INVESTMENT

STRATEGY

2024

FINANCE COMMITTEE

2 FEBRUARY 2024

INVESTMENT OFFICE

Agenda

1. Introduction

2. Strategy Discussion

a) 2024 Proposed Strategy Overview

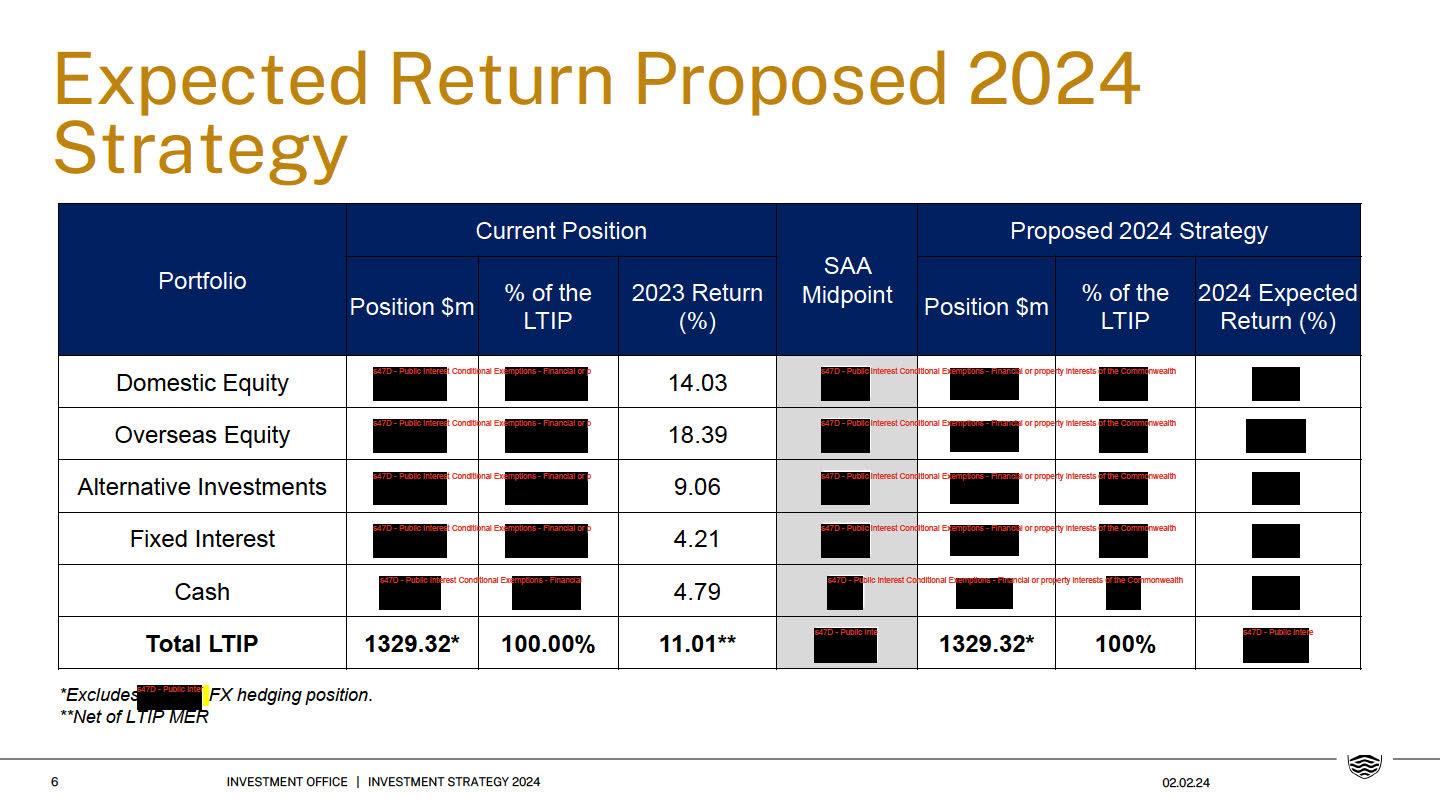

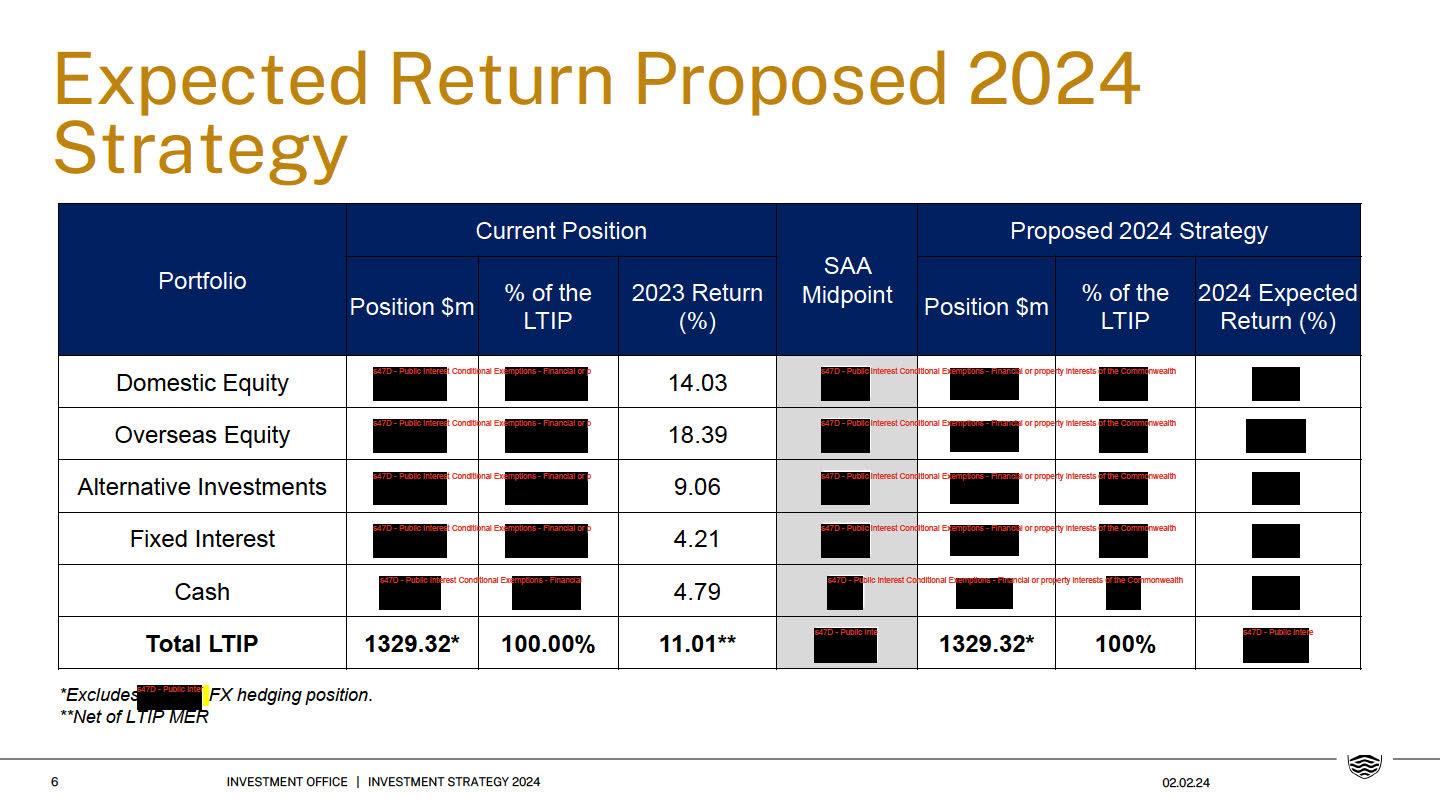

b) Expected Return Proposed 2024 Strategy

c) Overseas Equity

d) s47G - Public Interest Conditional Exemptions - Business

