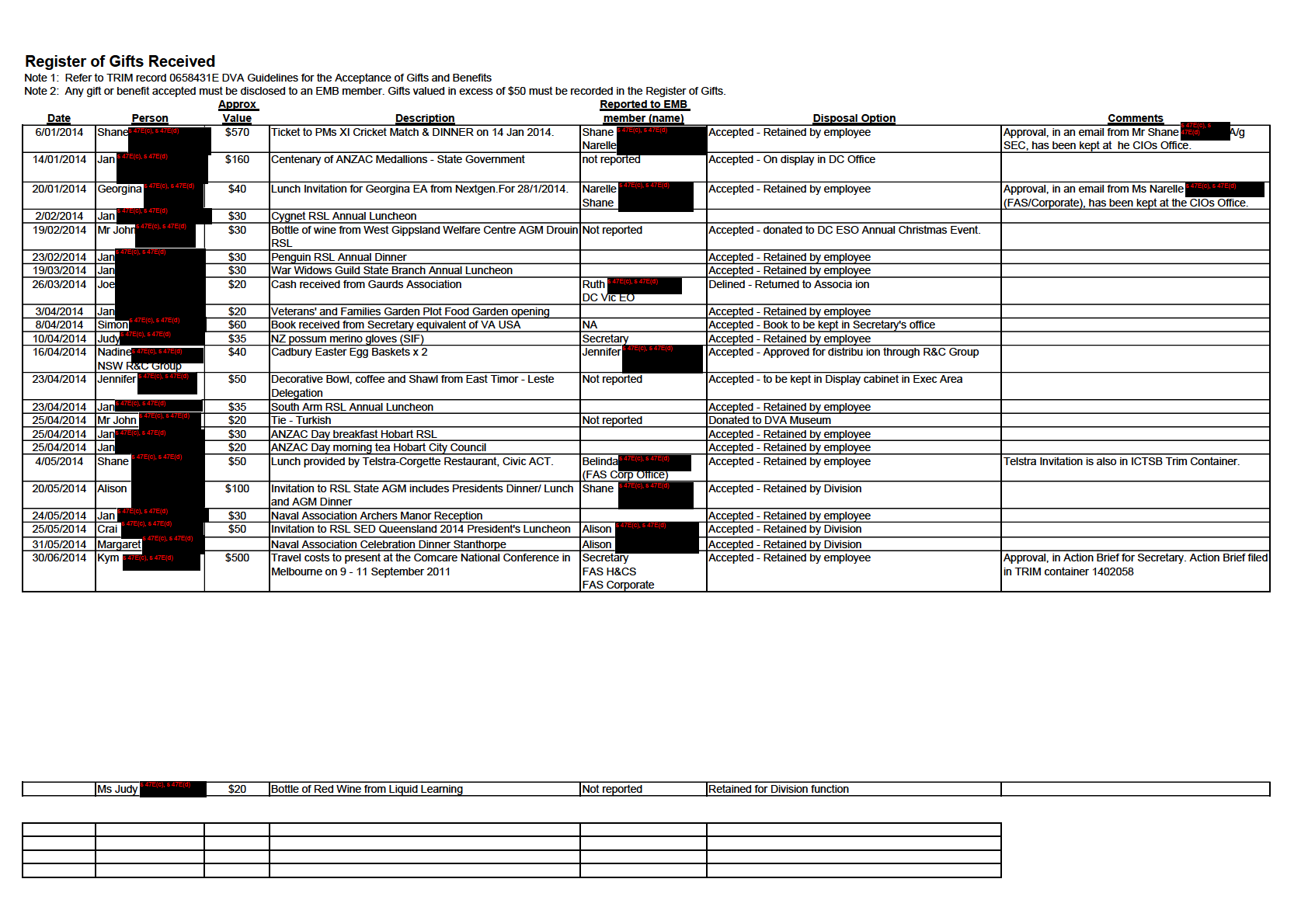

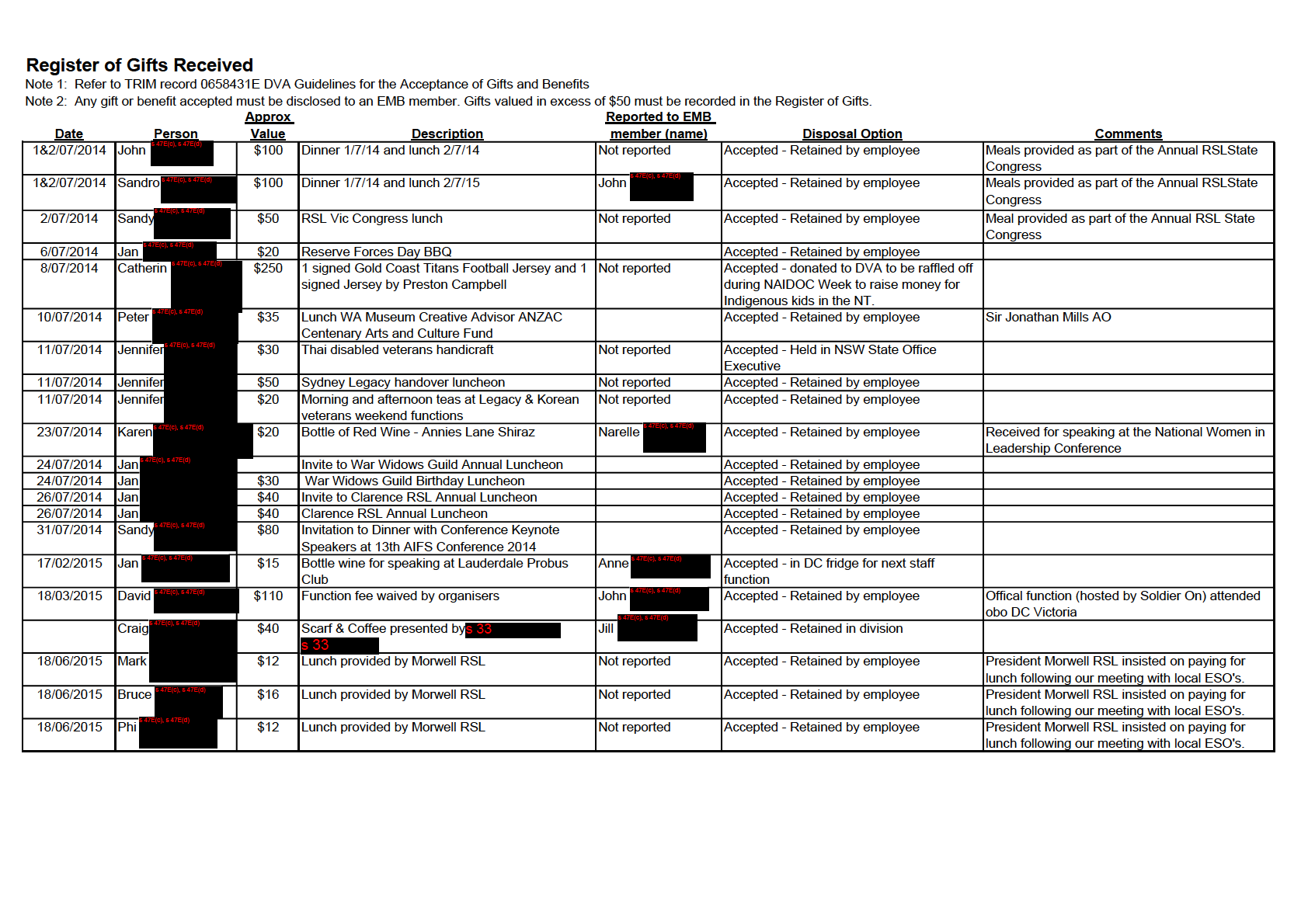

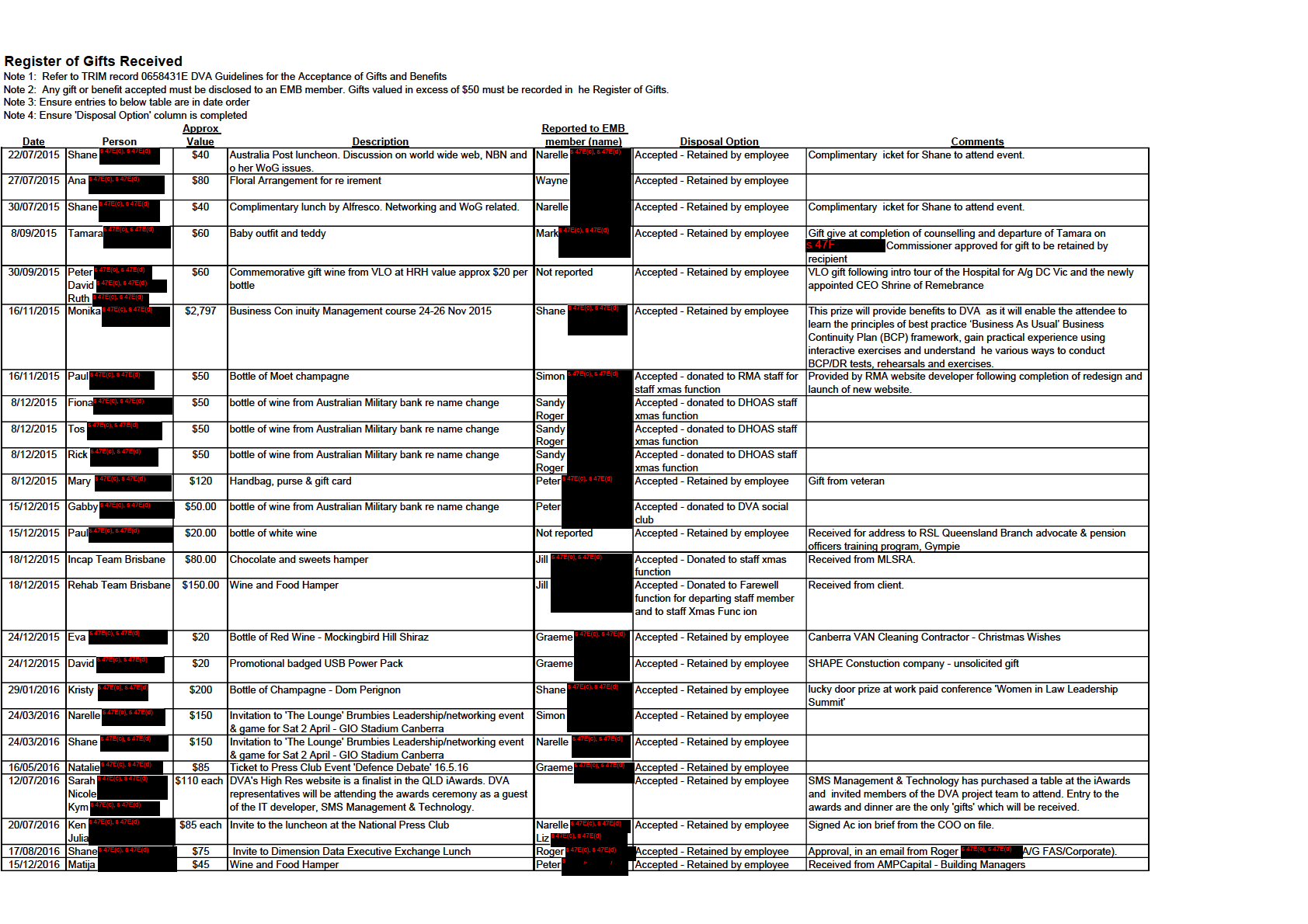

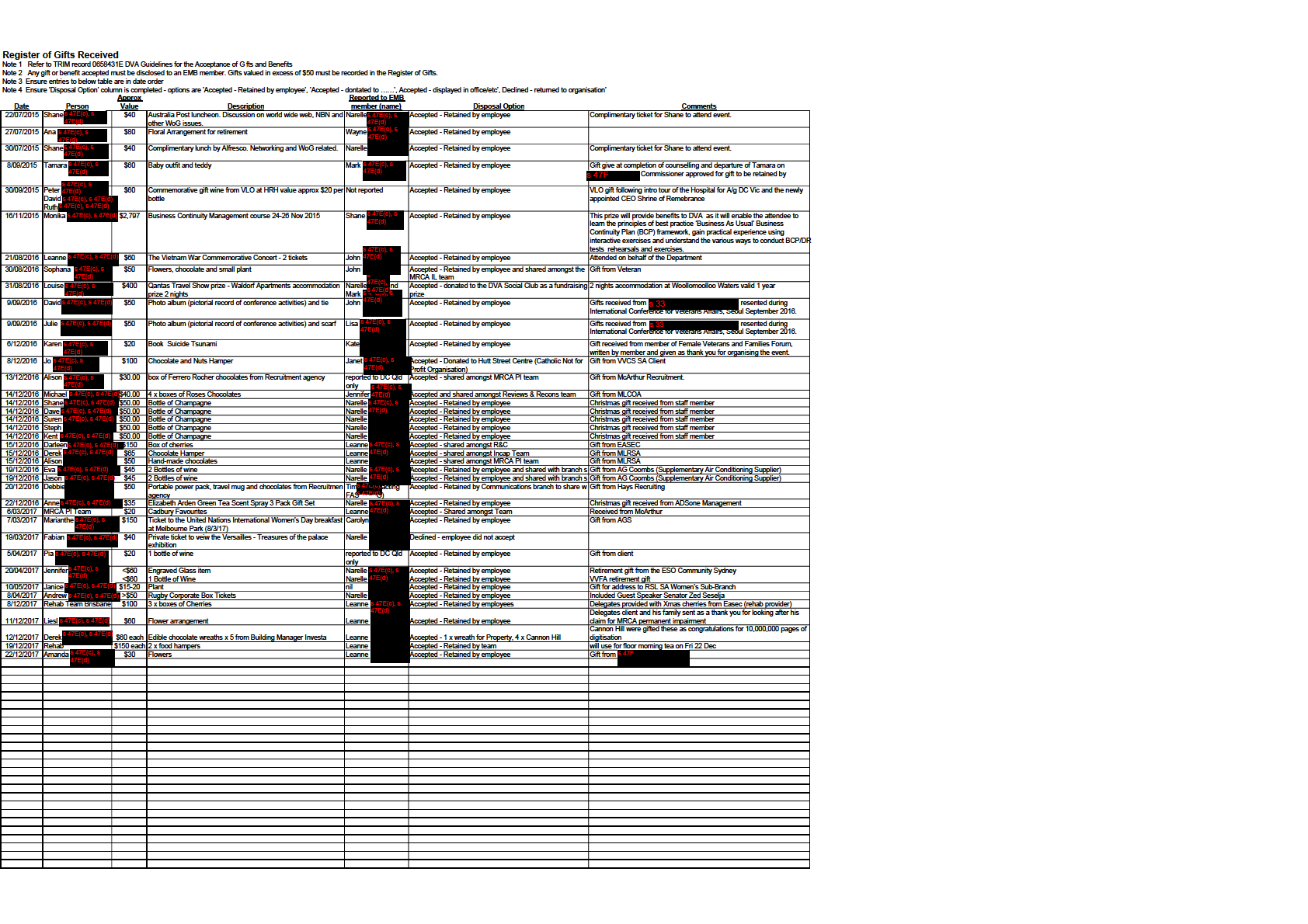

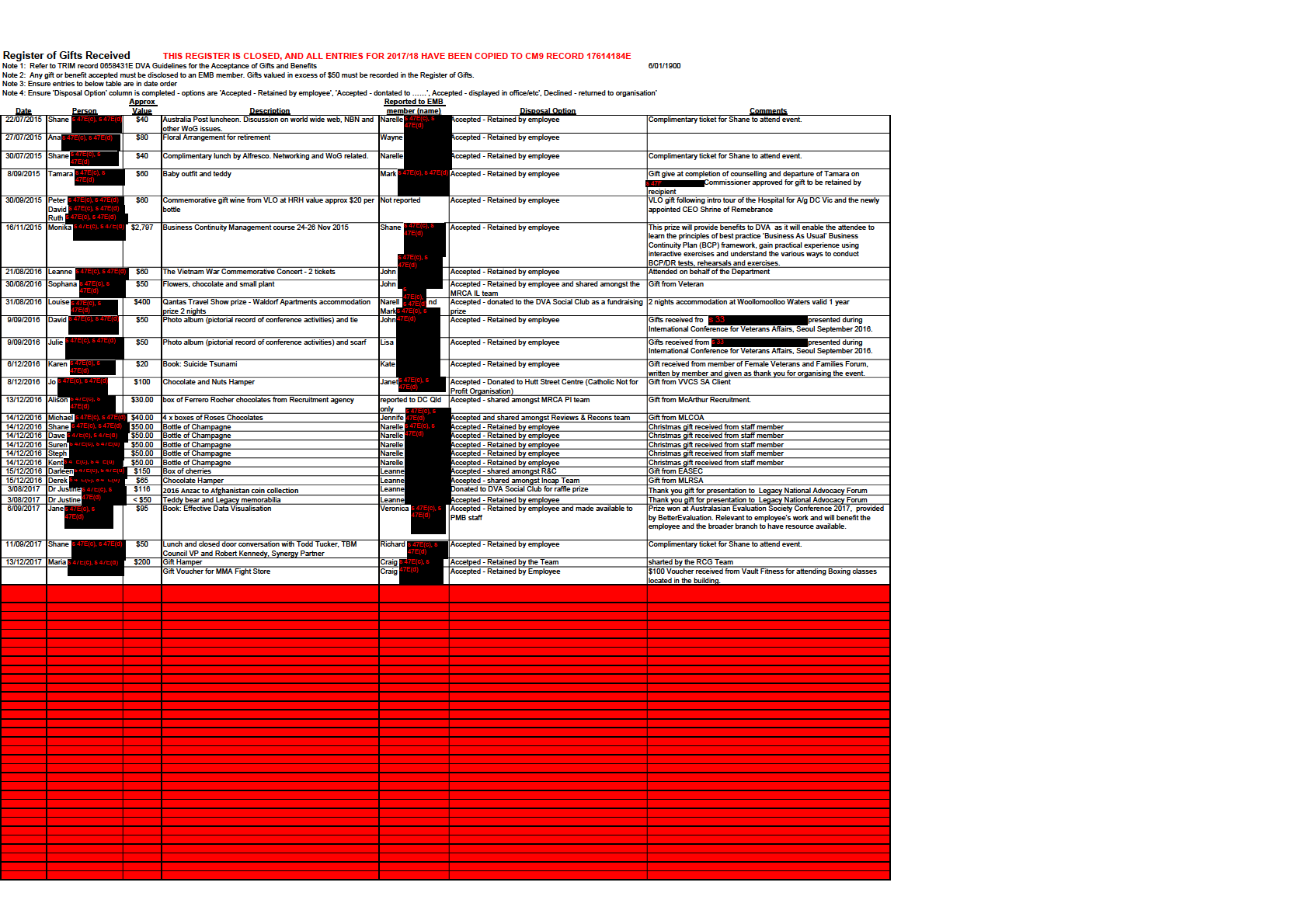

