FOI 3139

Document 1

Consumer Data Right newsletter: 17 May 2021

Dear <<First Name>>,

This week’s Consumer Data Right (CDR) newsletter includes:

• what the 2021-22 Federal Budget contained on CDR

• ACCC compliance guidance for data holders in the banking sector

• ACCC guidance on authorised deposit-taking institution (ADI) responsibility

for data holder brands

• a reminder about the consultation open on CDR rules and standards design

papers, and information about deferral of joint account and direct to

consumer obligations.

Federal Budget 2021-2022

As part of the

Budget papers released on 11 May 2021, the Government stated its

continued commitment to implementing the CDR in the banking sector and

accelerating its rollout across the economy, including in the energy and

telecommunications sectors. Treasury is excited for the next phase of the CDR

rollout, where we will see:

•

the development of a data-driven economy

•

increased innovation in a post-COVID economic environment

•

consumers empowered to make informed choices about their services, and

•

reduced costs for Australian households and small businesses.

As noted in our

7 May 2021 newsletter, the Government’s 2021-22 Federal Budget

includes $111.3 million of investment to both continue and expand CDR rollout.

ACCC compliance guide for data holders in the banking sector

The ACCC has published

compliance guidance for data holders in the banking

sector. This guide is designed to assist data holders to understand and comply

with their obligations under the Consumer Data Right Rules and Standards.

ACCC guidance on ADI responsibility for data holder brands

The ACCC has published some guidance on

ADI responsibility for data holder

brands. This document is designed to assist industry participants identify whether

they have data holder obligations in relation to particular brands or branded

products they are associated with.

Reminder: Consumer Data Right rules and standards design papers

As announced in our

30 April newsletter, Treasury and the Data Standards Body

are seeking input on design issues to inform the development of rules and

standards to implement:

•

a peer-to-peer data access model in the energy sector, and

•

an ‘opt-out’ data-sharing model for joint accounts in the banking and

energy sectors.

To support consultation and elicit informal feedback on these issues, two design

papers are now available on

Treasury’s website for stakeholders’ consideration.

We welcome feedback and engagement on an informal basis, which can be

provided through GitHub (with separate pages for

joint accounts and

peer-to-

peer model for energy feedback) or by emailing

xxxx@xxxxxxxx.xxx.xx.

As part of the consultation discussions, there have been a number of queries about the

deferral of the joint account requirements and ‘direct to consumer’ obligations that

would have applied from November 2021

(Treasury announcement). Treasury has

responded to these queries with additional information which is available on the

CDR

Support Portal.

We are seeking stakeholder views by

26 May on the details of rules and standards

outlined in these papers.

Feedback received on these papers will inform the development of draft rules

and standards, which will be the subject of formal consultation in the coming

months.

Kind regards,

Kate O’Rourke

First Assistant Secretary

Consumer Data Right Division

The Treasury

FOI 3139

Document 2

Response to queries: Deferral of joint account and direct to consumer

obligations

On 30 April 2021 the Treasury

announced that the current requirements for banks to implement the

joint account requirements that would have applied from November 2021 will be deferred, with new

compliance dates to be set following

consultation on the joint account data sharing model.

Separately, compliance with data holders’ ‘direct to consumer’ obligations that would have applied

from November 2021 will also be deferred, pending a future consultation process.

In response to this announcement, Treasury has been asked for more details on the deferral

announcement and its implications for data holders in the banking sector.

What are the joint account obligations that are being deferred?

Major ADIs

Major ADIs must continue to facilitate joint account data sharing in accordance with the obligations

in

version 1 of the CDR Rules.

Under the deferral major ADIs will not be required to comply with the additional obligations in

version 2 of the CDR Rules that would have applied from November 2021. The key differences

between version 1 and version 2 of the joint account data sharing obligations in the CDR Rules are

described in

a CDR Support Portal article. In particular, major ADIs must continue to support joint

account data sharing for joint accounts with two account holders, maintain a joint account

management service to allow consumers to manage their disclosure options, as well as meet the

dashboard and notification requirements under version 1. However, the following obligations in

version 2 will be deferred:

•

requirements for sharing data on joint accounts where there are more than two account

holders (rather than two account holders only)

•

notification and invitation requirements

•

the ‘in-flow election’ processes

•

secondary user functionality for joint accounts.

Non-major ADIs

Obligations for non-major ADIs to share joint account data from November 2021 will be deferred.

This will also apply to the major banks for their non-primary brands.

Reciprocal data holders

Similarly, current requirements for reciprocal data holders to share joint account data under version

1 of the CDR Rules from July 2021, and version 2 of the CDR Rules from November 2021, will be

deferred.

The deferral does not affect other obligations for the non-major ADIs that are due to commence

from November 2021, in relation to phase 2 products and additional APIs. For example, this means

that non-major ADIs will be required to respond to consumer data requests for phase 2 products

from November 2021 where these products are held by single account holders (including home

loans, mortgage offset accounts and personal loans).

Requirements under the current rules

Effect of deferral

Present

Jul 2021

Nov 2021

Must continue sharing joint

Share joint

account data under version 1 of

account data

Share joint

the rules

Major ADIs under version

account data

1 of the rules

under version

No requirement to implement

until 31

2 of the rules

additional joint account

October 2021

functionality that would have

applied from November 2021

Non-major

ADIs and

Share joint

non-

account data

primary

under version

brands of

2 of the rules

major ADIs

No requirement to share joint

account data

Share joint

Reciprocal

account data

Share joint

data

under version account data

holders

1 of the rules

under version

until 31

2 of the rules

October 2021

What is the new compliance date for joint account obligations?

New compliance dates for joint account obligations will be determined by the Minister after

considering feedback from stakeholders received during the current consultation on the joint

account design paper, and from the formal consultation that will occur on draft amendments to the

CDR Rules. New compliance dates will be determined, even if the Minister decides, following

consultation, to maintain the current approach to joint account data sharing in the CDR Rules.