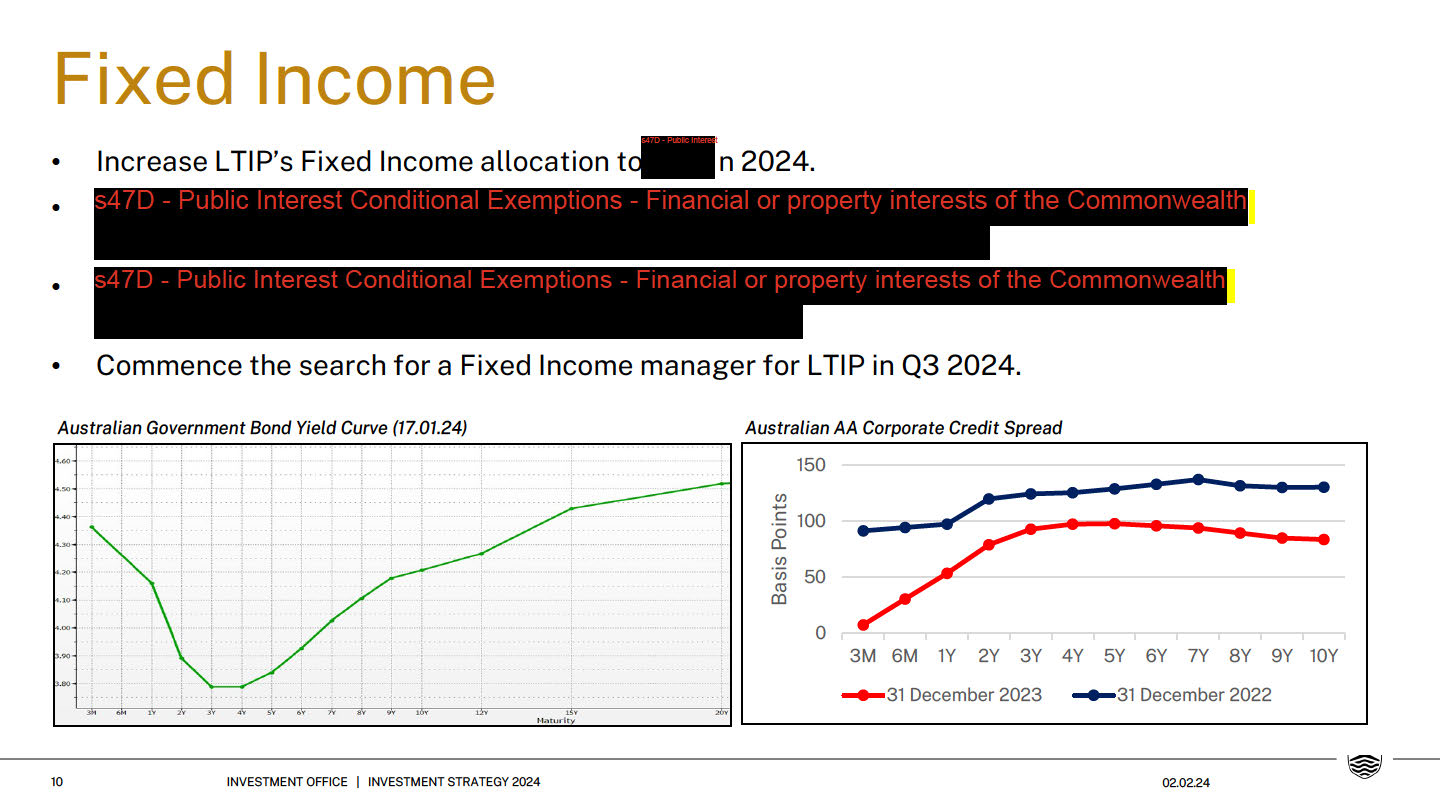

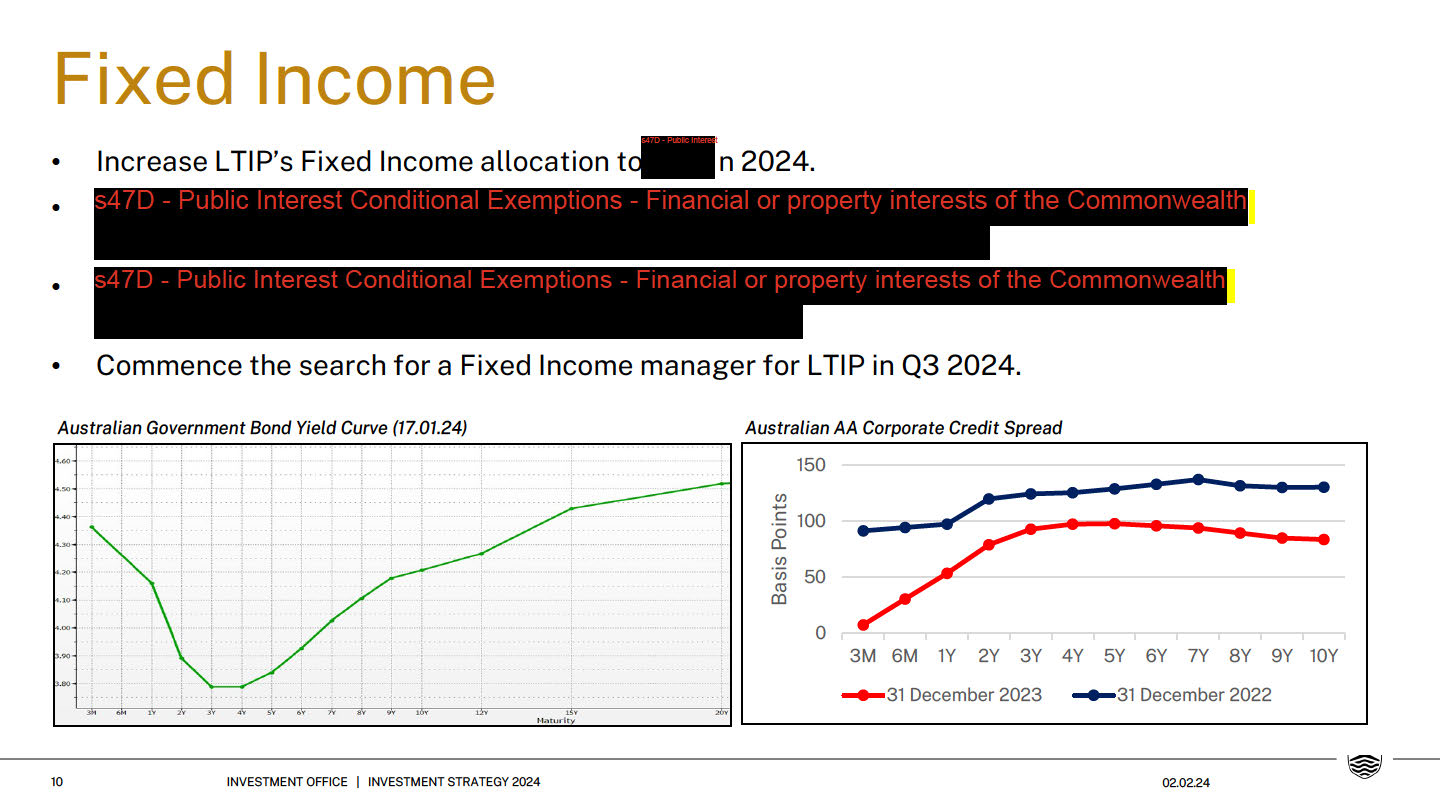

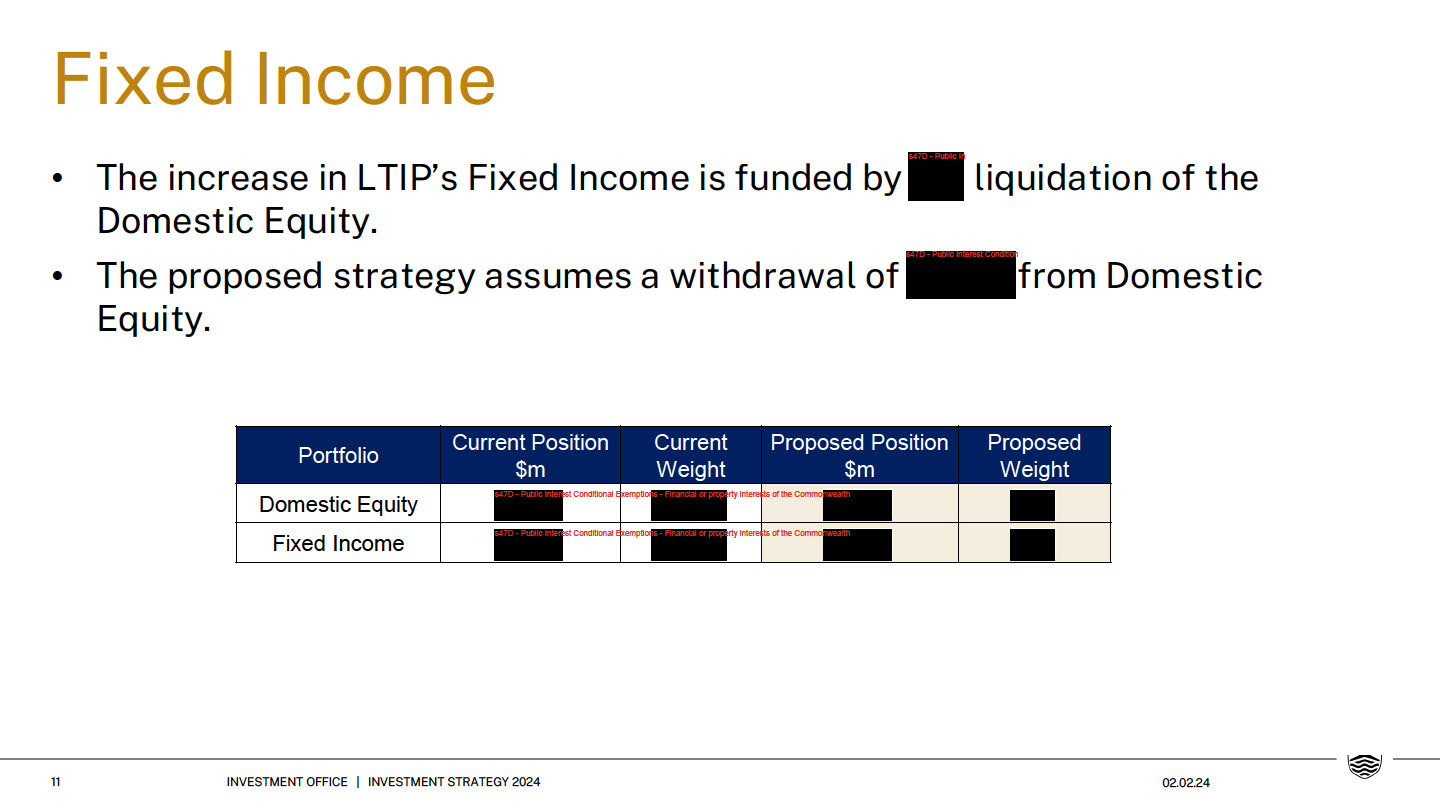

e) Fixed Income

f) FX Hedging Strategy

