How tax applies to Indigenous

artwork

About this guide

This guide explains how pay as you go (PAYG) withholding, the goods and services

tax (GST) and the Australian business number (ABN) apply to Indigenous artworks

sold at art centres.

Indigenous artwork sold at art centres

We have identified two ways Indigenous artworks are sold at art centres.

1. The buy and sell arrangement – you (the art centre operator) buy the artwork

from the artist and then sell the artwork to a buyer.

2. Acting as an agent arrangement – you (the art centre operator) acts as an agent

for the artist and sells the artwork on behalf of the artist.

Depending on how your art centre is set up, artwork can be sold using only one

arrangement or both arrangements.

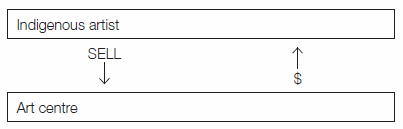

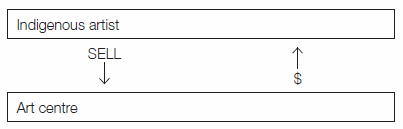

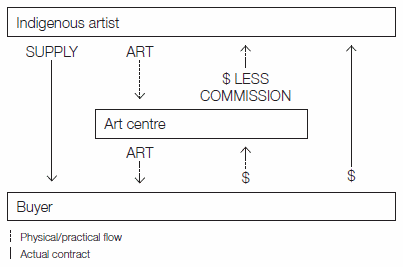

The buy and sell arrangement

There are two ways the buy and sell arrangement arises.

You can buy artwork either:

■ immediately on delivery from an artist

■ from an artist later, at the time of sale to an art centre buyer.

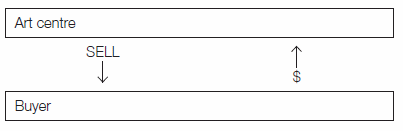

In a buy and sell arrangement, there are two supplies.

3. A supply between an artist and an art centre.

4. A supply between the art centre and the buyer.

The GST implications are the same for both supply situations.

Does an artist charge GST?

If an artist is not registered for GST, they will not include GST in the price when

selling an artwork to you the art centre operator.

If an artist is registered for GST, they will include GST in the price when selling an

artwork to you the art centre operator.

Do you charge GST when you sell an artwork?

If you are registered for GST, you must include GST on the full sale price of an

artwork.

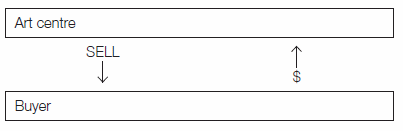

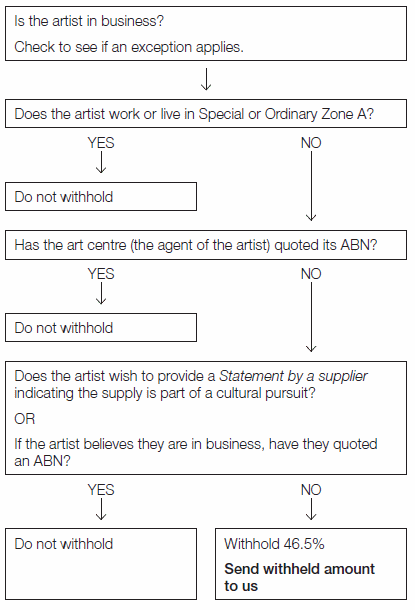

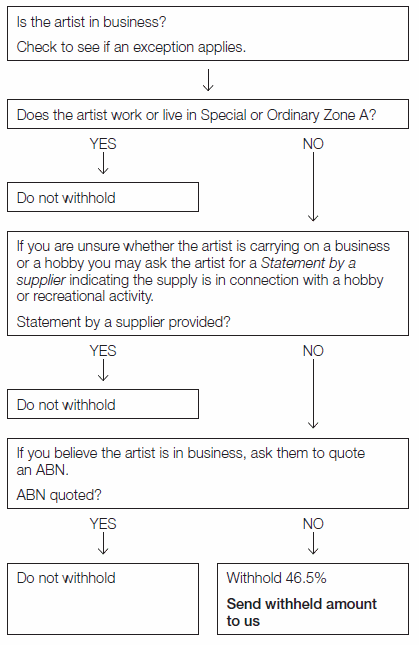

When are you required to withhold amounts from an

artist?

Explanations

Special or Ordinary Zone A includes most of the Northern Territory (including

Darwin and Alice Springs), northern Western Australia and far west and far north

Queensland.

Artistic works includes graphic works, painting, sculpture, collage, craftsmanship

and some performance art. For example, an artistic work would include handcrafting

a traditional spear.