How can I provide feedback on the new compliance date for joint account obligations?

Feedback on the issues outlined in the joint accoun

t design paper can be provided up until

26 May

2021, including on the implementation considerations to inform a new compliance date for joint

account data sharing. Draft rules will be developed for formal consultation as soon as possible

following the close of consultation on the design paper.

As noted in the design paper, we are keen to ensure that joint account data sharing can commence

as quickly as possible and for as many consumers as possible, and to support increased participation

in the CDR by prospective ADRs. While the design paper notes the desire for any new compliance

date to be in Q1 of 2022, this is a consultation issue and we encourage feedback on the

implementation timeframes that would be achievable for the options explored in the paper. We

encourage the provision of specific information about the implementation impacts of the opt-out

proposal to support submissions on the new compliance date.

What are ‘direct to consumer’ obligations that are being deferred?

All data holder requirements to disclose required consumer data in response to a direct request

made by a CDR consumer (the ‘direct to consumer’ obligations) will be deferred. The intention is for

consultation to occur at a future time on an API-based model for direct to consumer obligations and

part of that process would involve consideration of compliance dates for these obligations.

How wil the deferrals be given effect?

Deferrals relating to joint account and ‘direct to consumer’ obligations will be given effect though

amendments to commencement provisions in the CDR Rules. The process for consulting on and

finalising these rules is intended to occur prior to November 2021.

