committee is

satisfied that this index is conceptually satisfactory despite its potential for some volatility.

The material put to the Committee suggests that volatility was not a problem in the period

under review.

13. The most recent data available is the WCI for the June Quarter 2004.

The CPI

14. The LCA raised the issue of the use of the CTRM following the introduction of the New

Tax System. The LCA noted that the Committee’s 18th Report recommended reverting to the

use of the unadjusted CPI figure in relation to the calculation of the ‘other overheads’

component. The LCA recommended the continued use of that approach. The Committee

agreed with the LCA recommendation.

15. The CPI for the June Quarter 2004 is the most recent data available.

Superannuation Guarantee Levy (SGL)

16. The Committee accepted the submission of the LCA that an adjustment should be made

to the Wages and Salaries component to reflect the 1% increase in the SGL, operative from

1 July 2002.

Professional Indemnity Insurance

17. The Committee noted the material provided by the LCA concerning the likely

continuing increase of professional indemnity insurance premiums.

18. The Committee acknowledged the LCA’s concerns. The evidence established to the

satisfaction of the Committee that an allowance for this item is justified. While noting the

difficulty in calculating with precision the value of the increase the Committee accepted the

formula that was advanced by the LCA in its submission that an adjustment should be made

in the Other Overheads Component to reflect the increase of approximately 0.93% of the total

costs for legal practices. Expressed as a proportion of the elements of all other legal practice

costs in the Other Overheads Component the increase in professional indemnity costs is 2.04

per cent.

19.

The Committee noted the transient nature of the rise and fall in Professional Indemnity

Insurance and considered it as a special item in the Other Overheads Component for the

purpose of this review. Professional Indemnity Insurance will not be included as a permanent

element of the Other Overheads Component, but may be revisited in the event of any future

significant rise or fall.

4

Attorney-General's Department documents released under FOI22/171

Page 28 of 48

Document 5 - Page 5 of 6

SUMMARY OF FINDINGS

19. The Committee:

a) affirms its general approach to adjustment of the scales,

b) is satisfied that no discount to the CPI for the second round effect of the New Tax

System is necessary, and

c) acknowledges the LCA’s concern regarding professional indemnity insurance

premiums.

20. These findings lead the Committee to recommend an increase of 10.2 per cent in the

scales. This reflects movements in the relevant published indices from March 2002 to

June 2004 for CPI and from December 2001 to June 2004 for WCI. Detailed calculations are

as follows:

a)

Movements in Indices (with ABS adjustment)

At March 2002

At June 2004

% Increase

CPI

136.6

144.8

6.00

At December 2001

At June 2004

% Increase

WCI

114.5

124.3

8.56

b)

Solicitors' Costs

% of Gross Costs

Movement in

% Increase

Relevant Indices (%)

Wages and Salaries

38

9.56

3.63

(2002 – 35%)

(reflects WCI plus

1.00% for additional

Superannuation

Guarantee

adjustment)

Other Overheads

32

6.00

3.96

(2002 – 34%)

(reflects CPI plus

2.04% for

Professional

ndemnity Insurance

Premium

Adjustment)

5

Attorney-General's Department documents released under FOI22/171

Page 29 of 48

Document 5 - Page 6 of 6

Partners’ Salaries

30

8.56

2.57

and Profit Share

(2002 – 31%)

Sub-total

10.16

Recommended

Increase

10.2

RECOMMENDATION

21. The Committee recommends an increase of 10.2 percent to the scale of solicitors' costs

specified in the Second Schedule to the High Court Rules.

B J Lacy

Chairman

22 September 2004

6

Attorney-General's Department documents released under FOI22/171

Page 30 of 48

Document 6 - Page 1 of 6

FEDERAL COSTS ADVISORY COMMITTEE

NINETEENTH REPORT ON SOLICITORS' COSTS

UNDER THE FAMILY LAW ACT 1975

PRELIMINARY

1.

This is the Nineteenth Report of the Federal Costs Advisory Committee on solicitors'

costs in the Family Court of Australia.