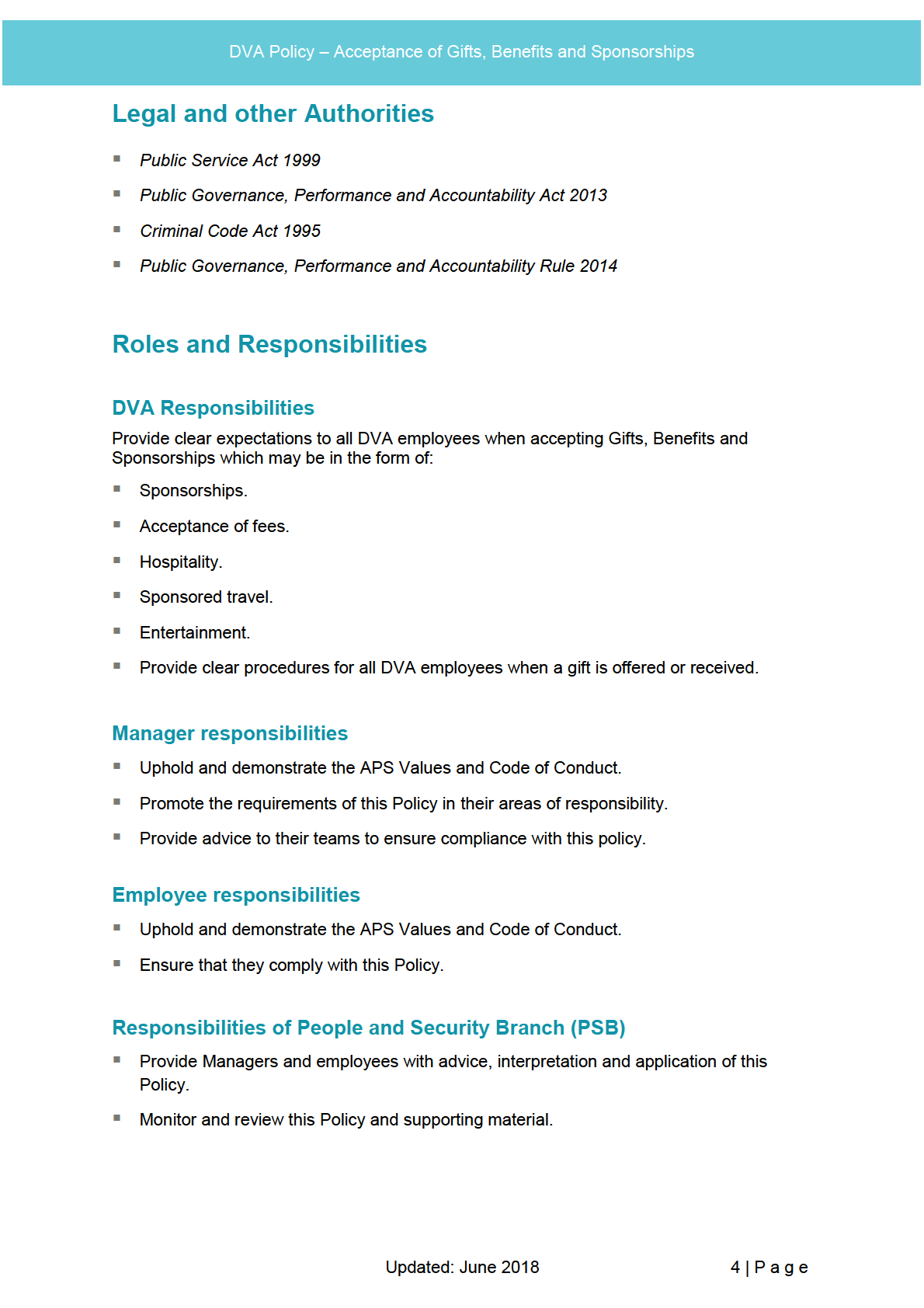

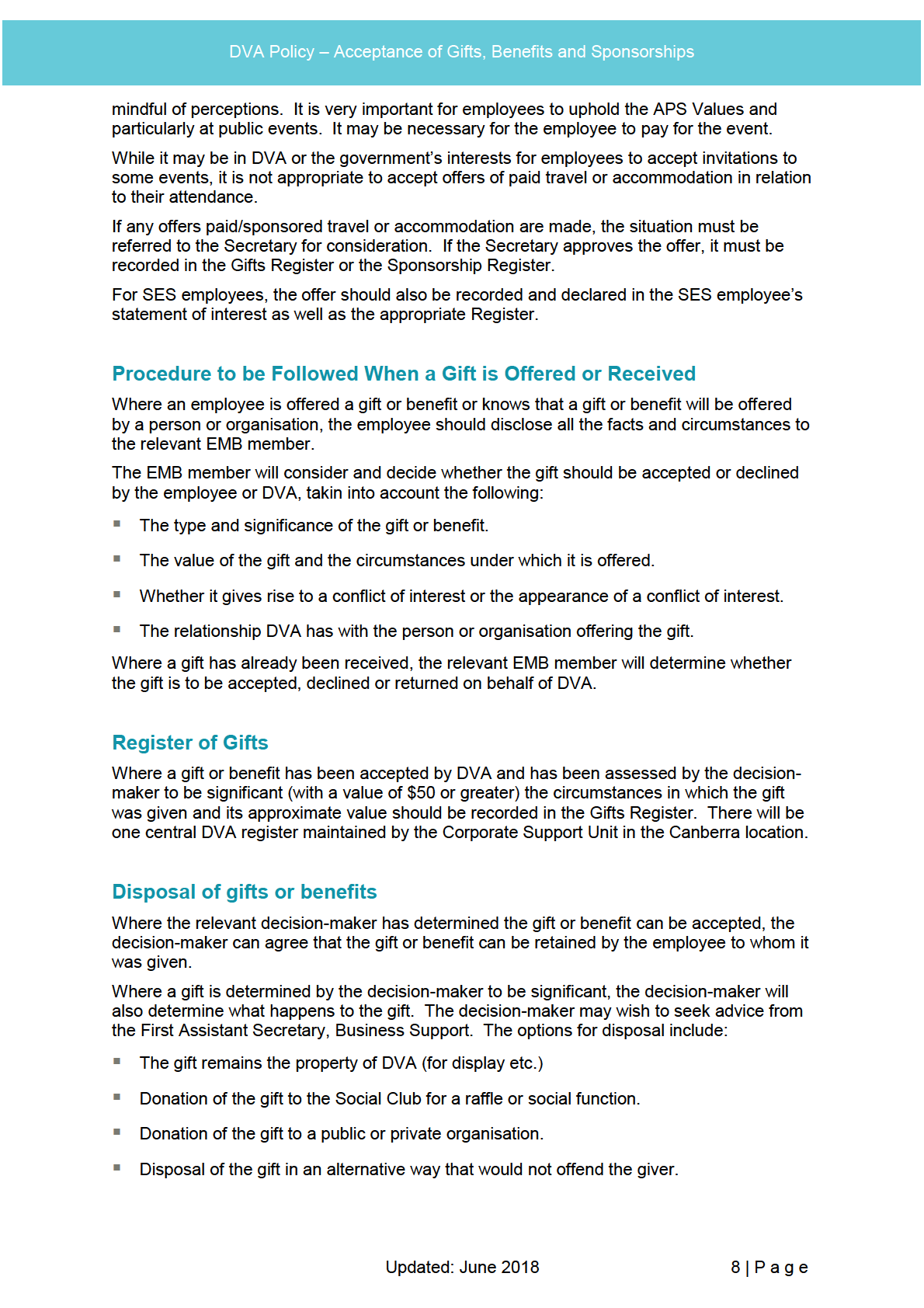

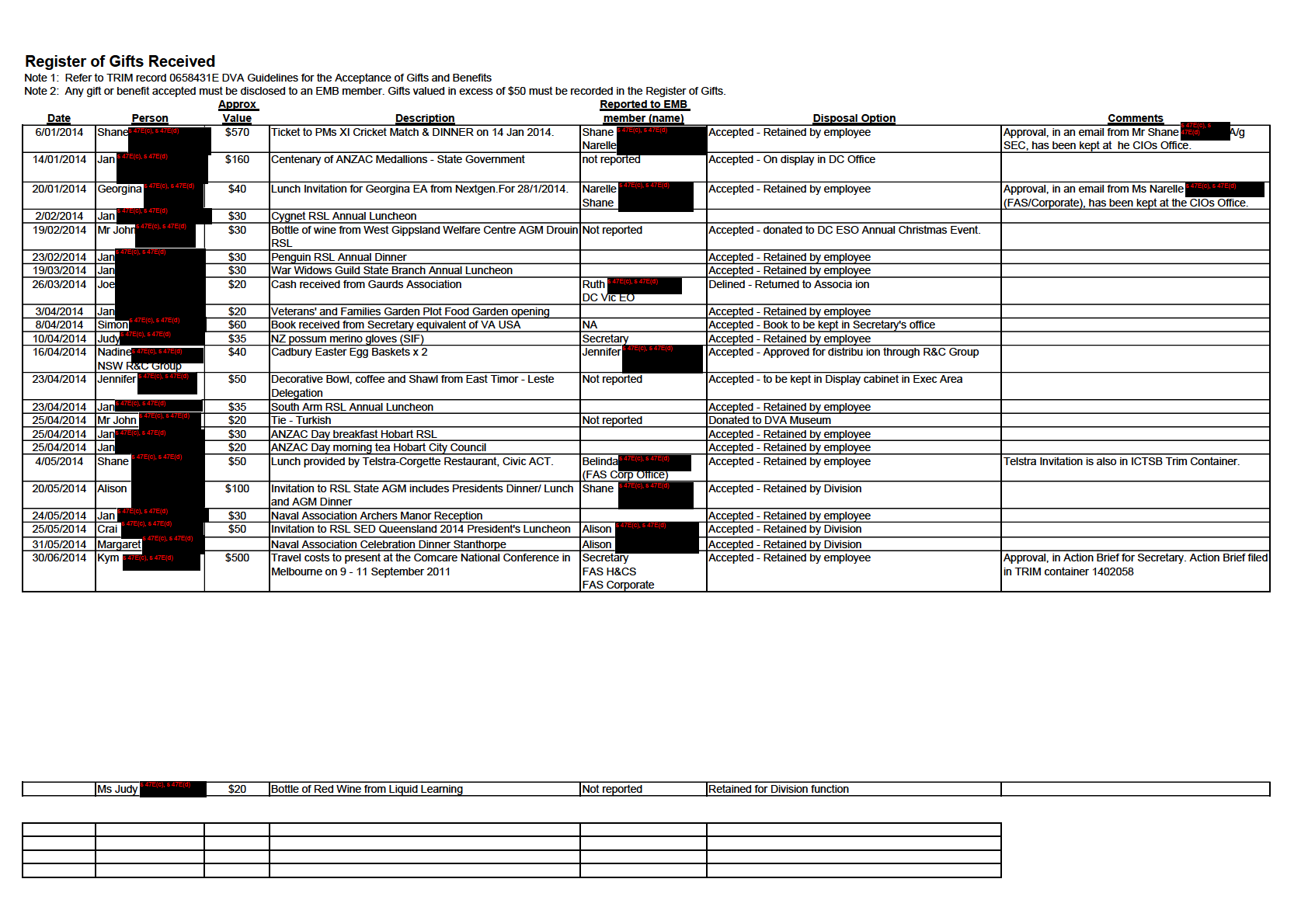

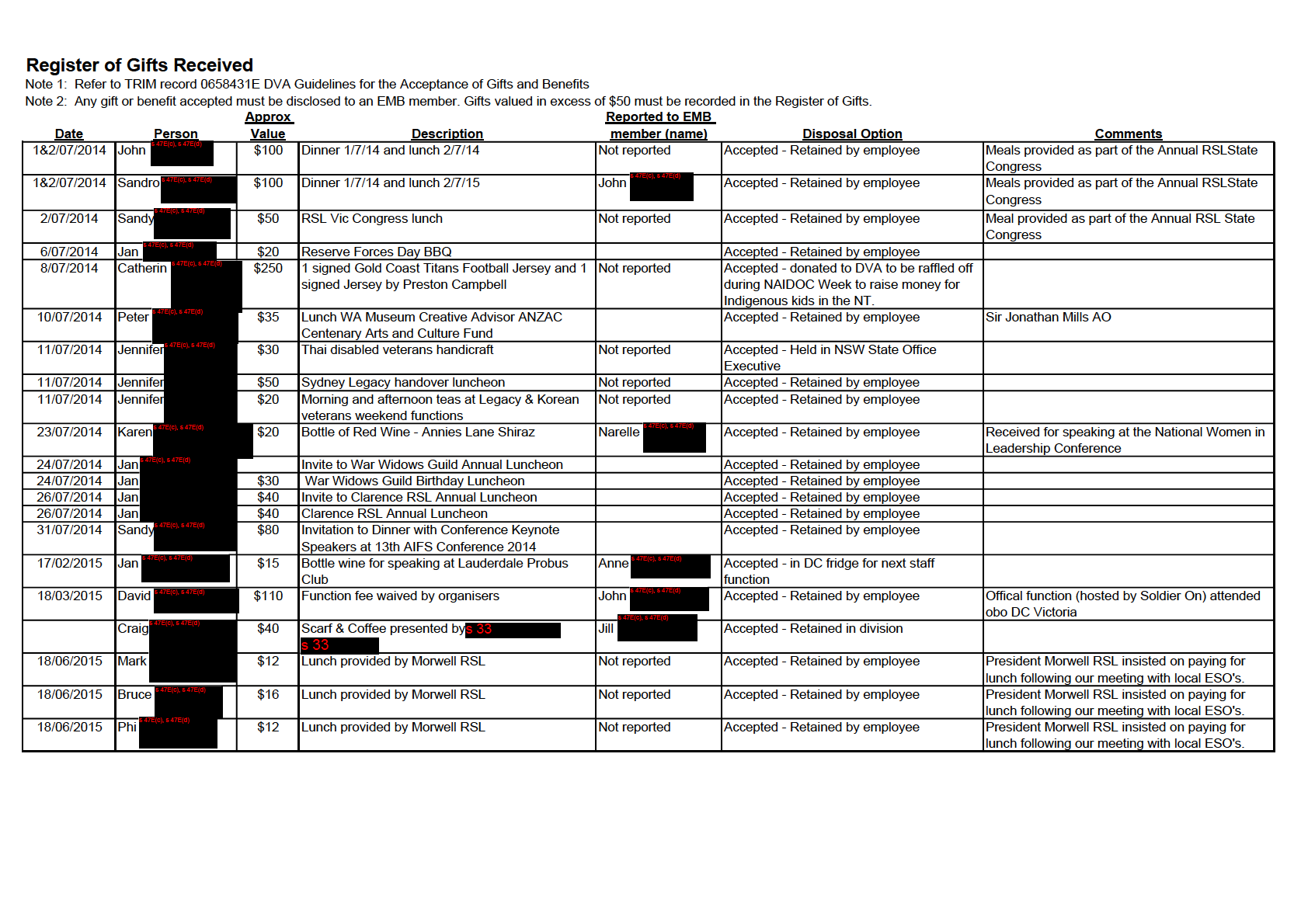