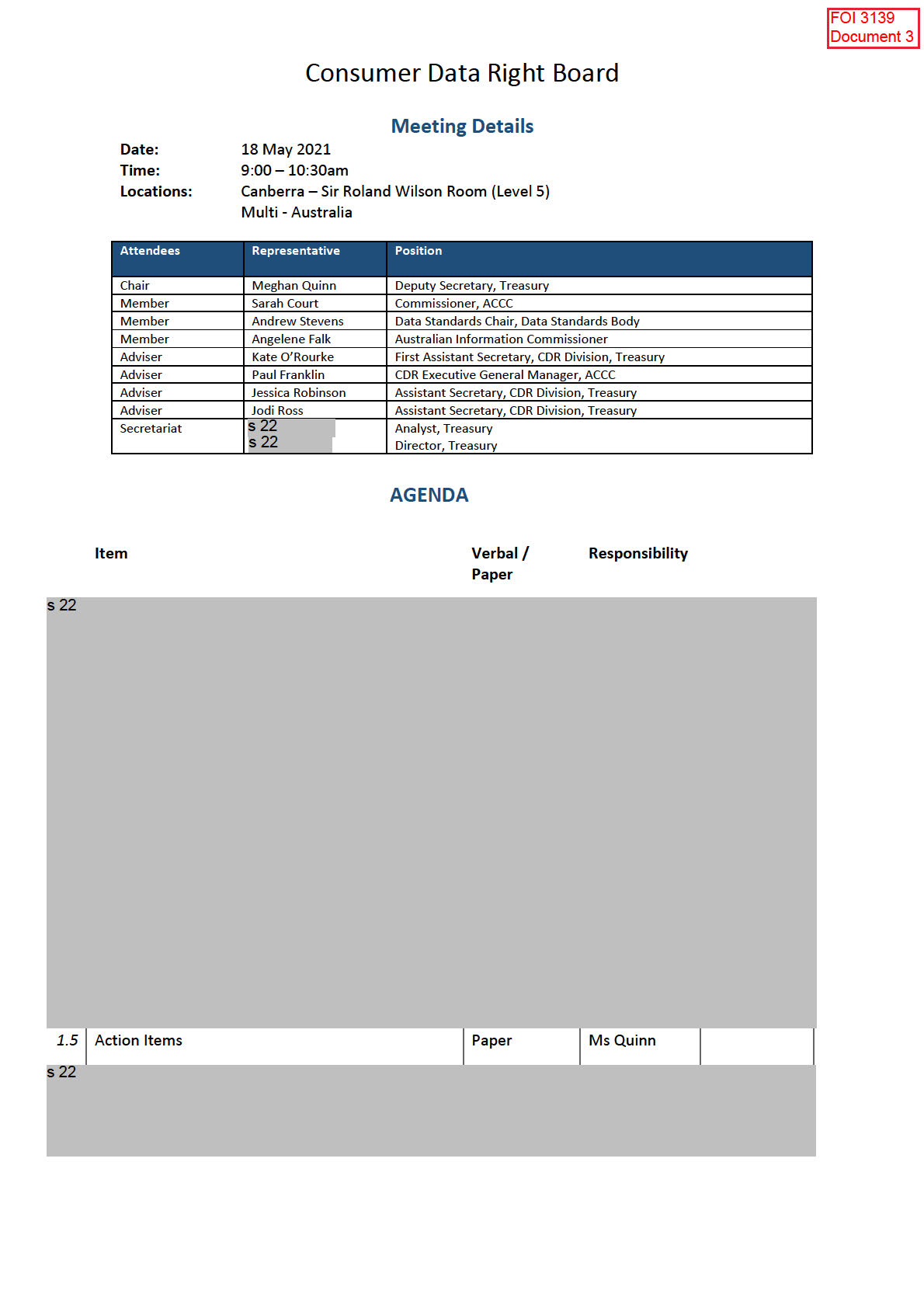

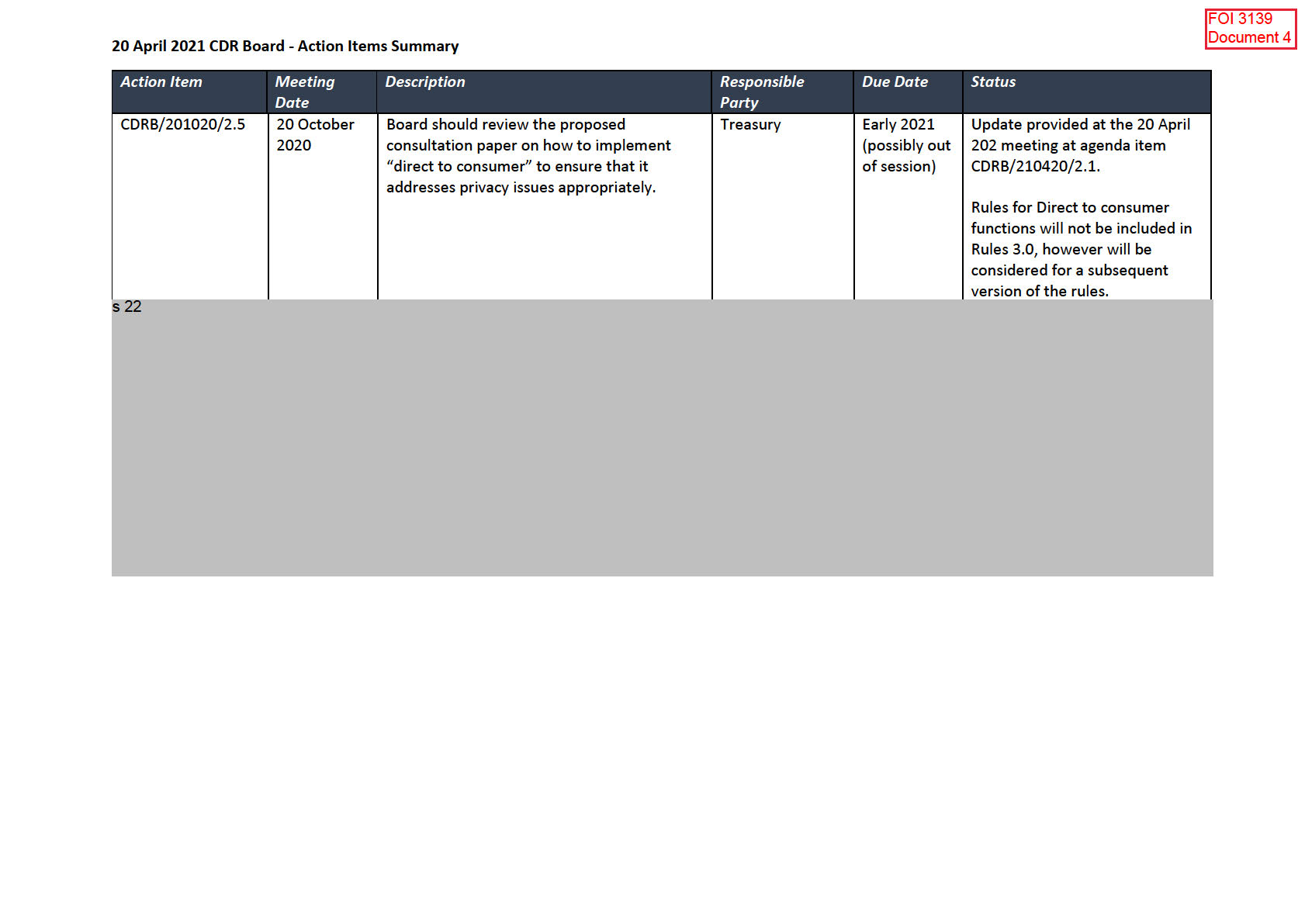