2.

The present scale is contained in Schedule 3 to the Family Law Rules made under the

Family Law Act 1975. The last amendment to this scale took effect on 29 March 2004

following the adoption of the Eighteenth Report by this Committee which recommended an

increase of 3.2 per cent in the scale of costs. The recommendation took into account the

Consumer Price Index (CPI) at June 2003; and the Wage Cost Index (WCI) at June 2003

published by the Australian Bureau of Statistics (ABS).

3.

The Committee is comprised of the following members:

a) The Hon Brian Lacy (Chairman),

b) Mr D A Crawford,

c) Mr D C D Harper,

d) Mr B McMillan,

e) Mr M Minogue, and

f) Mr W D K Teasdale.

4.

By an advertisement placed in the

Australian Financial Review on 1 August 2003 and

in

The Weekend Australian of 2 August 2003, the Committee invited interested persons and

organisations to forward written submissions to the Committee Secretary by 22 August 2003.

The Committee did not meet in 2003. The Committee held a public hearing on 1 September

2004.

SUBMISSIONS

5.

The Law Council of Australia (LCA) made the only substantive submission to the

Committee. The LCA made a submission in August 2003, and a subsequent submission on

26 August 2004. The LCA also made an oral submission to the Committee in the hearing on

1 September 2004. The LCA welcomed the new chair and expressed its appreciation for the

tremendous contribution made by the former Chairperson, the late Senior Deputy President

Polites, to the Committee’s proceedings and work over many years.

1

Attorney-General's Department documents released under FOI22/171

Page 31 of 48

Document 6 - Page 2 of 6

The LCA’s substantive submissions are summarised below:

a) Approach

The LCA recommended the Committee maintain the current approach for the

adjustment of fee scales.

b) Weightings

The LCA recommended the following formula weightings:

Salaries and Wages

38%

Other Overheads

32%

Partners’ Salaries and Profit Share 30%

c) Calculations

The LCA:

(i)

supported the continued use of the ABS WCI for salaries and wages and

partner’s salaries and profit share and the net income components of

solicitors’ costs

(ii)

supported the continued use of the ABS WCI ‘ordinary-time hourly rates

of pay including bonuses’ index

(iii) supported the continued use of the CPI as the primary index for the

adjustment of the “Other Overheads” component

(iv) opposed discounting of the CPI by reference to the Constant Tax Rate

Measure (CTRM) adjustment of the CPI.

d) Superannuation Guarantee Levy (SGL)

The LCA sought an adjustment by reference to the 1% increase in the SGL

effective from 1 July 2002.

e) Professional Indemnity Insurance

The LCA asked that the Committee note the potential impact of increasing

professional indemnity insurance premiums on solicitor’s overheads. The LCA

referred to a report commissioned by the Australian Government from the

Australian Competition and Consumer Commission entitled ‘Public Liability and

Professional Indemnity Insurance – Third Monitoring Report’ (July 2004) and

recommended an increase of 2.04% to the Other Overheads component to reflect

the increase in professional indemnity insurance premiums.

f)

Adjustment

The LCA recommended an increase of 10.2% in the scale of fees.

2

Attorney-General's Department documents released under FOI22/171

Page 32 of 48

Document 6 - Page 3 of 6

TERMS OF REFERENCE

6.

The Committee noted the revised terms of reference approved by the former

Attorney-General on 29 April 2002, noting the inclusion of the Federal Magistrates Service,

the exclusion of ACT Courts, and the incorporation of Bankruptcy Costs into the general

Federal Court scale.

CONSIDERATION OF THE ISSUES

Scope of the Committee’s Power

7.

The Terms of Reference of the Committee confine it to advising Commonwealth Courts

on:

“. . .variations in the quantum of costs for solicitors (including expenses and fees for

witnesses) which should be fixed in the rules and regulations for which they are

respectively responsible.”

8.