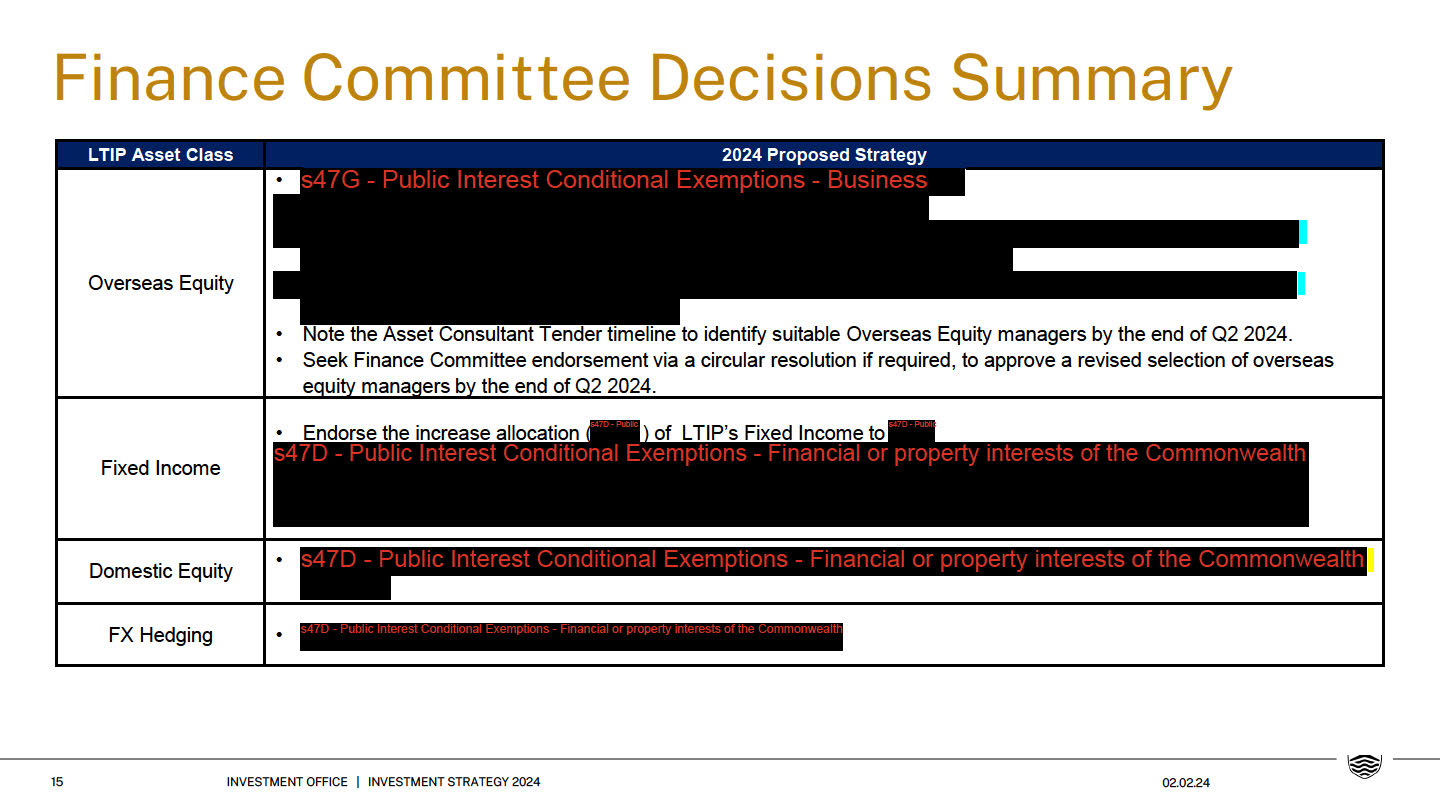

3. Finance Committee Decisions Summary

2

INVESTMENT OFFICE | INVESTMENT STRATEGY 2024

02.02.24

Introduction

This presentation sets out the proposed strategy for the University’s investment portfolio in 2024. The

presentation is intended for discussion at the February Finance Committee meeting.