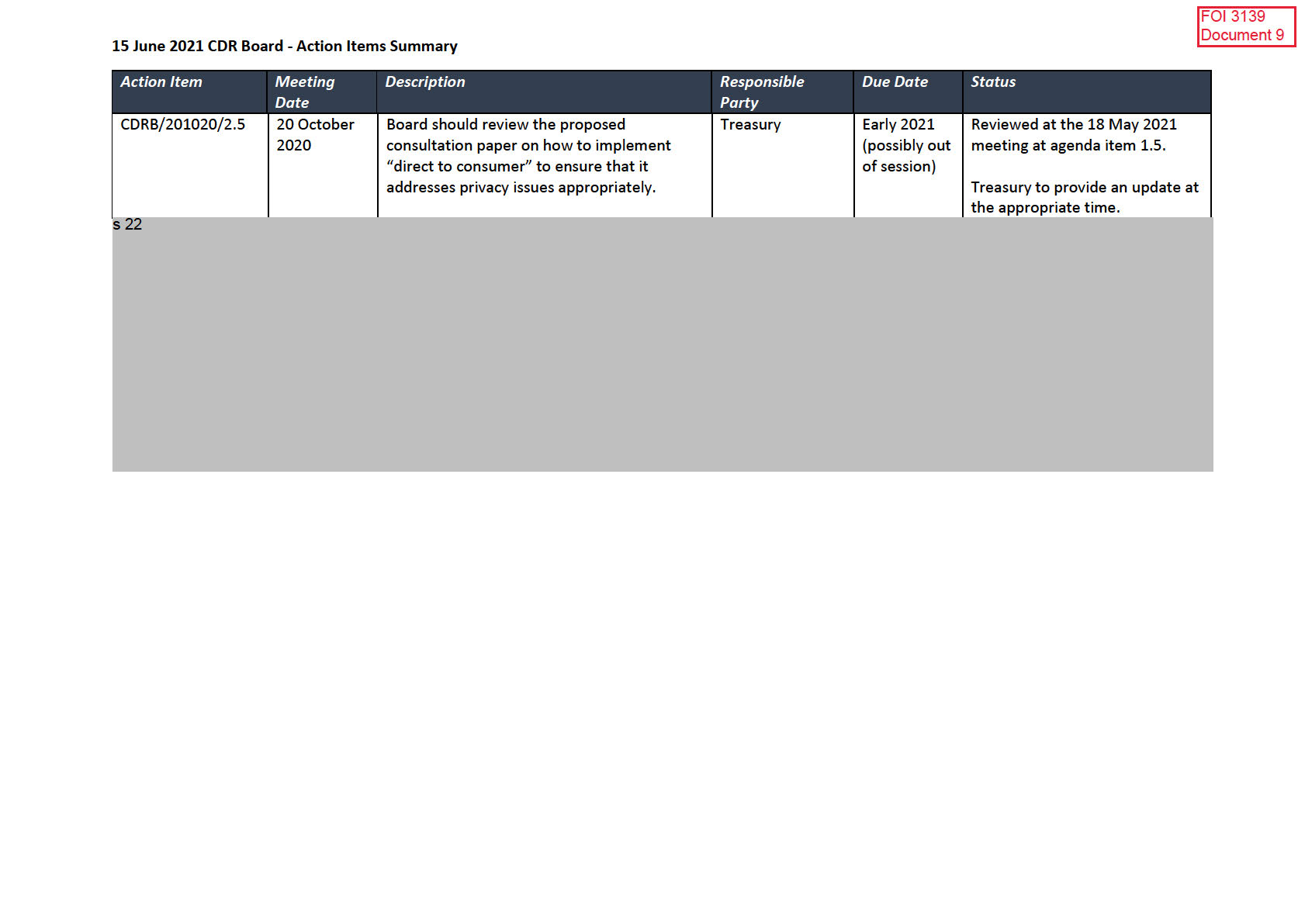

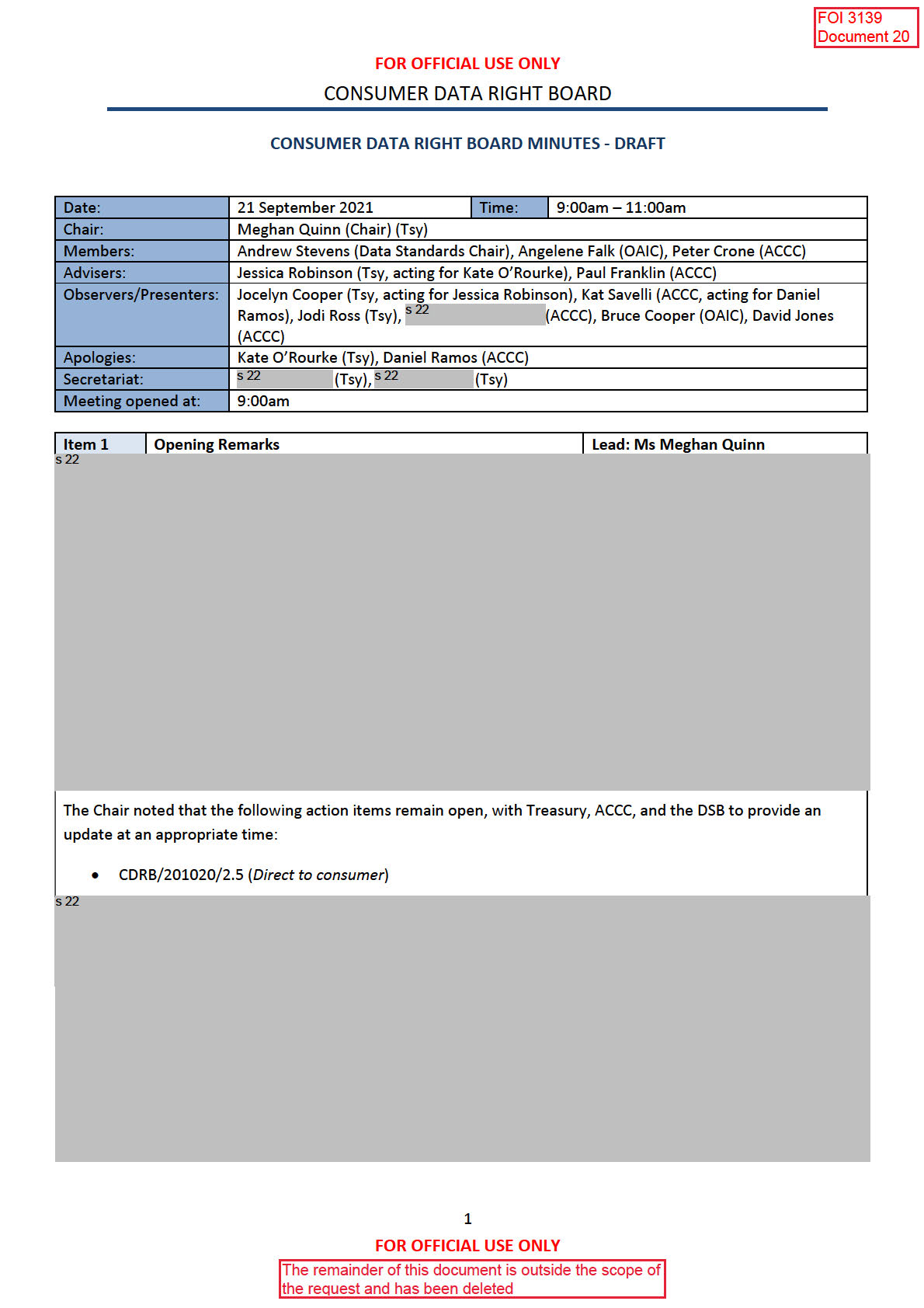