The Committee noted, as it had in the past, that any increase in scales will impact on

consumers of legal services. However, the terms of reference of the Committee contain the

following provisions:

a)

that the Committee is to have regard to the reasonable expenses incurred by

solicitors in the conduct of their practices and the need for them to recover, in

full, increases in these expenses; and

b)

the need for solicitors’ costs to be consistent with a reasonable return on

capital and to provide appropriate recognition of professional skills.

General Approach of the Committee

9.

The Committee considered it should maintain its longstanding approach to adjustment

of the Scales of Costs in accordance with a formula reflecting movements in salary and

wages, other overheads and an appropriate return for principals in legal practice.

Weighting of Components

10. The Committee accepted the submission by the LCA that ABS statistical information

supports a change in the weightings allocated to components of the formula for the purposes

of calculating recommended increases in fee scales. The validity of changing the weightings

was confirmed to the satisfaction of the Committee.

11. The weightings are:

a) Salaries and Wages:

38%;

b) Other Overheads:

32%; and

c) Partners’ Salaries and Profit Share:

30%.

3

Attorney-General's Department documents released under FOI22/171

Page 33 of 48

Document 6 - Page 4 of 6

Formula Indices

Wage Cost Index

12. The Committee agreed to continue with the use of the WCI for calculation of the wages

& salaries and profit share component of the formula. The WCI, reflecting ordinary time

rates of pay including bonuses, was adopted in the Sixteenth Report. The Committee is

satisfied that this index is conceptually satisfactory despite its potential for some volatility.

The material put to the Committee suggests that volatility was not a problem in the period

under review.

13. The most recent data available is the WCI for the June Quarter 2004.

The CPI

14. The LCA raised the issue of the use of the CTRM following the introduction of the New

Tax System. The LCA noted that the Committee’s 18th Report recommended reverting to the

use of the unadjusted CPI figure in relation to the calculation of the ‘other overheads’

component. The LCA recommended the continued use of that approach. The Committee

agreed with the LCA recommendation.

15. The CPI for the June Quarter 2004 is the most recent data available.

Superannuation Guarantee Levy (SGL)

16. The Committee accepted the submission of the LCA that an adjustment should be made

to the Wages and Salaries component to reflect the 1% increase in the SGL, operative from

1 July 2002.

Professional Indemnity Insurance

17. The Committee noted the material provided by the LCA concerning the likely

continuing increase of professional indemnity insurance premiums.

18. The Committee acknowledged the LCA’s concerns. The evidence established to the

satisfaction of the Committee that an allowance for this item is justified. While noting the

difficulty in calculating with precision the value of the increase the Committee accepted the

formula that was advanced by the LCA in its submission that an adjustment should be made

in the Other Overheads Component to reflect the increase of approximately 0.93% of the total

costs for legal practices. Expressed as a proportion of the elements of all other legal practice

costs in the Other Overheads Component the increase in professional indemnity costs is 2.04

per cent.

19.

The Committee noted the transient nature of the rise and fall in Professional Indemnity

Insurance and considered it as a special item in the Other Overheads Component for the

purpose of this review. Professional Indemnity Insurance will not be included as a permanent

element of the Other Overheads Component, but may be revisited in the event of any future

significant rise or fall.

4

Attorney-General's Department documents released under FOI22/171

Page 34 of 48

Document 6 - Page 5 of 6

SUMMARY OF FINDINGS

19. The Committee:

a) affirms its general approach to adjustment of the scales,

b) is satisfied that no discount to the CPI for the second round effect of the New Tax

System is necessary, and

c) acknowledges the LCA’s concern regarding professional indemnity insurance

premiums.

