1982

Act

FOI Office

under

Taxation

Released

Australian

1982

Act

FOI Office

under

Taxation

Released

Australian

1982

Act

FOI Office

under

Taxation

Released

Australian

Presentation to OECD: Australian Budget 2015-16 —

Multinational integrity measures

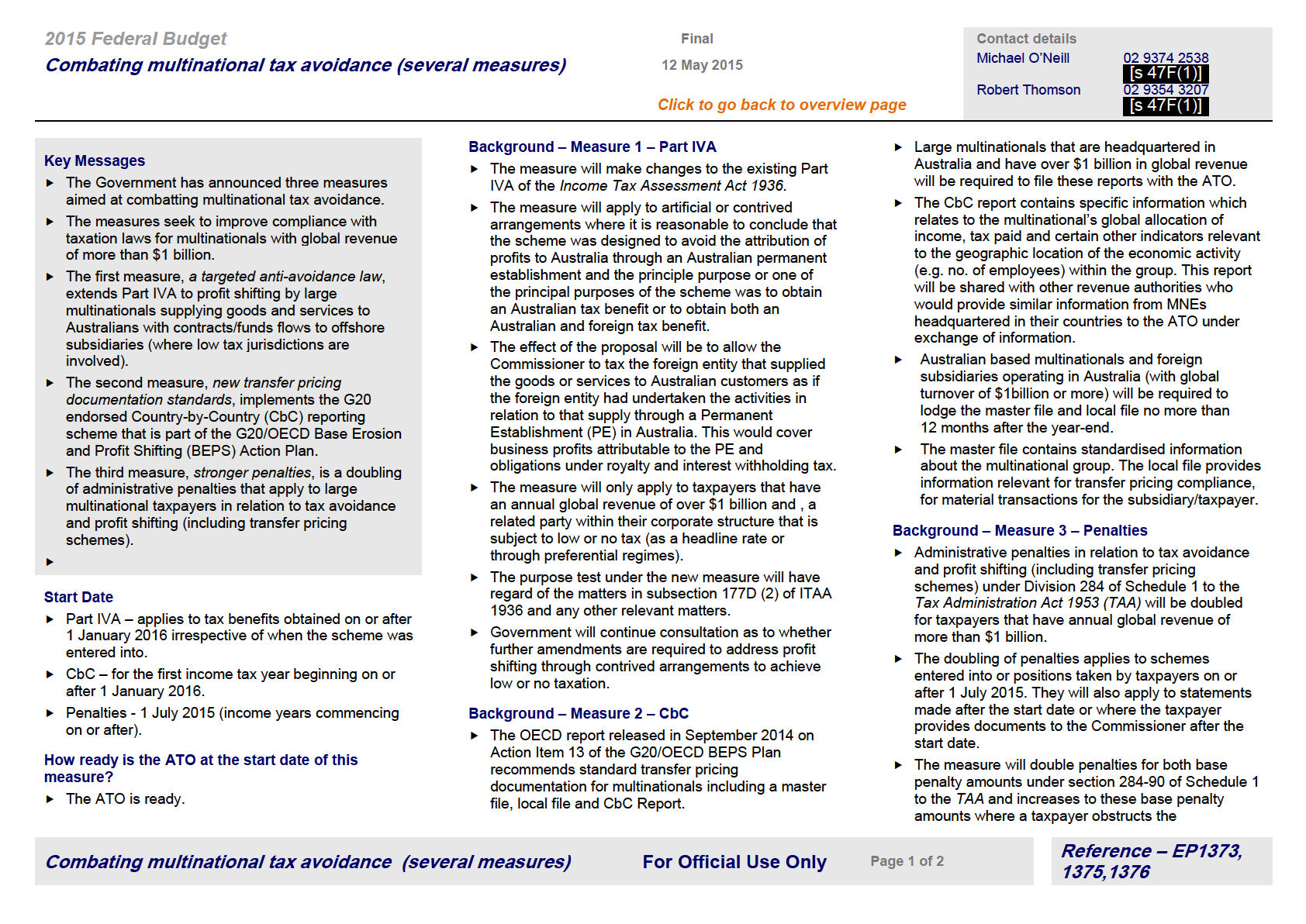

• The Australian Government has announced a package of measures in its 2015-16 Budget to

combat multinational tax avoidance.

• The package includes:

1982

–

three new domestic measures;

(1)

A new Multinational Anti-avoidance Law: which strengthens Australia’s General

Anti-Avoidance Rules. The rest of this presentation wil be focused on the MAAL.;

Act

(2)

Increased Penalties: for tax avoidance schemes and transfer pricing adjustments,

the maximum administrative penalties will be doubled for large corporates (from

50% to 100% of the tax benefit obtained).

(3)

Application of GST to imported digital goods and services: to ensure that supplies

Office

of digital products and services supplied to Australian consumers by foreign entities

FOI

receive the same GST treatment as equivalent supplies made by Australian entities.

These amendments are broadly modelled on similar rules currently in operation in

the European Union and Norway and draws on the work being undertaken by

Working Party 9.

(a) Products and services covered include streaming or downloading of movies,

music, apps, games, e-books as well as

other services such as consultancy and

professional services

under

– action on

four of the BEPS action items that were delivered last year;

(1)

Taxation

CbC: Australia will require large companies to provide a CbC, master file and local

file from 2016, consistent with the OECD’s implementation guidance.

(2)

Treaty Abuse: Australia will adopt the OECD’s recommendations into our treaty

negotiation policy. They will provide Australia’s starting point for future treaty

negotiations.

(3)

Hybrid Mismatches: the Board of Tax wil consult on how to implement the OECD’s

recommendations in the Australian context, reporting by March 2016.

(4)

Harmful Tax Practices: the ATO has already started exchanging rulings on

Released

preferential regimes.

– an announcement of

three further processes.

Australian

(1)

Consultation on further measures to address profit shifting: The Government has

announced a consultation process focused on schemes where transfer pricing is the

main issue. The recently announced diverted profits working group established with

the UK wil feed into this consultation process.

(2)

Development of a public tax transparency code with business: The Government has

asked the Board of Tax to lead the development of a voluntary public tax

transparency code for large corporates.

(a) Australia already has laws that mandate public disclosure by large companies of

their turnover, taxable income and tax paid. But we think a voluntary code for

greater disclosure will help build confidence in the majority of Australian

companies that do the right thing. A voluntary code will provide a framework

for corporates to take the lead, to become more transparent and help educate

the public about their compliance with Australia’s tax laws.

(3)

Signing of MCAA for CRS: Australia has committed to sign the OECD’s Multilateral

Competent Authority Agreement for the implementation of the common reporting

1982

standard.

Act

FOI Office

under

Taxation

Released

Australian