3

INVESTMENT OFFICE | INVESTMENT STRATEGY 2024

02.02.24

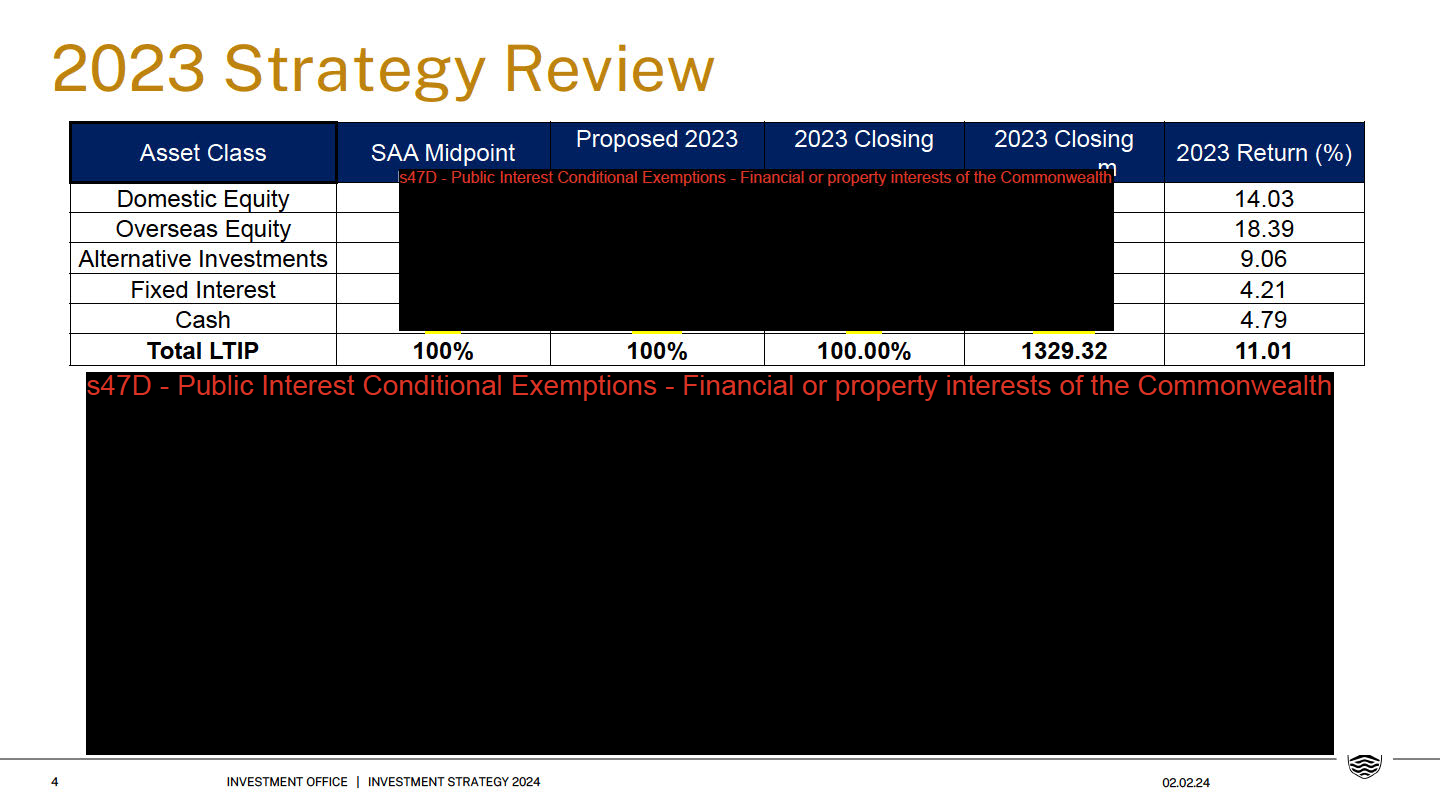

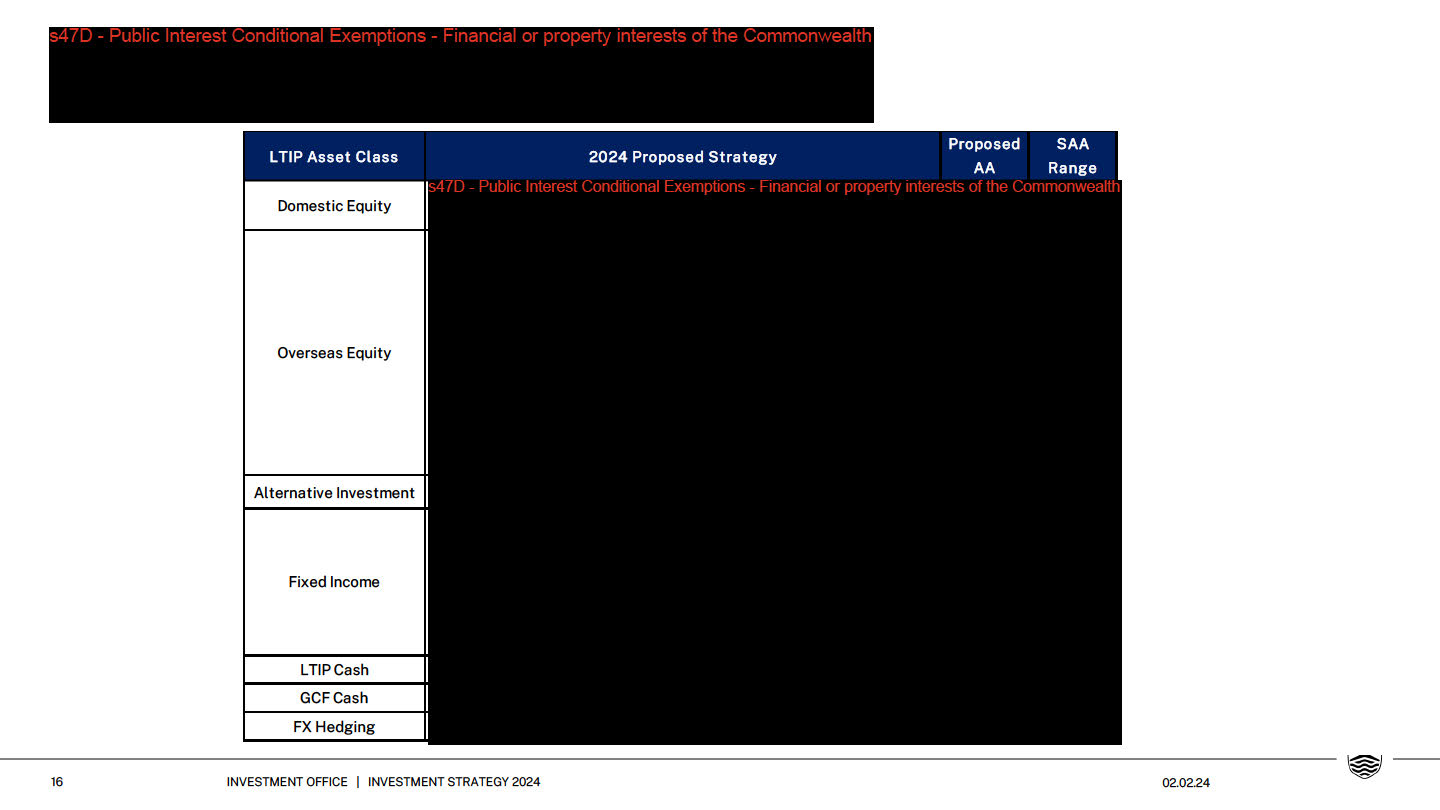

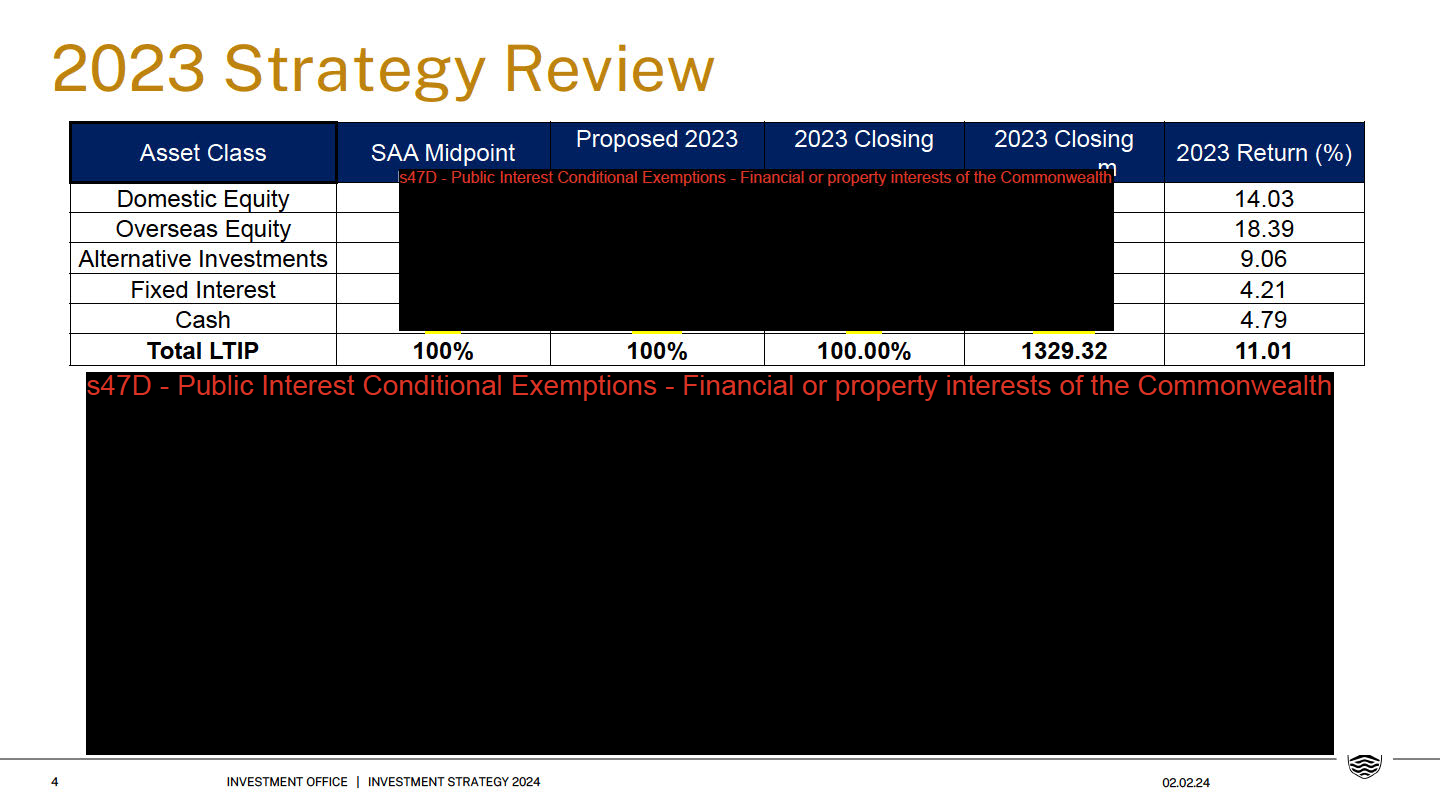

2024 Proposed Strategy Overview

• Equity markets are currently pricing in significant growth in 2024.

• Bond markets expect more interest rate cut from central bankers

then are inflationary prudent.

• The strategy targets a higher risk-adjusted return for the LTIP.

• s47D - Public Interest Conditional Exemptions - Financial or property interests of the Commonwealth

• Decrease the Domestic Equity allocation as it is currently

o

s47D - Public Intere ver we i gh t t he S AA

Midpoint.

s47D - Public Interest C

s47D - Public Interest C