20. These findings lead the Committee to recommend an increase of 10.2 per cent in the

scales. This reflects movements in the relevant published indices from March 2002 to

June 2004 for CPI and from December 2001 to June 2004 for WCI. Detailed calculations are

as follows:

a)

Movements in Indices (with ABS adjustment)

At March 2002

At June 2004

% Increase

CPI

136.6

144.8

6.00

At December 2001

At June 2004

% Increase

WCI

114.5

124.3

8.56

b)

Solicitors' Costs

% of Gross Costs

Movement in

% Increase

Relevant Indices (%)

Wages and Salaries

38

9.56

3.63

(2002 – 35%)

(reflects WCI plus

1.00% for additional

Superannuation

Guarantee

adjustment)

Other Overheads

32

6.00

3.96

(2002 – 34%)

(reflects CPI plus

2.04% for

Professional

Indemnity

Insurance Premium

Adjustment)

5

Attorney-General's Department documents released under FOI22/171

Page 35 of 48

Document 6 - Page 6 of 6

Partners’ Salaries

30

8.56

2.57

and Profit Share

(2002 – 31%)

Sub-total

10.16

Recommended

Increase

10.2

RECOMMENDATION

21. The Committee recommends an increase of 10.2 percent to the scale of solicitors' costs

specified in the Third Schedule to the Family Law Rules.

B J Lacy

Chairman

22 September 2004

6

Attorney-General's Department documents released under FOI22/171

Page 36 of 48

Document 7 - Page 1 of 6

FEDERAL COSTS ADVISORY COMMITTEE

SECOND REPORT ON SOLICITORS' COSTS

UNDER THE FEDERAL MAGISTRATES COURT RULES

PRELIMINARY

1.

This is the Second Report of the Federal Costs Advisory Committee on solicitors' costs

in the Federal Magistrates Court of Australia.

2.

The present scale is contained in the First Schedule of the Federal Magistrates Court

Rules. The last amendment to this scale took effect on 3 November 2003 following the

adoption of the First Report by this Committee which recommended an increase of 3.2 per

cent in the scale of costs. The recommendation took into account the Consumer Price Index

(CPI) at June 2003; and the Wage Cost Index (WCI) at June 2003 published by the Australian

Bureau of Statistics (ABS).

3.

The Committee is comprised of the following members:

a) The Hon Brian Lacy (Chairman),

b) Mr D A Crawford,

c) Mr D C D Harper,

d) Mr B McMillan,

e) Mr M Minogue, and

f) Mr W D K Teasdale.

4.

By an advertisement placed in the

Australian Financial Review on 1 August 2003 and

in

The Weekend Australian of 2 August 2003, the Committee invited interested persons and

organisations to forward written submissions to the Committee Secretary by 22 August 2003.

The Committee did not meet in 2003. The Committee held a public hearing on 1 September

2004.

SUBMISSIONS

5.

The Law Council of Australia (LCA) made the only substantive submission to the

Committee. The LCA made a submission in August 2003, and a subsequent submission on

26 August 2004. The LCA also made an oral submission to the Committee in the hearing on

1 September 2004. The LCA welcomed the new chair and expressed its appreciation for the

tremendous contribution made by the former Chairperson, the late Senior Deputy President

Polites, in the Committee’s proceedings and work over many years.

1

Attorney-General's Department documents released under FOI22/171

Page 37 of 48

Document 7 - Page 2 of 6

The LCA’s substantive submissions are summarised below:

a) Approach

The LCA recommended the Committee maintain the current approach for the

adjustment of fee scales.

b) Weightings

The LCA recommended the following formula weightings:

Salaries and Wages

38%

Other Overheads

32%

Partners’ Salaries and Profit Share 30%

c) Calculations

The LCA:

(i)

supported the continued use of the ABS WCI for salaries and wages and

partner’s salaries and profit share and the net income components of

solicitors’ costs

(ii)

supported the continued use of the ABS WCI ‘ordinary-time hourly rates

of pay including bonuses’ index

(iii) supported the continued use of the CPI as the primary index for the

adjustment of the “Other Overheads” component

(iv) opposed discounting of the CPI by reference to the Constant Tax Rate

Measure (CTRM) adjustment of the CPI.

d) Superannuation Guarantee Levy (SGL)

The LCA sought an adjustment by reference to the 1% increase in the SGL

effective from 1 July 2002.

e) Professional Indemnity Insurance

The LCA asked that the Committee note the potential impact of increasing

professional indemnity insurance premiums on solicitor’s overheads. The LCA

referred to a report commissioned by the Australian Government from the

Australian Competition and Consumer Commission entitled ‘Public Liability and

Professional Indemnity Insurance – Third Monitoring Report’ (July 2004) and

recommended an increase of 2.04% to the Other Overheads component to reflect

the increase in professional indemnity insurance premiums.

f)

Adjustment

The LCA recommended an increase of 10.2% in the scale of fees.