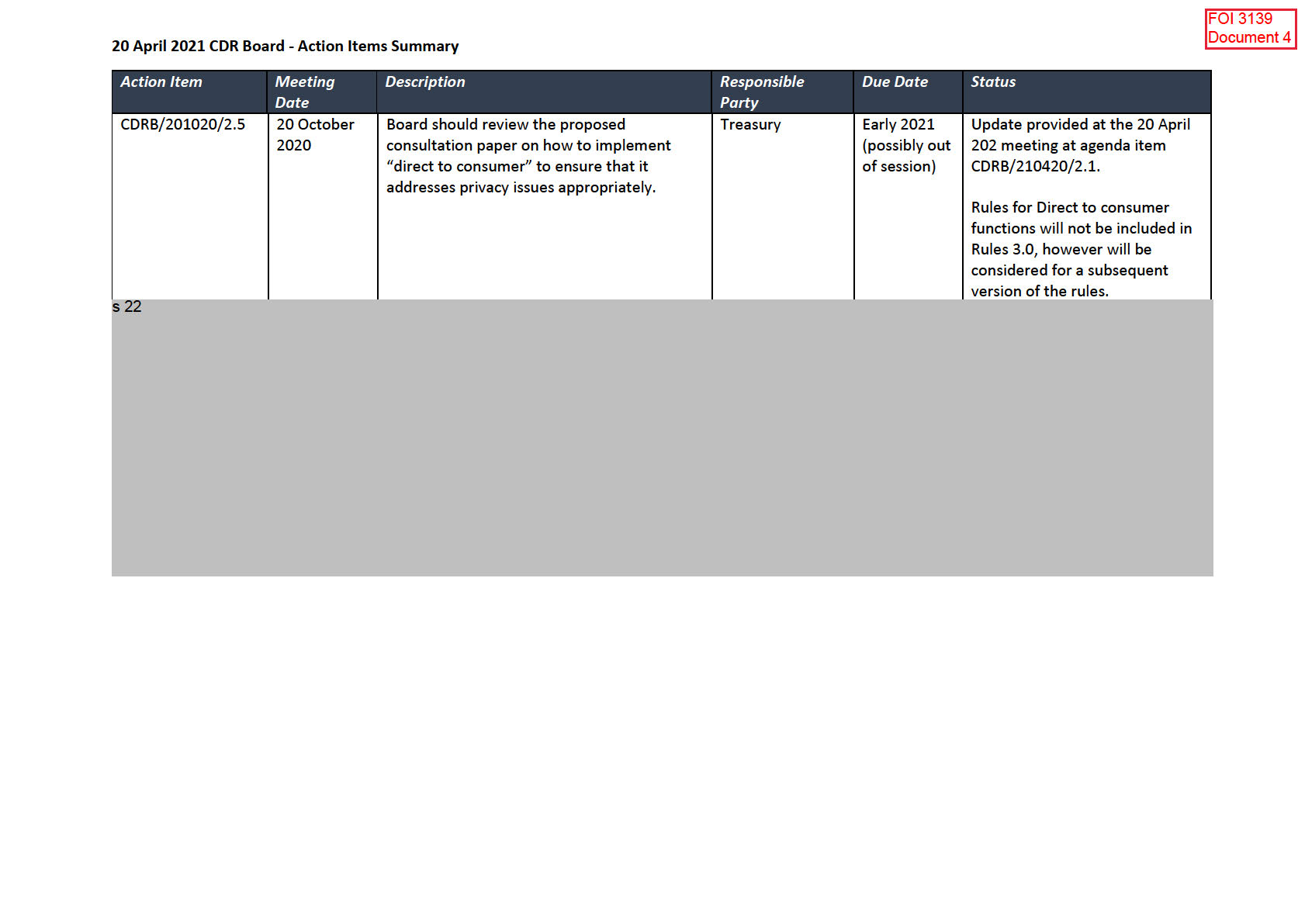