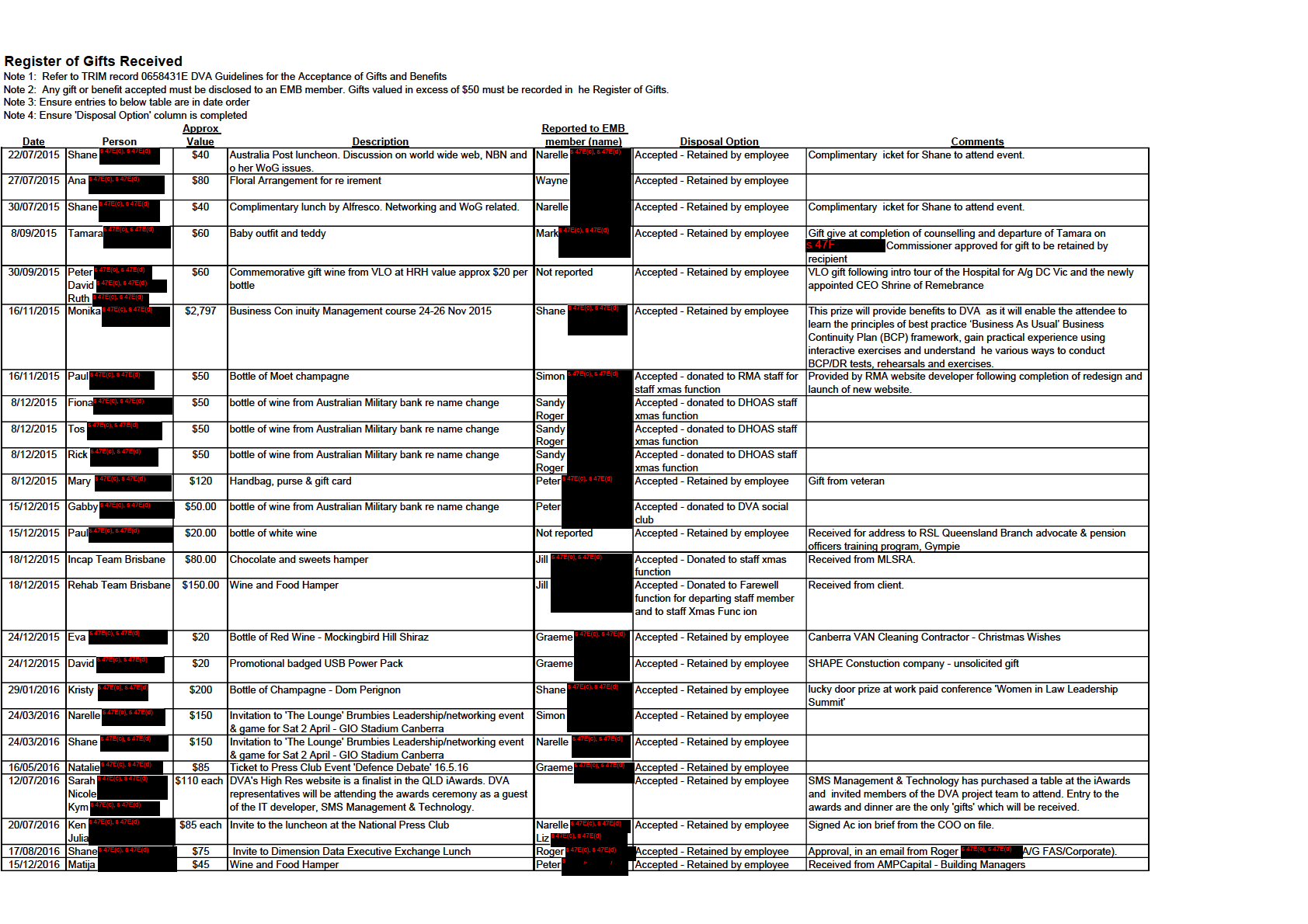

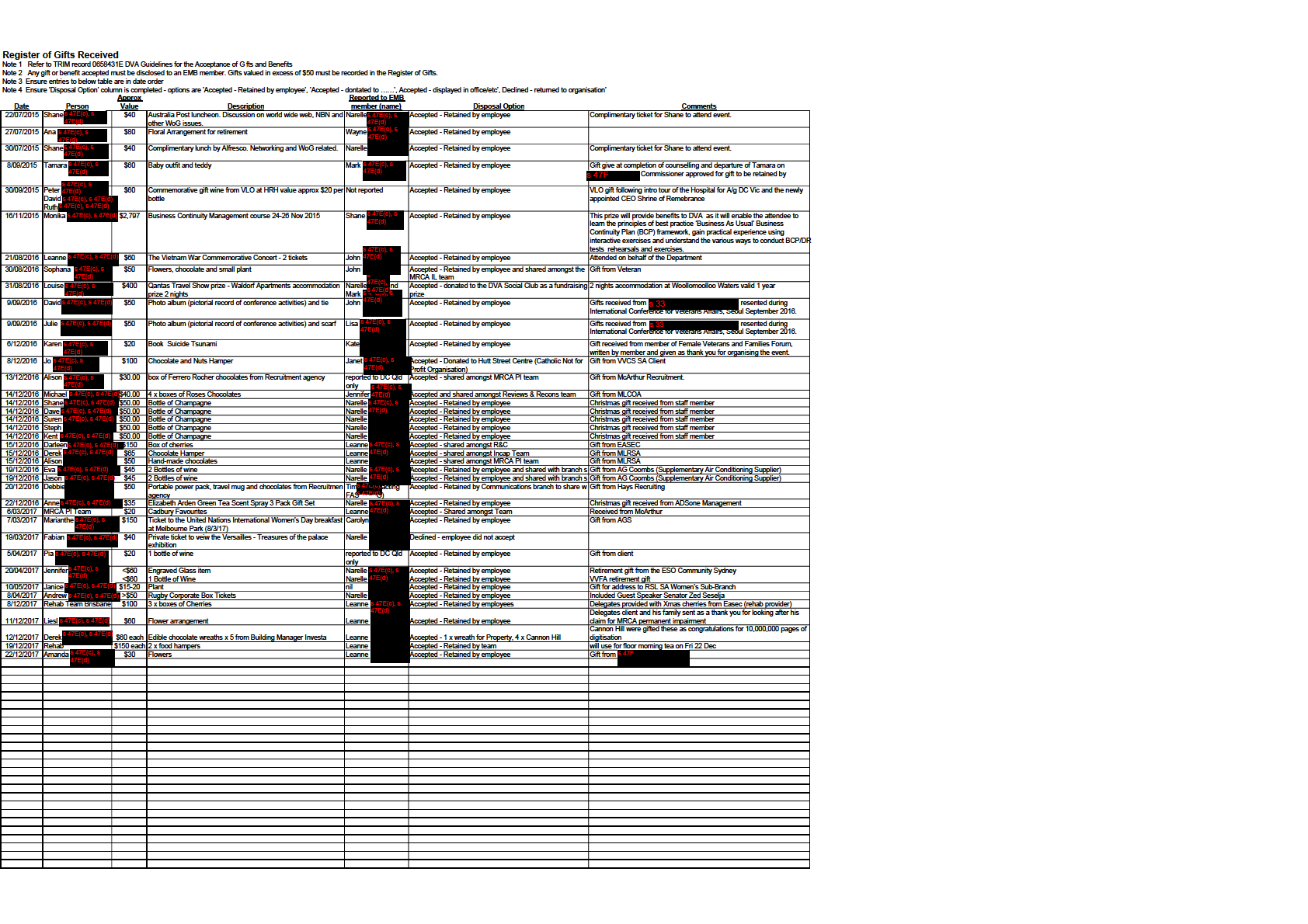

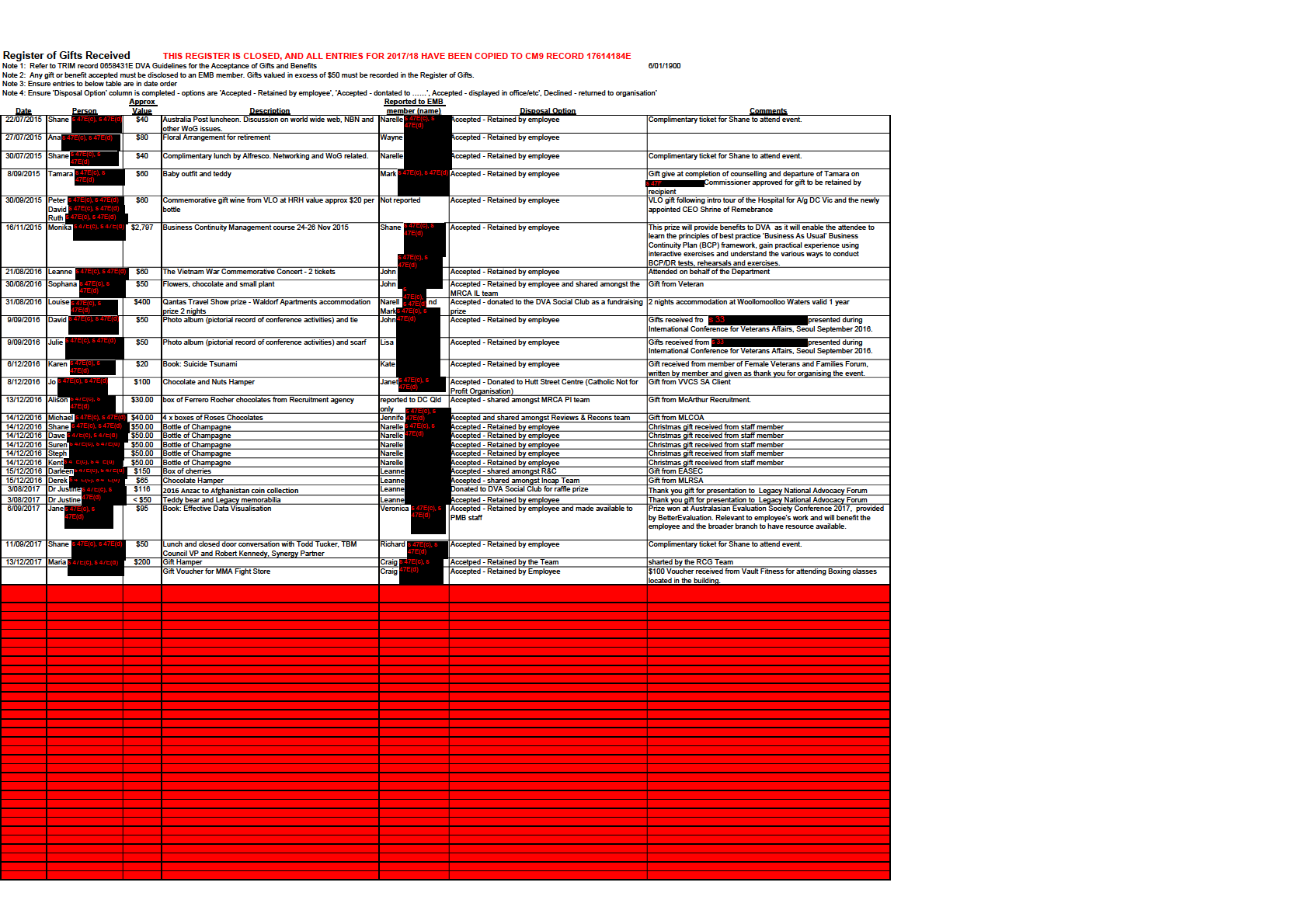

Register of Gifts Received

Note 1 Refer to TRIM record 0658431E DVA Guidelines for the Acceptance of Gifts and Benefits

Note 2 Gifts of a value in excess of $50 need to be reported to the Deputy Commissioner or General Manager, and recorded in the Register of G fts.