2

Attorney-General's Department documents released under FOI22/171

Page 38 of 48

Document 7 - Page 3 of 6

TERMS OF REFERENCE

6.

The Committee noted the revised terms of reference approved by the former

Attorney-General on 29 April 2002, noting the inclusion of the Federal Magistrates Service,

the exclusion of ACT Courts, and the incorporation of Bankruptcy Costs into the general

Federal Court scale.

CONSIDERATION OF THE ISSUES

Scope of the Committee’s Power

7.

The Terms of Reference of the Committee confine it to advising Commonwealth Courts

on:

“. . .variations in the quantum of costs for solicitors (including expenses and fees for

witnesses) which should be fixed in the rules and regulations for which they are

respectively responsible.”

8.

The Committee noted, as it had in the past, that any increase in scales will impact on

consumers of legal services. However, the terms of reference of the Committee contain the

following provisions:

a)

that the Committee is to have regard to the reasonable expenses incurred by

solicitors in the conduct of their practices and the need for them to recover, in

full, increases in these expenses; and

b)

the need for solicitors’ costs to be consistent with a reasonable return on

capital and to provide appropriate recognition of professional skills.

General Approach of the Committee

9.

The Committee considered it should maintain its longstanding approach to adjustment

of the Scales of Costs in accordance with a formula reflecting movements in salary and

wages, other overheads and an appropriate return for principals in legal practice.

Weighting of Components

10. The Committee accepted the submission by the LCA that ABS statistical information

supports a change in the weightings allocated to components of the formula for the purposes

of calculating recommended increases in fee scales. The validity of changing the weightings

was confirmed to the satisfaction of the Committee.

11. The weightings are:

a) Salaries and Wages:

38%;

b) Other Overheads:

32%; and

c) Partners’ Salaries and Profit Share:

30%.

3

Attorney-General's Department documents released under FOI22/171

Page 39 of 48

Document 7 - Page 4 of 6

Formula Indices

Wage Cost Index

12. The Committee agreed to continue with the use of the WCI for calculation of the wages

& salaries and profit share component of the formula. The WCI, reflecting ordinary time

rates of pay including bonuses, was adopted in the Sixteenth Report. The Committee is

satisfied that this index is conceptually satisfactory despite its potential for some volatility.

The material put to the Committee suggests that volatility was not a problem in the period

under review.

13. The most recent data available is the WCI for the June Quarter 2004.

The CPI

14. The LCA raised the issue of the use of the CTRM following the introduction of the New

Tax System. The LCA noted that the Committee’s 18th Report recommended reverting to the

use of the unadjusted CPI figure in relation to the calculation of the ‘other overheads’

component. The LCA recommended the continued use of that approach. The Committee

agreed with the LCA recommendation.

15. The CPI for the June Quarter 2004 is the most recent data available.

Superannuation Guarantee Levy (SGL)

16. The Committee accepted the submission of the LCA that an adjustment should be made

to the Wages and Salaries component to reflect the 1% increase in the SGL, operative from

1 July 2002.

Professional Indemnity Insurance

17. The Committee noted the material provided by the LCA concerning the likely

continuing increase of professional indemnity insurance premiums.