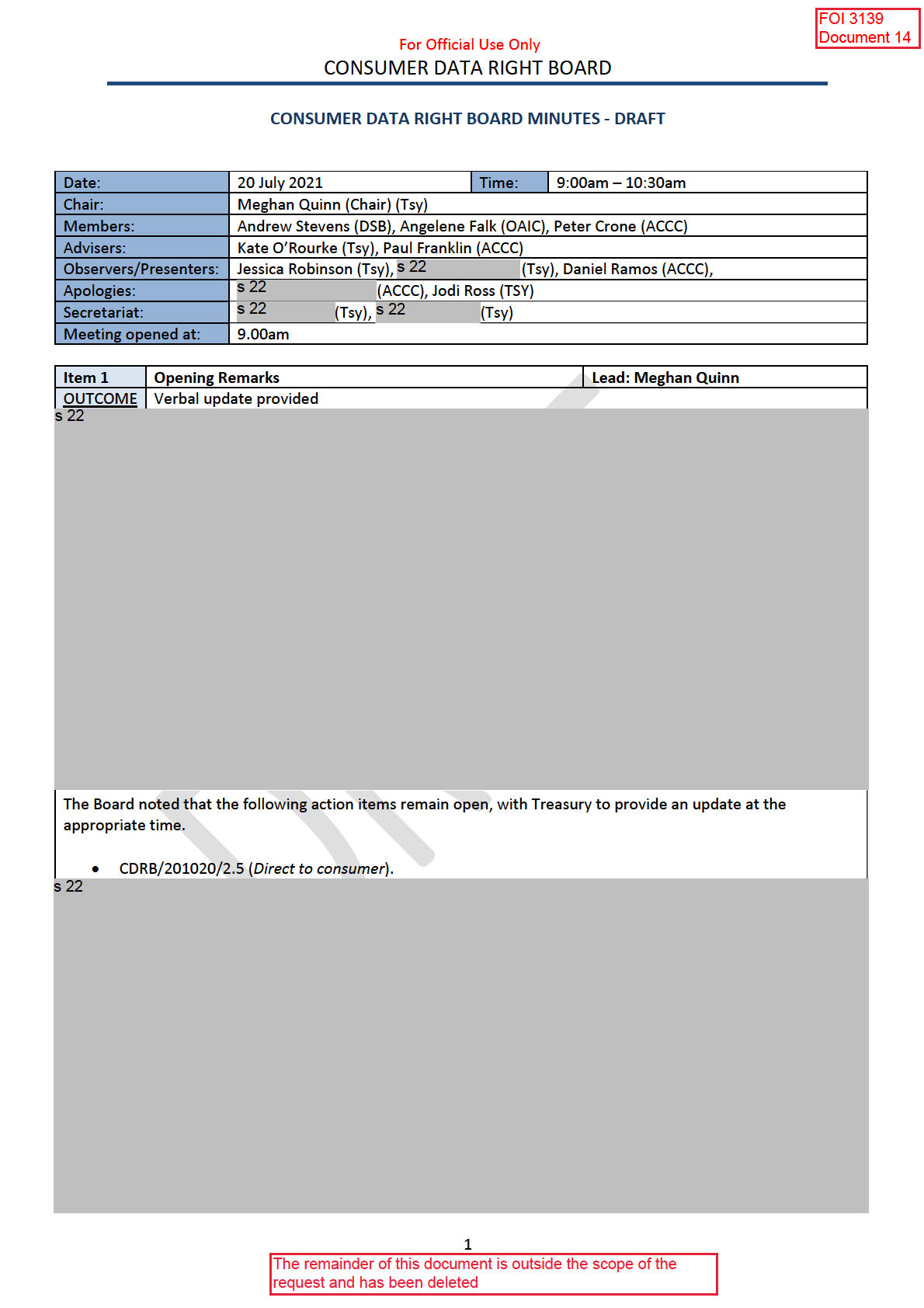

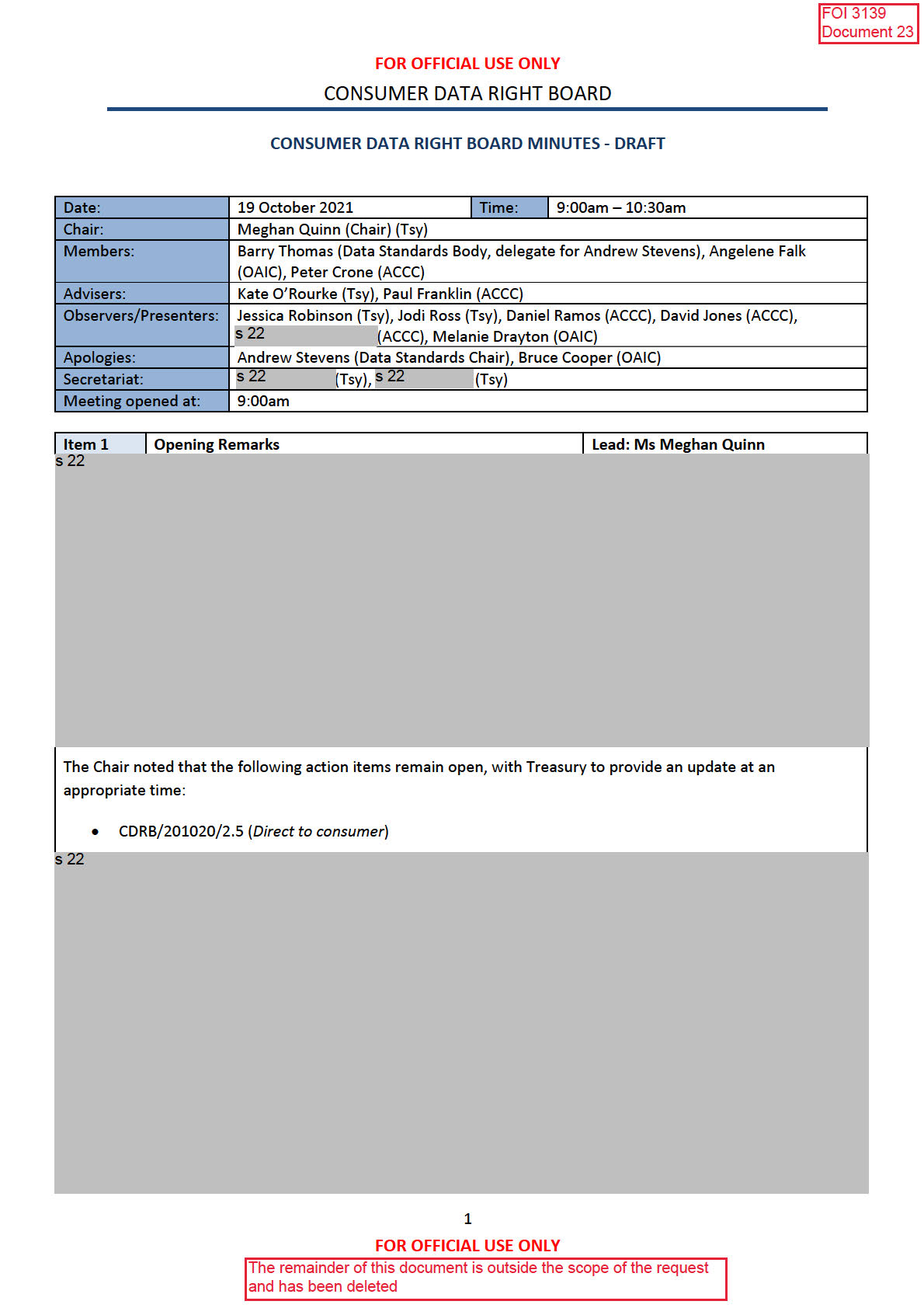