Approximate Value of Gift

Date Received

Received By

(see note 2)

Description of Gift

Reported to Senior Officer (name)

Additional Comments

s 47E(c), s

13/12/2010

Jason s 47E(c), s 47E(d)

$60

Hamper

Mike

Donated to staff Christmas Party

47E(d)

14/12/2010

Jean s 47E(c), s 47E(d)

$80

Wine package

Mike

Donated to staff Christmas Party

14/12/2010

Ken

$80

Wine package

Mike

Donated to staff Christmas Party

14/12/2010

Rosamaria s 47E(c), s 47E(d

$80

Wine package

Mike

Donated to staff Christmas Party

14/12/2010

Lorraine s 47E(c), s 47E(d)

$90

Hamper

Mike

Donated to staff Christmas Party

16/12/2010

Debbie s 47E(c), s 47E(d)

$20

Mini Hamper

Mike

Donated to staff Xmas Eve Morning Tea

14/12/2010

Lou s 47E(c), s 47E(d)

$20

Men's scarf

Mike

Kept by staff member

16/12/2010

Effie s 47E(c), s 47E(d)

$55

Cook Book

Letitia s 47E(c) s 47E(d)

Kept by staff member

20/12/2010

Sean s 47E(c), s 47E(d)

$20

Mince Pies

Mike s 47E(c), s 47E(d)

Donated to staff Xmas Eve Morning Tea

21/12/2010

Sean

$40

Chocolates

Mike

Donated to staff Xmas Eve Morning Tea

22/12/2010

Hugh

$100

David Jones Christmas Gift Card

Ken s 47E(c), s 47E(d)

24/02/2011

Ray s 47E(c), s 47E(d)

$25

Wine package

Mike

Donated to staff social club

28/04/2011

Gail

$50

Display box housing a small gold nugget

Mike

Kept by staff member

2/05/2011

RAP Team

$100

Fresh cup cakes

Mike

Kept by team

9/06/2011

R&C VIC

$100

Food and wine hamper

Mike

Used at team afternoon tea during restack

4/07/2011

Mike s 47E(c), s 47E(d

$350

Framed Jeff Hook cartoon

Shane s 47E(c), s 47E(d)

A gift from the Sir Edward Dunlop Medical Research Foundation Board

1/08/2011

Natalie s 47E(c), s 47E(d)

$83

Inv tation from Oakton to WIC Dinner & Debate

GM Corporate Narelle s 47E(c), s

Staff member to attend

18/10/2011

Wendy

$100

Hamper

John s 47E(c), s 47E(d)E(d)

Donanted to staff Christmas Party

14/11/2011

Natalie

$40

Chocolate Hamper

Narelle s 47E(c), s 47E(d)

Thank you gift distributed between ICT Applications Development Team.

5/12/2011

Narelle

$50

Visa Debit Card - $50 value

John s 47E(c), s 47E(d)

Donated to staff Social Club Christmas Party

5/12/2011

Narelle

$50

Visa Debit Card - $50 value

John

Donated to staff Social Club Christmas Party

15/12/2011

Bob s 47E(c) s 47E(d)

$100

Telstra Phone

John

Donated to Staff Social Committee for Raffling in 2012

20/12/2011

Debbie s 47E(c), s 47E(d)

$50

Perishable food hampr

Mike

Donated to staff Xmas morning tea

19/12/2011

Lorraine s 47E(c), s 47E(d)

$50

Perishable food hampr

Mike

Donated to team for staff Xmas morning tea

21/12/2011

Sean s 47E(c), s 47E(d)

$100

2 x food hampers

Mike

Donated to team and Level morning tea

21/12/2011

B ll s 47E(c), s 47E(d)

$30

Christmas Card with Cash

John

Donated to Income Support/Bereavement Christmas Morning Tea Brisbane office

20/12/2011

Maureen s 47E(c), s 47E(d)

$150

Food and wine hamper

Judy

Donated to team X'mas Party and morning tea

21/12/2011

Bernice s 47E(c), s 47E(d)

$50

Food and wine hamper

Marilyn s 47E(c), s 47E(d)

Donated to team members

s 47E(c),

31/03/2012

Graeme s 47E(c), s 47E(d)

$150

Corporate seat at Brumby's game in Synergy box

Narelle

s 47E(d)

11/07/2012

Shane s 47E(c), s 47E(d)

$105

Macquarie Telecome Board Dinner

FAS CORP

Shan

attend - Better appreciation of proposed MT Data Centre of Fairbarn for PCEHR opportunities

24/07/2012

John s 47E(c), s 47E(d)

$120

Book entitled Neoclassical Architecture in Greece

Shane s 47E(c), s 47E(d)

Book o

n the Victorian Office

24/07/2012

Leo s 47E(c), s 47E(d)

$120

Book entitled Neoclassical Architecture in Greece

Shane

Book on display in the Victorian Office

13-Aug

Natalie s 47E(c), s 47E(d)

$100

WIC Winter Dinner & Debate

Shane

22-Oct

Shane s 47E(c), s 47E(d)

$120

2012 Pub ic Sector summit - Interactive roundtable & Three co FAS CORP

nvitation to join an exclusive invitation-only Public Sector Summit that will explore the

s

47E(c), ncreasingly prevalent issue of cyber security

18/10/2012

Jenni s 47E(c), s 47E(d)

$60

Chinese silk scarf and art

FAS Rehab & Support - Sea

s 47E(c), s 47E(d)

s 47E(d)Retained by Jenni

7/11/2012

Shane s 47E(c), s 47E(d)

$50

Cordelata Christmas Celebrations Invite

FAS CORP

Shane attending

7/11/2012

Natalie s 47E(c), s 47E(d)

$50

Cordelata Christmas Celebrations Invite

CIO

Natalie attending

8/11/2012

Marilyn

$20

Scarf

Hadyn s 47E(c), s 47E(d)

20-Nov

Shane

$120

Telstra's Christmas celebrations

FAS CORP

Shane attending

25-Nov

A ison s 47E(c), s 47E(d)

$120

Telstra's Christmas celebrations

CIO

Alison attending

27/11/2012

Marilyn s 47E(c), s 47E(d)

$30

PVA pen & Christmas bauble

Hadyn s 47E(c), s 47E(d)

20/11/2012

Michaela s 47E(c), s 47E(d)

$120

Telstra's Christmas celebrations

CIO

Michaela attending

s 47E(c), s

20/11/2012

Tyler s 47E(c), s 47E(d)

$120

Telstra's Christmas celebrations

Michaela

Tyler attending

20/11/2012

Ashleigh s 47E(c), s 47E(d)

$120

Telstra's Christmas celebrations

Michaela 47E(d)

Ashleigh attending

20/11/2012

Chris s 47E(c), s 47E(d)

$120

Telstra's Christmas celebrations

Michaela

Chris attending

20/11/2012

Malcolm s 47E(c), s 47E(d)

$120

Telstra's Christmas celebrations

Michaela

Malcolm attending

20/11/2012

Craig s 47E(c), s 47E(d)

$120

Telstra's Christmas celebrations

Michaela

Craig attending

3/12/2012

Shane s 47E(c), s 47E(d)

$50

Synergy Re-launch party

FAS CORP

Shane attending

3/12/2012

Alison s 47E(c), s 47E(d)

$50

Synergy Re-launch party

CIO

Alison attending

14/12/2012

CLU Team

$15

Choclates

DC

Kept by team

5-Dec

Desktop Project team

$80

Fuji Diaries

CIO

Kept by team

19/12/2012

DSHI Vic

$75

Hamper

Kept by team, perishable items

20-Dec

DSHI QLD

$400

Hamper

DC QLD

Kept by team, perishable items

21/12/2012

Andrew s 47E(c), s 47E(d)

$80

Gift box of o ive oils

FAS CORP

Donated to DVA Social Club

24/04/2013

CIO

$50

Oracle Spotlight Executive Lunch

FAS CORP

CIO attending

7/05/2013

Jennifer s 47E(c), s 47E(d)

$10

Box of chocolates

FAS H&CS

Kept - shared with staff, perishable item

14-May

CIO

$120

IT Leaders Roundtable

FAS CORP

CIO to attend, other Dept's CIO are also in attendance.

s

Gift Box from anonymous client. Includes Bottle of

47E(c),

s 47E(c), s

26-Nov-13

Michelle s 47E(c) s 47E(d)

$150

champagne, biscuits, dip, gourmet meat, cheese, chips etc)

Justin

Alison

s 47E(d)

Gifts shared w th Townsville Office in a morning tea.

12-Dec-13

Janice s 47E(c), s 47E(d)