18. The Committee acknowledged the LCA’s concerns. The evidence established to the

satisfaction of the Committee that an allowance for this item is justified. While noting the

difficulty in calculating with precision the value of the increase the Committee accepted the

formula that was advanced by the LCA in its submission that an adjustment should be made

in the Other Overheads Component to reflect the increase of approximately 0.93% of the total

costs for legal practices. Expressed as a proportion of the elements of all other legal practice

costs in the Other Overheads Component the increase in professional indemnity costs is 2.04

per cent.

19.

The Committee noted the transient nature of the rise and fall in Professional Indemnity

Insurance and considered it as a special item in the Other Overheads Component for the

purpose of this review. Professional Indemnity Insurance will not be included as a permanent

element of the Other Overheads Component, but may be revisited in the event of any future

significant rise or fall.

4

Attorney-General's Department documents released under FOI22/171

Page 40 of 48

Document 7 - Page 5 of 6

SUMMARY OF FINDINGS

19. The Committee:

a) affirms its general approach to adjustment of the scales,

b) is satisfied that no discount to the CPI for the second round effect of the New Tax

System is necessary, and

c) acknowledges the LCA’s concern regarding professional indemnity insurance

premiums.

20. These findings lead the Committee to recommend an increase of 10.2 per cent in the

scales. This reflects movements in the relevant published indices from March 2002 to

June 2004 for CPI and from December 2001 to June 2004 for WCI. Detailed calculations are

as follows:

a)

Movements in Indices (with ABS adjustment)

At March 2002

At June 2004

% Increase

CPI

136.6

144.8

6.00

At December 2001

At June 2004

% Increase

WCI

114.5

124.3

8.56

b)

Solicitors' Costs

% of Gross Costs

Movement in

% Increase

Relevant Indices (%)

Wages and Salaries

38

9.56

3.63

(2002 – 35%)

(reflects WCI plus

1.00% for additional

Superannuation

Guarantee

adjustment)

Other Overheads

32

6.00

3.96

(2002 – 34%)

(reflects CPI

plus 2.04% for

Professional

Indemnity

nsurance Premium

Adjustment)

5

Attorney-General's Department documents released under FOI22/171

Page 41 of 48

Document 7 - Page 6 of 6

Partners’ Salaries

30

8.56

2.57

and Profit Share

(2002 – 31%)

Sub-total

10.16

Recommended

Increase

10.2

RECOMMENDATION

21. The Committee recommends an increase of 10.2 percent to the scale of solicitors' costs

specified in First Schedule to the Federal Magistrates Court Rules. .

B J Lacy

Chairman

22 September 2004

6

Attorney-General's Department documents released under FOI22/171

Page 42 of 48

Document 8 - Page 1 of 6

FEDERAL COSTS ADVISORY COMMITTEE

NINETEENTH REPORT ON SOLICITORS' COSTS

UNDER THE FEDERAL COURT ACT 1976

PRELIMINARY

1.

This is the Nineteenth Report of the Federal Costs Advisory Committee on solicitors' costs

in the Federal Court of Australia.

2.

The present scale is contained in the Second Schedule of Rules made under the

Federal

Court of Australia Act 1976. The last amendment to this scale took effect on 26 November 2002

following the adoption of the Eighteenth Report by this Committee which recommended an

increase of 3.2 per cent in the scale of costs. The recommendation took into account the Consumer

Price Index (CPI) at June 2003; and the Wage Cost Index (WCI) at June 2003 published by the

Australian Bureau of Statistics (ABS).

3.

The Committee is comprised of the following members:

a)

The Hon Brian Lacy (Chairman),

b)

Mr D A Crawford,

c) Mr D C D Harper,

d)

Mr B McMillan,

e)

Mr M Minogue, and

f)

Mr W D K Teasdale.

4.

By an advertisement placed in the

Australian Financial Review on 1 August 2003 and in

The Weekend Australian of 2 August 2003, the Committee invited interested persons and

organisations to forward written submissions to the Committee Secretary by 22 August 2003. The

Committee did not meet in 2003. The Committee held a public hearing on 1 September 2004.

SUBMISSIONS

5.