According to the PAYG withholding system, you must withhold 46.5% of the payment

for an artwork if all of the following apply:

■ an artist does not quote an ABN

■ that artist is in business.

You must send the amount withheld to us.

When are you not required to withhold amounts

from an artist?

You are not required to withhold amounts in the following two circumstances.

1: Artist works or lives in Special or Ordinary Zone A

We have varied to nil the amount to be withheld from a payment to an Indigenous

artist for

artistic works if an Indigenous artist works or lives in

Special or

Ordinary Zone A and does not quote an ABN.

The variation applies to payments made from 1 July 2004.

In summary, where an art centre makes a payment to an Indigenous artist for

artistic works, the art centre is not required to withhold amounts where that artist

works or lives in Special or Ordinary Zone A.

Although this variation will reduce the amount to be withheld to nil in some

circumstances where artists are in business, if their turnover exceeds $75,000 the

artist will be required to register for GST.

2: Statement by a supplier

Often it is difficult to work out if an artist is in business or just creating artworks as

a hobby or recreational activity. However, where an artist does not live in

Special

or Ordinary Zone A, an art centre may seek a

Statement by a supplier from

the artist. This indicates that an artist is creating artwork as a hobby or

recreational activity and is not in business.

Art centres do not need to seek a new statement for each supply. We

recommend that the details be confirmed with the artist every 6-12 months.

Buy and sell arrangement process

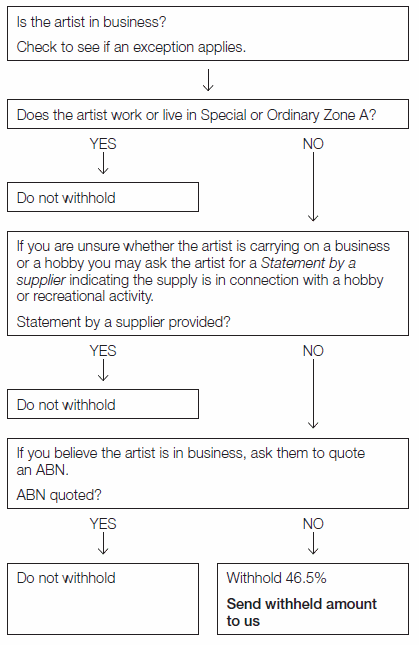

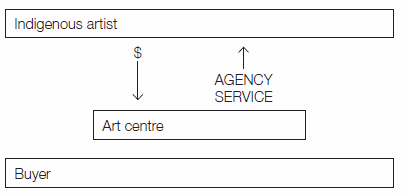

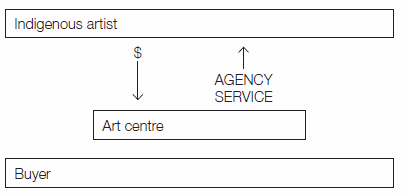

The acting as an agent arrangement

When you act as an agent for an artist, you essentially take the role of the artist.

There are two separate supplies made, one from the artist to the buyer for the sale of

the artwork, and the second from the art centre to the artist for agency services.

5. The transactions between the artist, the buyer and you for the sale of artwork.

6. The transaction between you and the artist for agency services.

In practice, the commission will generally be deducted from the sale proceeds due to

the artist.

Does the artist (you acting as an agent) charge

GST on the sale price of the artwork?

If an artist is not required to be registered for GST, the artist will not include GST in

the sale price of the artwork.

If the artist is registered, the artist will include GST in the sale price.

Do you charge GST on your commission?

If you are registered for GST, you include GST in the commission fee. The artist can

claim a GST credit if they are registered for GST.

If you are providing a service to the artist, you agree to sell the artwork and pay the

proceeds to the artist in return for a fee (usually deducted from the sale proceeds).

Find out more

■ GST definitions: GST credits.

■ GSTR 2000/37

Goods and services tax: agency relationships and the application

of the law.