$46

Eliunt Olive Oil gift pack

DC - NT (Leanne s 47E(c), s 47E(d) Donated to Social Club, to raffle

19-Dec-13

Lance

$15

7 sma l bottles smarties and 2014 calandar

DC -NT

Donated to staff

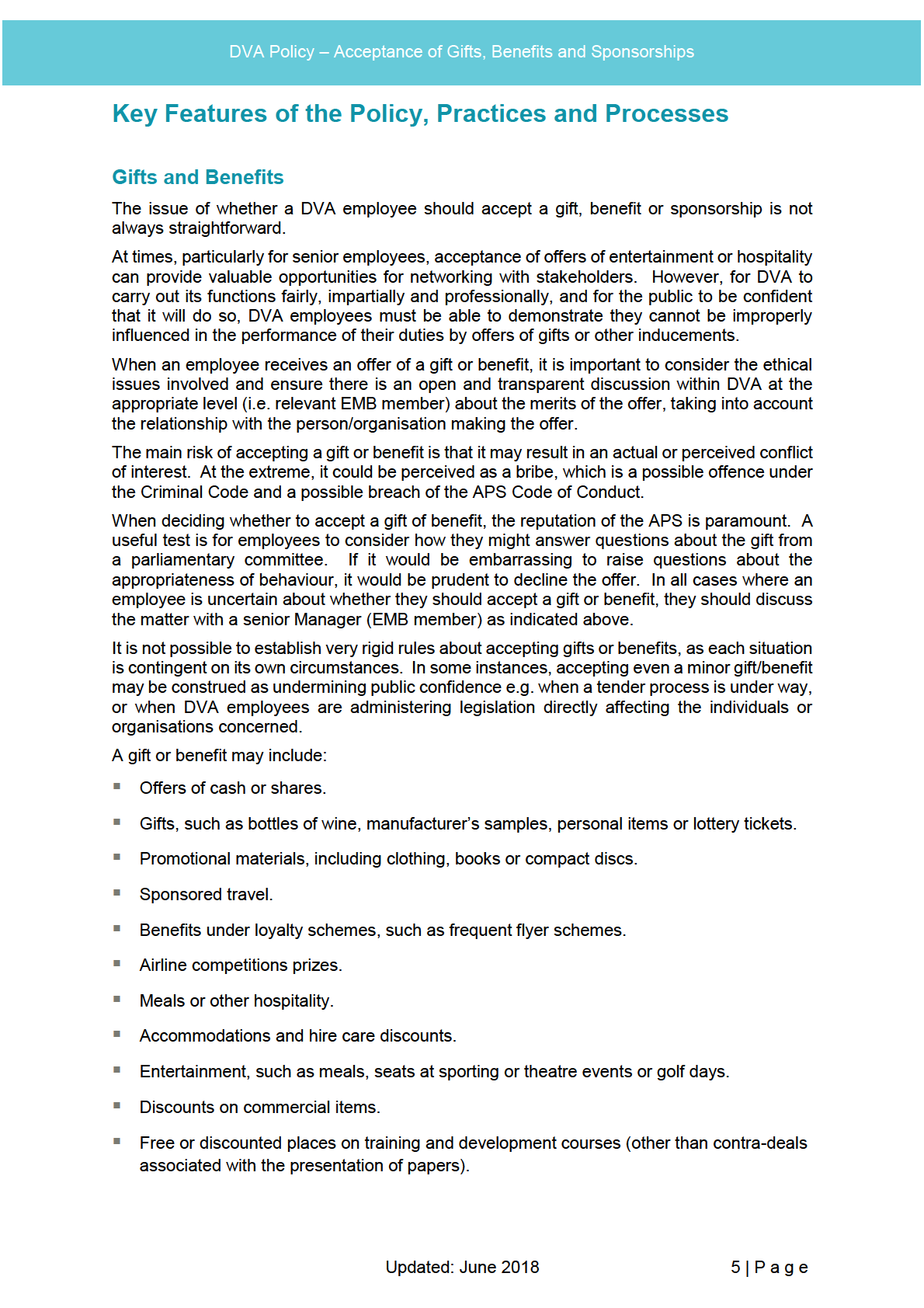

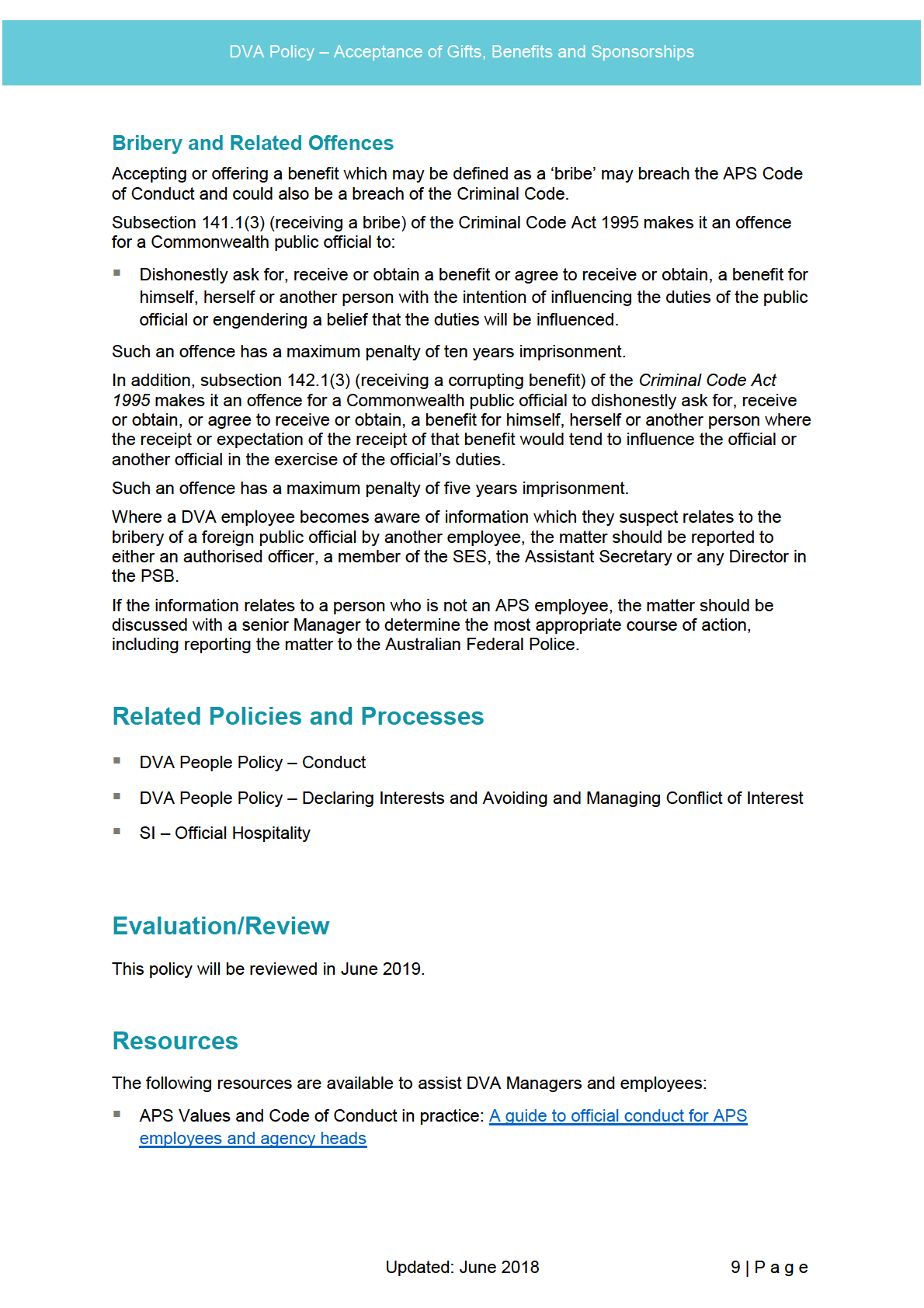

Register of Gifts Received

Note 1 Refer to TRIM record 0658431E DVA Guidelines for the Acceptance of Gifts and Benefits

Note 2 Gifts of a value in excess of $50 need to be reported to the Deputy Commissioner or General Manager, and recorded in the Register of Gifts.

Approximate Value of

Reported to Senior

Date Received

Received By

Gift (see note 2)

Description of Gift

Officer (name)

Additional Comments

s 47E(c), s

s 47E(c), s

28/09/2010

Ian

$100

Tea set - 8 cups and saucers, and tea pot

Shane

Retained by the Ian s 47E(c), s 47E(d)

47E(d)

47E(d)

22/04/2011

Ian

$10

Ceramic tile with Straits Commands Logo presented by s 33

Shane

Placed in the Secretary's Office

27/04/2011

Ian

$40

Glass plate with historic figure - presented by A/g UnderSecretarys 33

Shane

Placed in the Secretary's Office

27/04/2011

Ian

$35

Book "Colours and Masterpieces of Turkey" presented by A/g UnderSecretary s 33

Shane

Placed in the Secretary's Office

27/04/2011

Ian

$40

Frame with Ottoman Tughra presented by Deputy UnderSecretary s 33

Shane

Placed in the Secretary's Office

27/04/2011

Ian

$25

Book "Ottoman Tughra" presented by Deputy UnderSecretary, s 33

Shane

Placed in the Secretary's Office

27/04/2011

Ian

$30

3D Book about Canakkale presented by Deputy UnderSecretary s 33

Shane

Placed in the Secretary's Office

2/09/2011

Ian

$35

Stone Inukshuk figure presented by s 33

Deputy Minister s 33

Shane

Placed in the Secretary's Office

Register of Gifts Given

Approximate Value of

Delegate & Staff

Date Given

Received By

Gift (see note 2)

Description of Gift

(names)

Additional Comments

Register of Gifts Received - 2018/19 Financial Year

Note 1: Refer to TRIM record 17799992E - DVA People Policy - The Acceptance of Gifts, Benefits and Sponsorships

Note 2: Any gift or benefit accepted must be disclosed to an EMB member. Gifts valued in excess of $50 must be recorded in the Register of Gifts.

Note 3: Ensure entries to below table are in date order

Note 4: Ensure 'Disposal Option' column is completed - options are 'Accepted - Retained by employee', 'Accepted - dontated to ……', Accepted - displayed in office/etc', Declined - returned to organisation'

Approx

Reported to EMB

Date

Person

Value

Description

member (name)

Disposal Option

Comments

9/07/2018

Elly Jervis

$118

Taronga Zoo Family Pass

Mark Harrigan

Accepted- used for 2018 Trivia Night

Sponsor for Graduate run 2018 DVA Trivia Night. Awarded for Best

Dressed Individual.

9/07/2018

Elly Jervis

$200

Pedlar (Campbell) Voucher

Mark Harrigan

Accepted- used for 2018 Trivia Night

Sponsor for Graduate run 2018 DVA Trivia Night. Awarded for

Intermission Competition.

27/08/2018 John Reeday

$100

Limited Edition Cold Cast Bronze Figurine of the Wounded

Rick Carter

Accepted (on display at work and used for inspiration)