The Law Council of Australia (LCA) made the only substantive submission to the

Committee. The LCA made a submission in August 2003, and a subsequent submission on 26

August 2004. The LCA also made an oral submission to the Committee in the hearing on 1

September 2004. The LCA welcomed the new chair and expressed its appreciation for the

tremendous contribution made by the former Chairperson, the late Senior Deputy President Polites,

to the Committee’s proceedings and work over many years.

1

Attorney-General's Department documents released under FOI22/171

Page 43 of 48

Document 8 - Page 2 of 6

The LCA’s substantive submissions are summarised below:

a)

Approach

The LCA recommended the Committee maintain the current approach for the

adjustment of fee scales.

b)

Weightings

The LCA recommended the following formula weightings:

Salaries and Wages

38%

Other Overheads

32%

Partners’ Salaries and Profit Share

30%

c)

Calculations

The LCA:

(i)

supported the continued use of the ABS WCI for salaries and wages and

partner’s salaries and profit share and the net income components of solicitors’

costs

(ii)

supported the continued use of the ABS WCI ‘ordinary-time hourly rates of pay

including bonuses’ index

(iii)

supported the continued use of the CPI as the primary index for the adjustment

of the “Other Overheads” component

(iv)

opposed discounting of the CPI by reference to the Constant Tax Rate Measure

(CTRM) adjustment of the CPI.

d)

Superannuation Guarantee Levy (SGL)

The LCA sought an adjustment by reference to the 1% increase in the SGL effective

from 1 July 2002.

e)

Professional Indemnity Insurance

The LCA asked that the Committee note the potential impact of increasing professional

indemnity insurance premiums on solicitor’s overheads. The LCA referred to a report

commissioned by the Australian Government from the Australian Competition and

Consumer Commission entitled ‘Public Liability and Professional Indemnity Insurance

– Third Monitoring Report’ (July 2004) and recommended an increase of 2.04% to the

Other Overheads component to reflect the increase in professional indemnity insurance

premiums.

f)

Adjustment

The LCA recommended an increase of 10.2% in the scale of fees.

2

Attorney-General's Department documents released under FOI22/171

Page 44 of 48

Document 8 - Page 3 of 6

TERMS OF REFERENCE

6.

The Committee noted the revised terms of reference approved by the former

Attorney-General on 29 April 2002, noting the inclusion of the Federal Magistrates Service, the

exclusion of ACT Courts, and the incorporation of Bankruptcy Costs into the general Federal Court

scale.

CONSIDERATION OF THE ISSUES

Scope of the Committee’s Power

7.

The Terms of Reference of the Committee confine it to advising Commonwealth Courts on:

“. . .variations in the quantum of costs for solicitors (including expenses and fees for witnesses)

which should be fixed in the rules and regulations for which they are respectively

responsible.”

8.

The Committee noted, as it had in the past, that any increase in scales will impact on

consumers of legal services. However, the terms of reference of the Committee contain the

following provisions:

a)

that the Committee is to have regard to the reasonable expenses incurred by

solicitors in the conduct of their practices and the need for them to recover, in full,

increases in these expenses; and

b)

the need for solicitors’ costs to be consistent with a reasonable return on capital and

to provide appropriate recognition of professional skills.

General Approach of the Committee

9.

The Committee considered it should maintain its longstanding approach to adjustment of the

Scales of Costs in accordance with a formula reflecting movements in salary and wages, other

overheads and an appropriate return for principals in legal practice.

Weighting of Components

10.

The Committee accepted the submission by the LCA that ABS statistical information

supports a change in the weightings allocated to components of the formula for the purposes of

calculating recommended increases in fee scales. The validity of changing the weightings was

confirmed to the satisfaction of the Committee.

11.

The weightings are:

a)

Salaries and Wages:

38%;

b)

Other Overheads:

32%; and

c)

Partners’ Salaries and Profit Share:

30%.

Formula Indices

3

Attorney-General's Department documents released under FOI22/171

Page 45 of 48

Document 8 - Page 4 of 6

Wage Cost Index

12.