Consumer Data Right Board

s 22

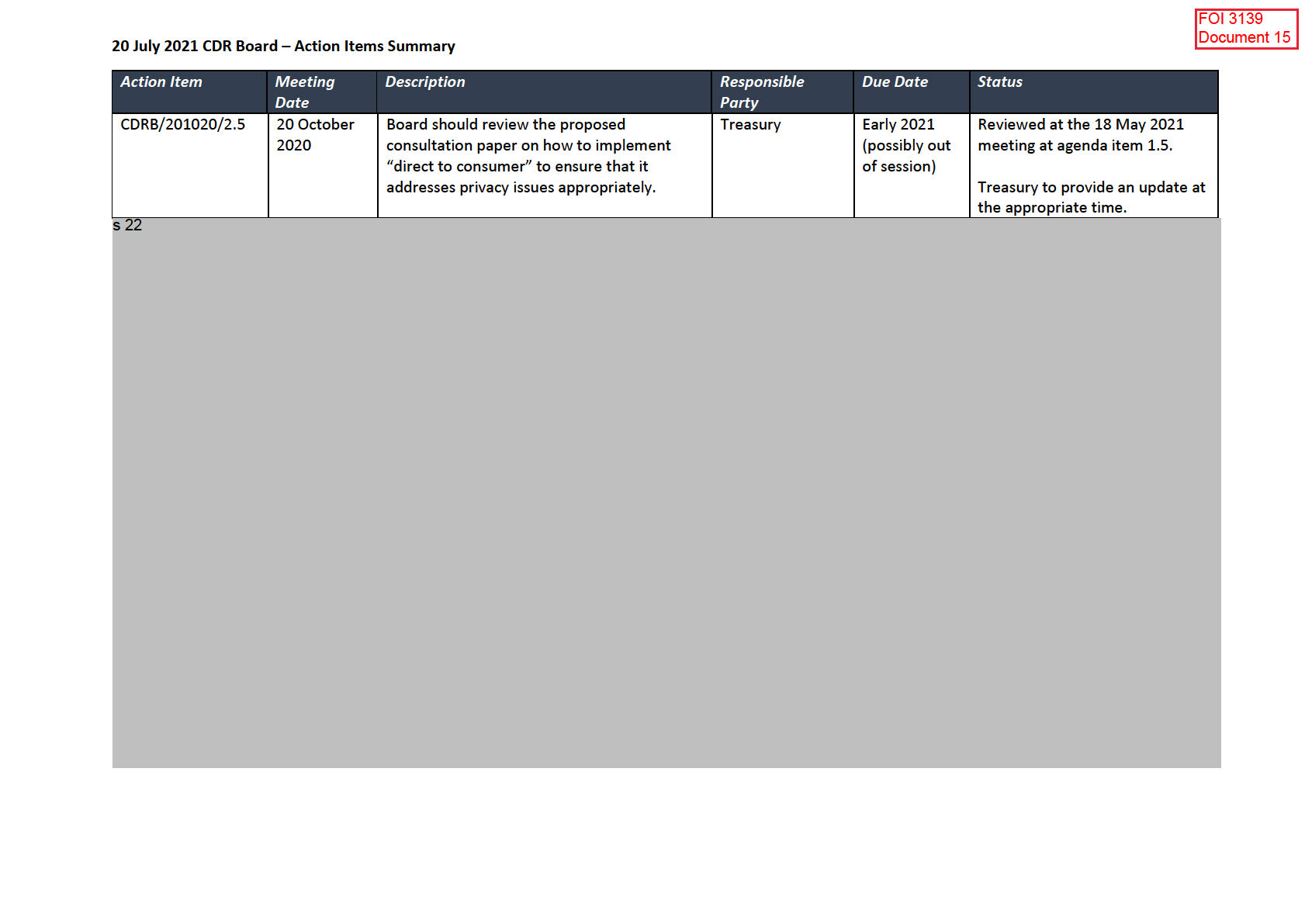