Digger from the Great War 1914-1918

I'm very proud and appreciative of the gift from a CCS Client

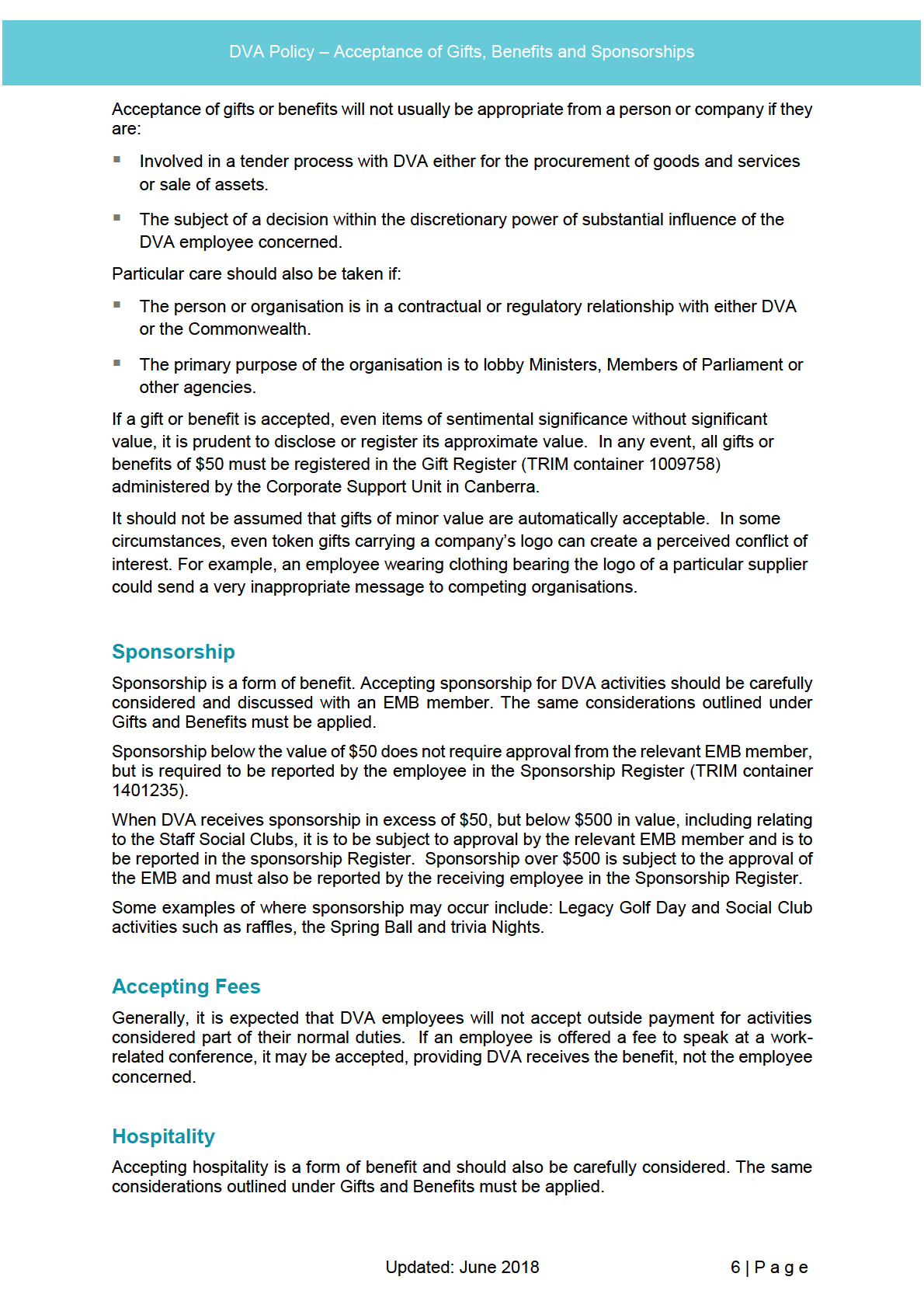

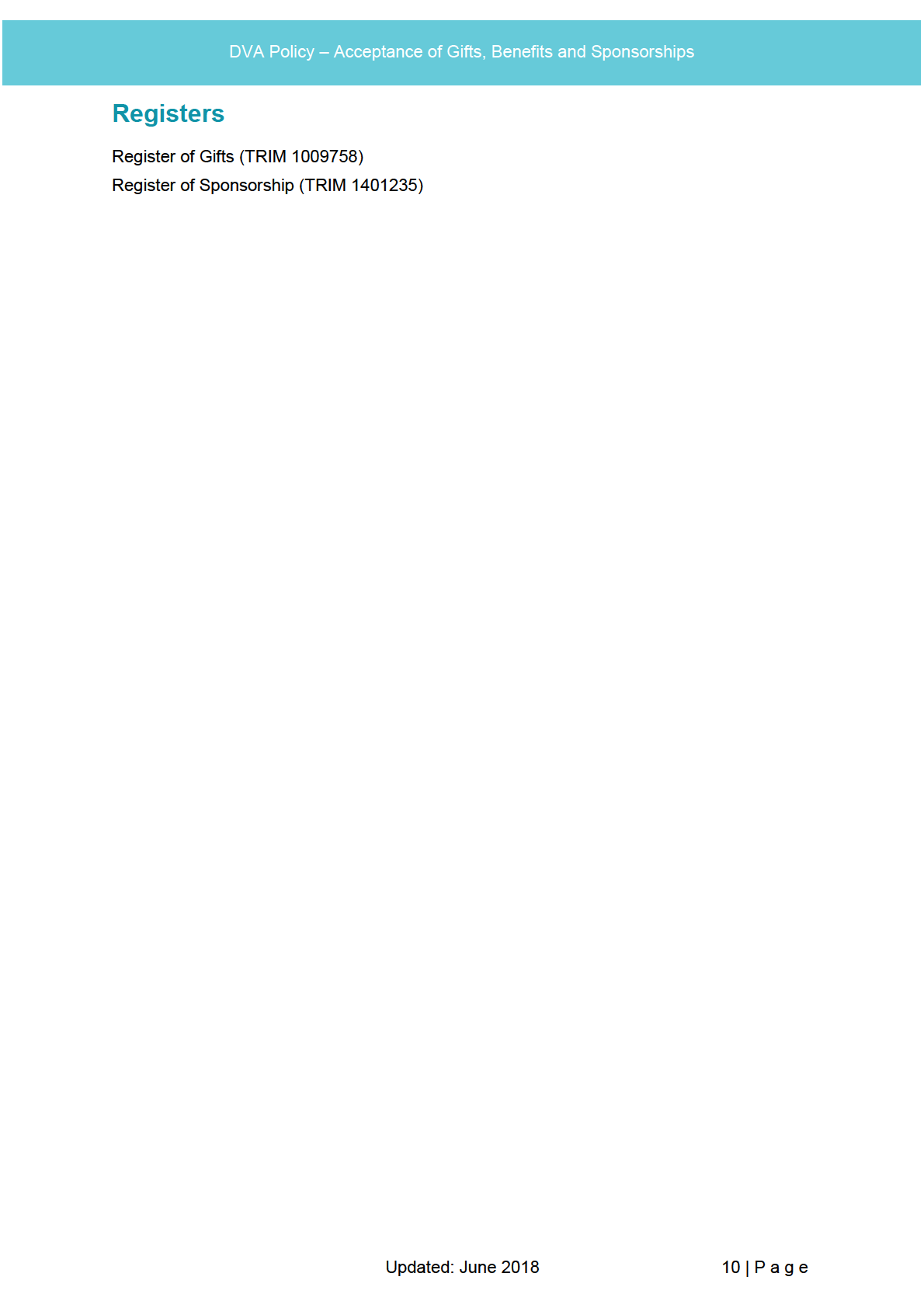

Register of Sponsorship Received

Note 1: Refer to TRIM record 0658431E DVA Guidelines for the Acceptance of Gifts, Benefits and Sponsorship

Note 2: Any sponsorship in excess of $50 but below $500 in value, including via the staff social club, is subject to approval by the relevant EMB business Division/DC member and must be recorded in this Register . Sponsorship

valued in excess of $500 is subject to the approval of the EMB, and must be recorded in this Register.

Approximate Value of

Reported to EMB

Date Received

Received By

Sponsorship (see note 2)

Description of Sponsorship

member (name)

Additional Comments

Register of Sponsorship Received

Note 1: Refer to TRIM record 0658431E DVA Guidelines for the Acceptance of Gifts, Benefits and Sponsorship

Note 2: Any sponsorship in excess of $50 but below $500 in value, including via the staff social club, is subject to approval by the relevant EMB business Division/DC member and must be recorded in this Register . Sponsorship

valued in excess of $500 is subject to the approval of the EMB, and must be recorded in this Register.

Approximate Value of

Reported to EMB

Date Received

Received By

Sponsorship (see note 2)

Description of Sponsorship

member (name)

Additional Comments

s 47E(c), s 47E(d)

s 47E(c), s 47E(d)

16/02/2015

Chris

$354 Accom for two people including breakfast

Shane

DVA Legacy Charity Golf Day Sponsorship - Roundhouse Hotels

20/02/2015

Chris

$300 Dinner Voucher - Italian & Sons

Shane

DVA Legacy Charity Golf Day Sponsorship - DTZ

20/02/2015

Chris

$60 Bottle of Devils Lair Merlot 2005

Shane

DVA Legacy Charity Golf Day Sponsorship - Shaw Building Grou

2/02/2015

Chris

$200 Pendo Pad 8

Shane

DVA Legacy Charity Golf Day Sponsorship - Paper Monkey

20/02/2015

Callum s 47E(c), s 47E(d)

$160 Four Solar Umbrellas

Shane

DVA Legacy Charity Golf Day Sponsorship - Pete's Golf Connec

DVA Legacy Charity Golf Day Sponsorship - Jigsaw Body

s 47E(c), s 47E(d)

20/02/2015

Chris

$425 Assessment and reformer golf sessions

Shane

Mechanics

DVA Legacy Charity Golf Day Sponsorship - Telstra - Major

s 47E(c), s 47E(d)

20/02/2015

Malcom

$500 Samsung Galaxy Pad - 4

Shane

raffle prize

2/02/2015

Chriss 47E(c), s 47E(d)

$285 Free Printing of Raffle Tickets

Shane

DVA Legacy Charity Golf Day Sponsorship - Kwik Kopy

13/02/2015

Malcom s 47E(c), s 47E(d)

$150 Prize Packs Branded bags and Fleece Jackets

Shane

DVA Legacy Charity Golf Day Sponsorship - Paxus

13/02/2015

Malcom

$150 Prize Packs

Shane

DVA Legacy Charity Golf Day Sponsorship - Fuji Xerox

19/02/2015

Kim s 47E(c), s 47E(d)

$275 Accom for two people

Shane

DVA Legacy Charity Golf Day Sponsorship - TFE Hotels

19/02/2015

Kim

$250 Free rental

Shane

DVA Legacy Charity Golf Day Sponsorship - Europcar

One night stay for two in an Executive Suite at the

Rex Hotel including buffet breakfast and

s 47E(c), s 47E(d)

15/09/2015

Tristan

$400 complimentary bottle of wine

Simon

DVA Spring Ball Raffle

30/09/2015

Jamie-Lee s 47E(c), s 47E(d)

$70 Dinner Voucher - Rama's F ji Indian Restaurant

Simon

DVA Spring Ball Raffle

13/10/2015

Amy s 47E(c), s 47E(d)

$39 Three small bags of coffee beans from ONA coffee

Simon

DVA Spring Ball Raffle

18/09/2015

Mohammeds 47E(c), s 47E(d)

$80 4 X Hoyts Woden movie tickets

Simon

DVA Spring Ball Raffle

(Premier Hotel)

p

tion

Register of Sponsorship Received

Note 1: Refer to TRIM record 0658431E DVA Guidelines for the Acceptance of Gifts, Benefits and Sponsorship

Note 2: Any sponsorship in excess of $50 but below $500 in value, including via the staff social club, is subject to approval by the relevant EMB business Division/DC member and must be recorded in this Register . Sponsorship

valued in excess of $500 is subject to the approval of the EMB, and must be recorded in this Register.

Approximate Value of

Reported to EMB

Date Received

Received By

Sponsorship (see note 2)

Description of Sponsorship

member (name)

Additional Comments

s 47E(c), s 47E(d)

15/08/2016

Louise s 47E(c), s 47E(d)

$120 Cookware prizes for RSPCA cupcake day fundraiser

Mark

Donated by The Hospitality Store, Canberra

Register of Sponsorship Received

Note 1: Refer to TRIM record 0658431E DVA Guidelines for the Acceptance of Gifts, Benefits and Sponsorship

Note 2: Any sponsorship in excess of $50 but below $500 in value, including via the staff social club, is subject to approval by the relevant EMB member and must be recorded in this Register . Sponsorship valued in excess of

$500 is subject to the approval of the EMB, and must be recorded in this Register.

Approximate Value of

Reported to EMB

Date Received

Received By

Sponsorship (see note 2)

Description of Sponsorship

member (name)

Additional Comments

11/08.2017

Leigh-Anne s 47E(c), s 47E(d)

s 47E(c), s 47E(d)

$300 Cookware prizes for RSPCA cupcake day fundraiser

Narelle

Donated by The Hospitality Shop, Canberra

Register of Sponsorship Received

Note 1: Refer to TRIM record 0658431E DVA Guidelines for the Acceptance of Gifts, Benefits and Sponsorship

Note 2: Any sponsorship in excess of $50 but below $500 in value, including via the staff social club, is subject to approval by the relevant EMB member and must be recorded in this Register . Sponsorship valued in excess of

$500 is subject to the approval of the EMB, and must be recorded in this Register.

Approximate Value of

Reported to EMB

Date Received

Received By

Sponsorship (see note 2)

Description of Sponsorship

member (name)

Additional Comments

DVA GUIDELI

NES FOR THE ACCEPTANCE OF GIFTS

AND BENEFITS

Contents

1.

Gifts and Benefits

2.

Accepting Fees

3.

Hospitality

4.

Sponsored Travel

5.

Entertainment

6.

Bribery and Related Offences

7.

Resources

1. GIFTS AND BENEFITS

The issue of whether or not an APS employee accepts a gift or benefit is not always

straightforward.

At times, particularly for senior employees, acceptance of offers of entertainment or

hospitality can provide valuable opportunities for networking with stakeholders.

However, for DVA to carry out its functions fairly, impartially and professionally,

and for the public to be confident that it will do so, DVA employees must be able to

demonstrate that they cannot be improperly influenced in the performance of their

duties by offers of gifts or other inducements.

When an employee receives an offer of a gift or benefit, it is important that they

consider the ethical issues involved and that there is an open and transparent

discussion within DVA at the appropriate level (ie. Secretary, General Manager,

Deputy Commissioners, Principal Member VRB or the Director OAWG) about the

merits of the offer, taking into account the relationship with the organisation making

the offer.

The main risk of accepting a gift or benefit is that it may result in an actual or

perceived conflict of interest. At the extreme, it could be perceived as a bribe, which

is an offence under the Criminal Code and a breach of the APS Code of Conduct.

When deciding whether to accept a gift or benefit, the reputation of the APS is

paramount. A useful test is for employees to consider how they might answer

questions from a parliamentary committee. If it would be embarrassing, it would be

prudent to decline the offer. In all cases where an employee is uncertain about

DVA Guidelines on Acceptance of Gifts and Benefits – Revised July 2010

whether they should accept a gift or benefit, they should discuss the matter with a

senior manager as indicated above.