The Committee agreed to continue with the use of the WCI for calculation of the wages &

salaries and profit share component of the formula. The WCI, reflecting ordinary time rates of pay

including bonuses, was adopted in the Sixteenth Report. The Committee is satisfied that this index

is conceptually satisfactory despite its potential for some volatility. The material put to the

Committee suggests that volatility was not a problem in the period under review.

13.

The most recent data available is the WCI for the June Quarter 2004.

The CPI

14.

The LCA raised the issue of the use of the CTRM following the introduction of the New

Tax System. The LCA noted that the Committee’s 18th Report recommended reverting to the use

of the unadjusted CPI figure in relation to the calculation of the ‘other overheads’ component. The

LCA recommended the continued use of that approach. The Committee agreed with the LCA

recommendation.

15.

The CPI for the June Quarter 2004 is the most recent data available.

Superannuation Guarantee Levy (SGL)

16.

The Committee accepted the submission of the LCA that an adjustment should be made to the

Wages and Salaries component to reflect the 1% increase in the SGL, operative from 1 July 2002.

Professional Indemnity Insurance

17.

The Committee noted the material provided by the LCA concerning the likely continuing

increase of professional indemnity insurance premiums.

18.

The Committee acknowledged the LCA’s concerns. The evidence established to the

satisfaction of the Committee that an allowance for this item is justified. While noting the difficulty

in calculating with precision the value of the increase the Committee accepted the formula that was

advanced by the LCA in its submission that an adjustment should be made in the Other Overheads

Component to reflect the increase of approximately 0.93% of the total costs for legal practices.

Expressed as a proportion of the elements of all other legal practice costs in the Other Overheads

Component the increase in professional indemnity costs is 2.04 per cent.

19.

The Committee noted the transient nature of the rise and fall in Professional Indemnity

Insurance and considered it as a special item in the Other Overheads Component for the purpose of

this review. Professional Indemnity Insurance will not be included as a permanent element of the

Other Overheads Component, but may be revisited in the event of any future significant rise or fall.

SUMMARY OF FINDINGS

19.

The Committee:

a)

affirms its general approach to adjustment of the scales,

b)

is satisfied that no discount to the CPI for the second round effect of the New Tax

System is necessary, and

4

Attorney-General's Department documents released under FOI22/171

Page 46 of 48

Document 8 - Page 5 of 6

c)

acknowledges the LCA’s concern regarding professional indemnity insurance

premiums.

20.

These findings lead the Committee to recommend an increase of 10.2 per cent in the scales.

This reflects movements in the relevant published indices from March 2002 to June 2004 for CPI

and from December 2001 to June 2004 for WCI. Detailed calculations are as follows:

a)

Movements in Indices (with ABS adjustment)

At March 2002

At June 2004

% Increase

CPI

136.6

144.8

6.00

At December 2001

At June 2004

% Increase

WCI

114.5

124.3

8.56

b)

Solicitors' Costs

% of Gross Costs

Movement in

% Increase

Relevant Indices (%)

Wages and Salaries

38

9.56

3.63

(2002 – 35%)

(reflects WCI plus

1.00% for additional

Superannuation

Guarantee

adjustment)

Other Overheads

32

6.00

3.96

(2002 – 34%)

(reflects CPI plus

2.04% for

Professional

Indemnity

Insurance Premium

Adjustment)

Partners’ Salaries

30

8.56

2.57

and Profit Share

(2002 – 31%)

Sub-total

10.16

Recommended

Increase

10.2

RECOMMENDATION

21.

The Committee recommends an increase of 10.2 percent to the scale of solicitors' costs

specified in the Second Schedule of Rules made under the

Federal Court of Australia Act 1976.

5

Attorney-General's Department documents released under FOI22/171

Page 47 of 48

Document 8 - Page 6 of 6

B J Lacy

Chairman

22 September 2004

6

Attorney-General's Department documents released under FOI22/171

Page 48 of 48