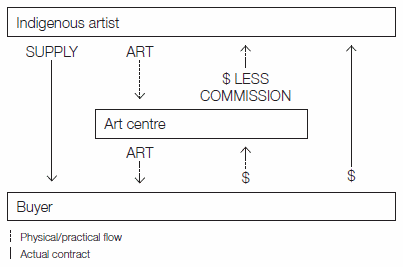

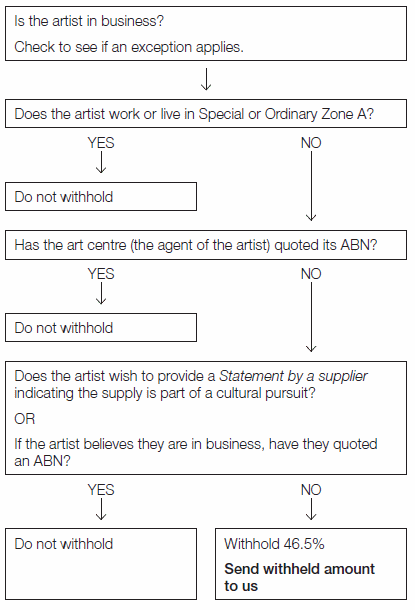

When is a buyer required to withhold amounts from

an artist?

According to the PAYG withholding system, the buyer must withhold 46.5% of the

payment for the artwork if the following apply:

■ an artist fails to quote an ABN

■ an artist is in business and the buyer purchases their artwork in the course of

their business (for example, a purchase made by a commercial gallery).

The buyer must send the withheld amount to us.

When is a buyer not required to withhold amounts

from an artist?

A buyer is not required to withhold in the three circumstances below.

1: Agent may quote its ABN instead of the artist's ABN

There is a specific exception in the law enabling the agent of a supplier to quote

their ABN instead of the ABN of the supplier. If an art centre has quoted its ABN

on an invoice or some other document relating to the supply there is no need for

the buyer to withhold.

2: Artist resides in Special or Ordinary Zone A

3: Statement by a supplier

Acting as an agent arrangement process

Statement by a supplier

A payer must withhold an amount from a payment it makes to another entity if the

payment is for a supply that the other entity has made, or proposes to make, to the

payer in the course or furtherance of an enterprise carried on in Australia.

The primary exception is that the supplier has quoted an ABN on an invoice or some

other document relating to the supply.

Where payers are unsure if the supplier is carrying on an enterprise they may want to

make a further inquiry with the supplier. The payer may ask the supplier to provide a

Statement by a supplier (NAT 3346).

The supplier can either use the form Statement by a supplier (NAT 3346) or they can

create their own form.

If a supplier chooses to create their own 'Statement by a supplier' it should contain

the following:

■ the supplier's name and address

■ why it was not necessary to withhold (for example, the supply is part of a hobby

or private recreational pursuit)

■ the supplier's signature.

GST credits

If an artist is required to be registered for GST and has issued a tax invoice, you can

claim a GST credit.

If an artist is registered for GST, they can claim a GST credit where you include GST

in the commission fee and issues a tax invoice to the artist.

You claim your GST credits when you lodge your activity statement.

There is a four-year time limit in claiming GST credits.

Find out more

Time limits on GST refunds

Keeping records

You should keep records relating to when an artwork was purchased from an artist.

This should include the following:

■ the date of purchase

■ the name and address of the artist

■ the purchase price.

You can also include this information in your cash payment book.

Summary

If the artist is not registered for GST, do not include the GST on the sale price of the

work.

If the artist is registered for GST, include the GST on the sale price of the work. You

issue a tax invoice showing the artist's ABN on behalf of the artist to the buyer. The

artist will need to send any GST collected to us.

If you are registered for GST, you include GST in the commission fee and issue a tax

invoice to the artist. You send the collected GST to us. Where the artist is registered

for GST they can claim a GST credit.

A buyer, who is making a purchase in the course of their own business, is not

required to withhold where:

■ you have quoted your ABN on an invoice or some other document relating to the

supply

■ the artist works or lives in special or ordinary zone A and does not quote an

ABN

■ the artist has provided a

Statement by a supplier (you can also include this

information in your cash payment book).

More information

Find out more

■ Statement by a supplier (NAT 3346)

■ PAYG withholding (NAT 8075)

■ GST

■ ABN registration for individuals (sole traders) (NAT 2938)

■ ABN registration for companies, partnerships, trusts and other organisations

(NAT 2939)

■ For further assistance, find out How we can help

■ Alternatively, phone ATO Indigenous Helpline

13 10 30 for individual income tax

and general personal enquiries.

Copies of this publication

Get it done

You can download a printable version of How tax applies to Indigenous artwork

(NAT 12066, 424KB) in Portable Document Format (PDF).

You can order a printed copy by noting the

full title of the publication and either:

■ visit our Online publications ordering service

■ phone the Publications Distribution Service (which operates from 8.00am to

6.00pm, Monday to Friday) on

1300 720 092.

Abstract: Explains how pay as you go (PAYG) withholding, the goods and services tax (GST)

and the Australian business number (ABN) apply to Indigenous artworks sold at art centres.