It is not possible to establish set very rigid rules about accepting gifts or benefits as it

is contingent on the circumstances. In some instances accepting even minor benefits

may be construed as undermining public confidence—for example, when a tender

process is under way, or when DVA employees are administering legislation directly

affecting the individuals or organisations concerned.

A gift or benefit may include:

offers of cash or shares

gifts, such as bottles of wine, manufacturer's samples or personal items

promotional materials, including clothing, books or compact discs

sponsored travel

benefits under loyalty schemes, such as frequent flyer schemes

airline competition prizes

meals or other hospitality

accommodation and hire car discounts

entertainment, such as meals, seats at sporting or theatre events or golf days

discounts on commercial items

free or discounted places on training and development courses (other than

contra-deals associated with the presentation of papers).

Acceptance of gifts or benefits will not usually be appropriate from a person or

company if they are:

involved in a tender process with the agency, either for the procurement of

goods and services or sale of assets; or

the subject of a decision within the discretionary power or substantial

influence of the DVA employee concerned.

Particular care should also be taken if:

the person or organisation is in a contractual or regulatory relationship with

the Commonwealth

the organisation's primary purpose is to lobby Ministers, Members of

Parliament or agencies.

If a gift or benefit is accepted, it is prudent to disclose or register its approximate

value. All valuable gifts or benefits should be registered.

It should not be assumed, however, that gifts of minor value are acceptable. Even

token gifts that carry a company's logo can create, in some circumstances, a perceived

conflict of interest. For example, an employee from a purchasing area wearing

clothing bearing the logo of a particular supplier could send a very inappropriate

message to competing organisations.

2. ACCEPTING FEES Generally, it is expected that DVA employees will not accept outside payment for

activities considered part of their normal duties. If an employee is offered a fee to

DVA Guidelines on Acceptance of Gifts and Benefits – Revised July 2010

speak at a work-related conference, it may be accepted, providing DVA receives the

benefit, not the individual.

3. HOSPITALITY

In relation to the provision of official hospitality, the guidelines in the DVA Chief

Executive Instruction (CEI) No. 5.15 entitled

Official Hospitality, apply. The CEI

identifies circumstances where official hospitality may be justified and lists examples

of expenditure which are acceptable or are not acceptable as official hospitality.

4. SPONSORED TRAVEL

As a general rule, DVA pays for its employees to travel as part of their official duties.

Situations may arise, however, where a body external to DVA offers to pay for travel

for an employee. In such cases of sponsored travel, a DVA employee is being offered

a benefit and it should be treated in the same way as gifts and other benefits described

earlier.

DVA employees should be aware of the following principles regarding sponsored

travel:

DVA should meet the expenses associated with work undertaken on its behalf

by its employees

DVA employees should avoid conflicts of interest or the appearance of such

conflicts.

DVA employees should not accept offers of travel sponsored by private organisations

or groups. Sponsored travel includes cases where transport, accommodation or living

expenses are paid for or provided other than from DVA funds or the employee's own

resources. Acceptance of such travel may lead to the perception that DVA or the

employee is favouring the organisation concerned or using their position to gain a

benefit. Offers of sponsored travel or entertainment should be referred to the

Secretary for consideration.

Where the Secretary considers acceptance to be in DVA’s interest and where practical

alternative means of travel or attendance at official expense are not available, DVA

may offer to contribute to the costs involved. Participation by DVA employees in

travel relating to the inauguration of travel services or opening ceremonies at new

commercial or industrial undertakings may fall into this category. The important

criterion to be borne in mind is that DVA, or the APS as a whole, should gain and be

seen to gain the benefit of the opportunity, rather than the individual undertaking the

travel. This is essential to avoid giving rise to perceptions of conflicts of interest.

Sponsored travel that would not be acceptable under this guidance material is not

made acceptable by being undertaken during a period of leave.

Offers of sponsorship by bodies such as an inter-governmental or international

agency, another government, an educational institution, a non-profit organisation, a

recognised humanitarian organisation or broad-based industry group may be

acceptable.

Official travel and associated arrangements (accommodation, car rental etc.) should

not be used to accumulate bonus points for 'frequent flyer' benefits for private

DVA Guidelines on Acceptance of Gifts and Benefits – Revised July 2010

purposes. Further, it is Government policy that where an employee of the Australian

Public Service has already accumulated bonus points which would otherwise entitle

them to obtain a benefit, they should not accept such a benefit.

When travelling on official business, employees should not enter competitions, or

lottery-style promotions on offer by the airline companies, eg by placing boarding

passes or business cards in competition containers.

This policy applies also to the family of the person involved where there is a clear link

with the person's official duties.

5. ENTERTAINMENT

Offers of entertainment are often used in private business to make relevant business

contacts and improve business relationships. In some instances, accepting an offer of

entertainment may improve stakeholder relationships. Attendance at significant events

can provide senior DVA employees with opportunities to make important business

connections. There may also be an important representational role for senior

employees at such events. However, any offers must be assessed to ensure that

accepting the offer would not create an actual or perceived conflict of interest.

Accompanying a Minister is a relevant factor. Nonetheless, it is important for senior

staff to appreciate the example they set for other DVA employees in upholding the

Values. The more prominent the entertainment event, the more important it is to be

mindful of perceptions. Another option is for the individual to pay for the

entertainment.

While it may be in DVA’s or the government’s interests for senior employees to

accept invitations to some events, it is not appropriate for them to accept offers of

paid travel or accommodation in relation to their attendance. Offers that are accepted

should be recorded and declared in SES employees’ statements of interest.

6. PROCEDURE TO BE FOLLOWED WHEN A GIFT IS OFFERED OR

RECEIVED

Where an employee is

offered a gift or benefit or knows that a gift or benefit will be

offered by a person or organisation, the employee should disclose all the facts and

circumstances to the appropriate decision-maker (usually the location Deputy

Commissioner but otherwise a member of the Executive). The decision-maker will

consider the matter and decide whether the gift should be accepted or declined by the

Department, taking into account the issues listed below, including

the type and significance of the gift or benefit;

whether it gives rise to a conflict of interest or the appearance of a conflict

of interest;

the nature of the Departments functions;

the relationship the Department has with the person or organisation

offering the gift; and

its value and the circumstances in which it is offered.

DVA Guidelines on Acceptance of Gifts and Benefits – Revised July 2010

Where

a gift has already been received, the decision-maker will determine whether

the gift is to be accepted or declined and returned on behalf of the Department .

Register of Gifts

Where a gift or benefit has been accepted by the Department and has been judged by

the decision-maker to be significant, (with a value of $50 or greater) the

circumstances in which the gift was given and its approximate value should be

recorded in the Register of Gifts maintained by the Corporate Support Unit in ACT.

Where the decision-maker judges the gift to be insignificant there is no requirement to

include it in the Register of Gifts.

Disposal of gifts or benefits

Where the relevant decision-maker has determined the gift or benefit to be

insignificant, the decision-maker can agree that the gift or benefit can be retained by

the employee to whom it was given.

Where a gift is determined by the decision-maker to be

significant, the decision-

maker will also determine the method of disposal. (The decision-maker may wish to

seek advice from the Group Manager, Corporate Strategy and Support Group or from

a member of the Executive.) The options for disposal include:

the gift remaining the property of the Department (for display etc);

donation of the gift to the Social Club for a raffle or social function;

donation of the gift to a public or private organisation; or

disposal of the gift in an alternative way that would not offend the giver.

6. BRIBERY AND RELATED OFFENCES Accepting or offering a benefit that may be defined as a bribe may breach the APS

Code and the Criminal Code.

Subsection 141.1(3) (receiving a bribe) of the Criminal Code makes it an offence for a

Commonwealth public official to:

dishonestly ask for, receive or obtain a benefit or agree to receive or obtain, a

benefit for himself, herself or another person with the intention of influencing

the duties of the public official or engendering a belief that the duties will be

influenced.

Such an offence has a maximum penalty of 10 years imprisonment.

In addition, subsection 142.1(3) (receiving a corrupting benefit) of the Criminal Code

makes it an offence for a Commonwealth public official to dishonestly ask for,

receive or obtain, or agree to receive or obtain, a benefit for himself, herself or

another person where the receipt or expectation of the receipt of that benefit would

tend to influence the official or another official in the exercise of the official’s duties.

Such an offence has a maximum penalty of five years imprisonment.

DVA Guidelines on Acceptance of Gifts and Benefits – Revised July 2010

Consistent with Australia’s obligations under the OECD Convention on the Bribery of

Foreign Public Officials in International Business Transactions, under section 70.2 of

the Criminal Code it is an offence to bribe a foreign public official, whether in

http://sharepoint/money/Documents/0681935E_CEI_5_15.tr5Australia or in another

country. An Australian in another country who bribes or attempts to bribe an official

of that country can be prosecuted for bribery in an Australian court.

Such an offence has a maximum penalty of 10 years imprisonment.

Where a DVA employee becomes aware of information which they suspect relates to

the bribery of a foreign public official by another employee, consistent with their

obligations under the APS Values and Code of Conduct to behave ethically, honestly

and with integrity, they should report the information in accordance with the DVA

instructions on reporting breaches of the Code of Conduct. If the information relates

to a person who is not an APS employee, the employee should discuss the matter with

an appropriate senior manager to determine the most appropriate course of action,

including reporting the matter to the Australian Federal Police.

7. RESOURCES

APSC Values and Code of Conduct in Practice:

http://www.apsc.gov.au/values/conductguidelines14.htm

APSC Ethics Advisory Service :

http://www.apsc.gov.au/ethics/index.html

Gift Register Template

DVA Guidelines on Acceptance of Gifts and Benefits – Revised July 2010

link to page 25 link to page 25 link to page 25 link to page 25 link to page 25 link to page 26 link to page 26 link to page 26 link to page 26 link to page 26 link to page 26 link to page 27 link to page 27 link to page 28 link to page 28 link to page 31 link to page 31 link to page 31 link to page 32

BUSINESS SUPPORT SERVICES DIVISION – BRANCH BRIEF – OCTOBER 2018

E4

BSSD.COORD TRIM: 18622264E

ISSUE: GIFTS, HOSPITALITY & SPONSORSHIP

The Department of Veterans’ Affairs (DVA) has a set of policies and

procedures about the acceptance and recording of gifts and sponsorship.

These policies are compliant with the Public Governance, Performance and

Accountability Act 2013.

Oversight of the acceptance of all gifts by departmental staff, regardless of

value, is the responsibility of senior departmental staff.

Key Facts

All DVA employees are required to uphold and adhere to the Australian

Public Service (APS) Values and Employment Principles and Code of

Conduct (the Code) as set out in sections 10 and 13 of the Public Service

Act 1999 (the PS Act) and to behave ethically.

Any gift, benefit or sponsorship offered to a DVA employee must be

disclosed to an Executive Management Board (EMB) member and, if

accepted, entered in the Gifts Register or the Sponsorship Register.

All gifts or benefits over $50 must be registered in the Gift Register.

Background

In addition to the above requirements of registration and informing an

EMB member, sponsorship of over $500 requires EMB approval.

Recent Media Coverage

NIL

Recent Key Correspondence

NIL

Relevant QoNs

Nil over the past 12 months.

I certify that a check has been performed against the Annual Report, Portfolio Budget Statements, previous answers to QoNs,

and the CFO has cleared where there are financial implications:

Contact officer:

Phone:

Branch:

Date created:

Jeanette s 47E(c), s 47E(d)

s 47E(c), s 47E(d)

BSS Management & Procurement

18/04/2018

Clearance officer:

Division:

Date updated /

s 47E(c), s 47E(d)

Mark

BSS

reviewed:

21/09/2018