s47D - Public Interest Conditional Exemptions - Fin

• Increase the existing

hedge of the USD exposure to

hedge at

USD.

5

INVESTMENT OFFICE | INVESTMENT STRATEGY 2024

02.02.24

FX Hedging Strategy

• The US bond market priced in 1.50% in interest rate cuts in 2024 while the Australian Cash Rate

Futures market priced in approximately 0.39% in interest rate cuts in 2024. Hedging cost will

decrease as interest rate differentials narrow.

• DXY expected to trade sideways in the range of 100-105 in 1H2024.

s47D - Public Interest Conditional Exemptio

• Subsequently, increase the existing s47D - Public In h edg e o f th e

US

D exp

osure to

s47D - Public Inte h edg e a t

USD.

AUD/USD 6-month Fibonacci Retracement levels.

DXY 6-month Fibonacci Retracement levels.

12

INVESTMENT OFFICE | INVESTMENT STRATEGY 2024

02.02.24

Dollar Index (DXY)

• The Dollar Index (DXY) measures the value of the USD against a basket of foreign currencies,

excluding AUD. DXY explains the fluctuation in AUDUSD attributed to USD’s relative strength.

• USD’s relative strength is expected to continue to be the driver of AUDUSD fluctuation. As the

reserve currency in the world, USD’s volatility is expected in an election year. Federal Reserve’s

rates cuts will impact central banks’ decisions around the world.

Source: Bloomberg – AUD/USD (Black) and DXY (Red) in 2023

13

INVESTMENT OFFICE | INVESTMENT STRATEGY 2024

02.02.24