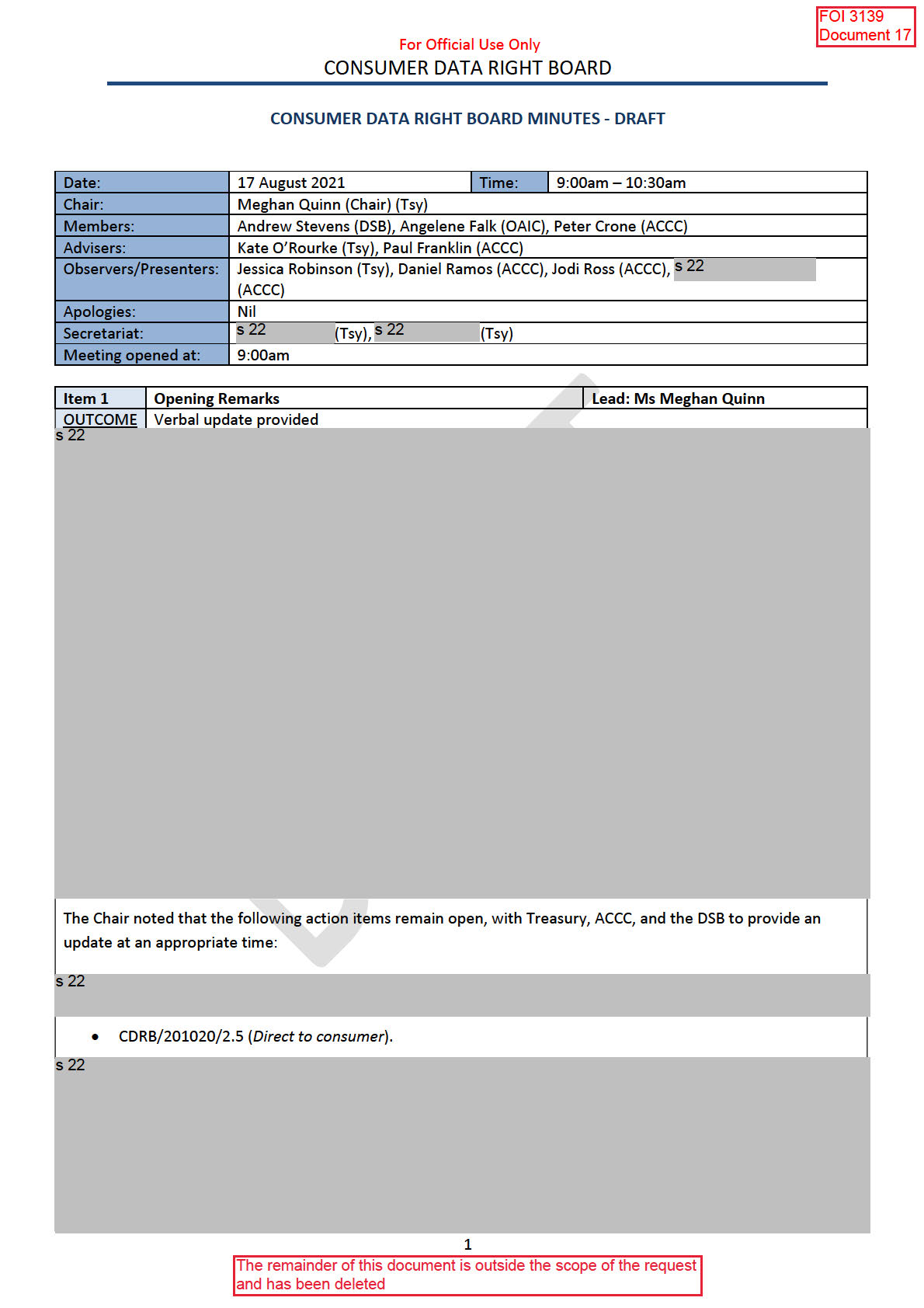

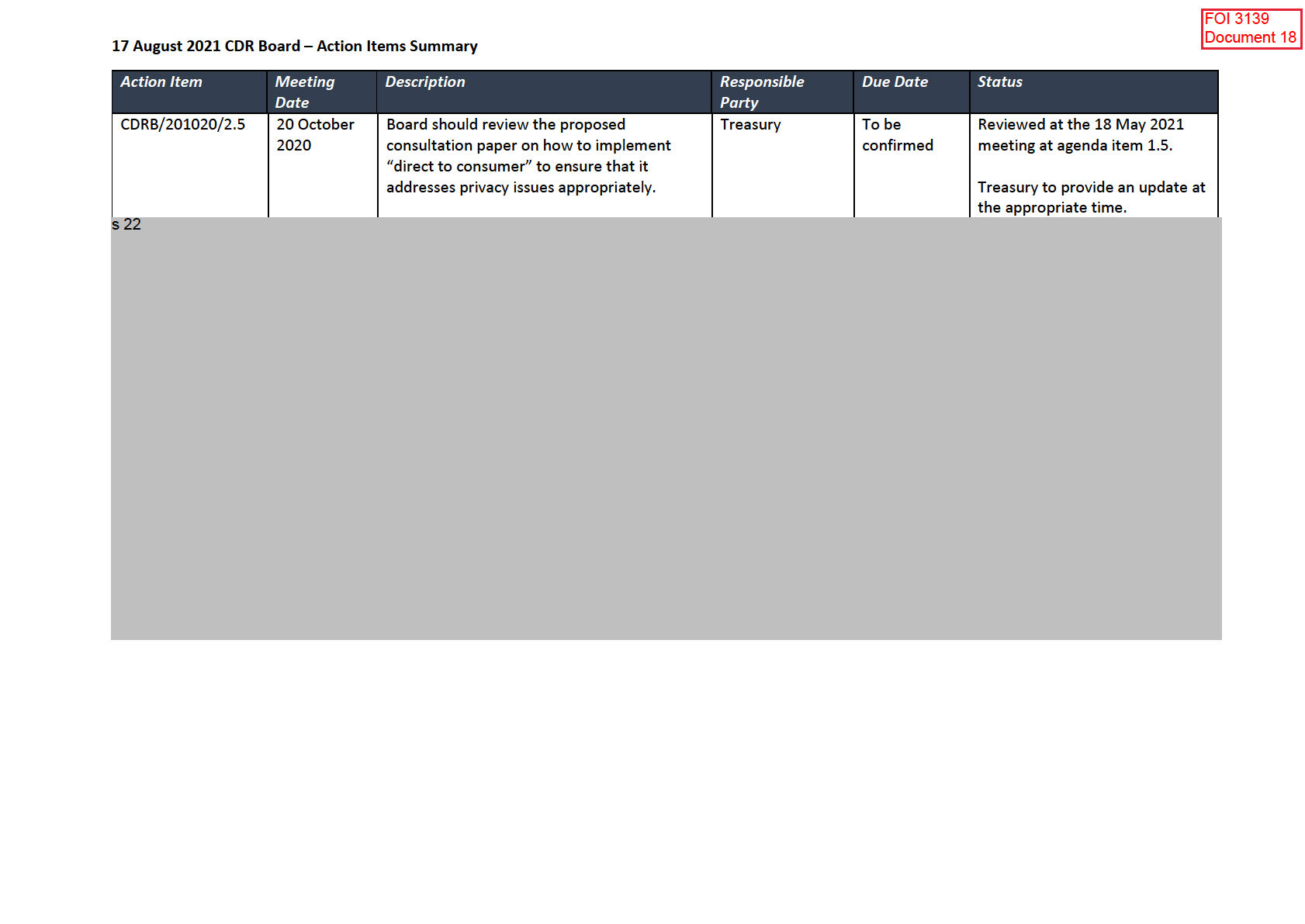

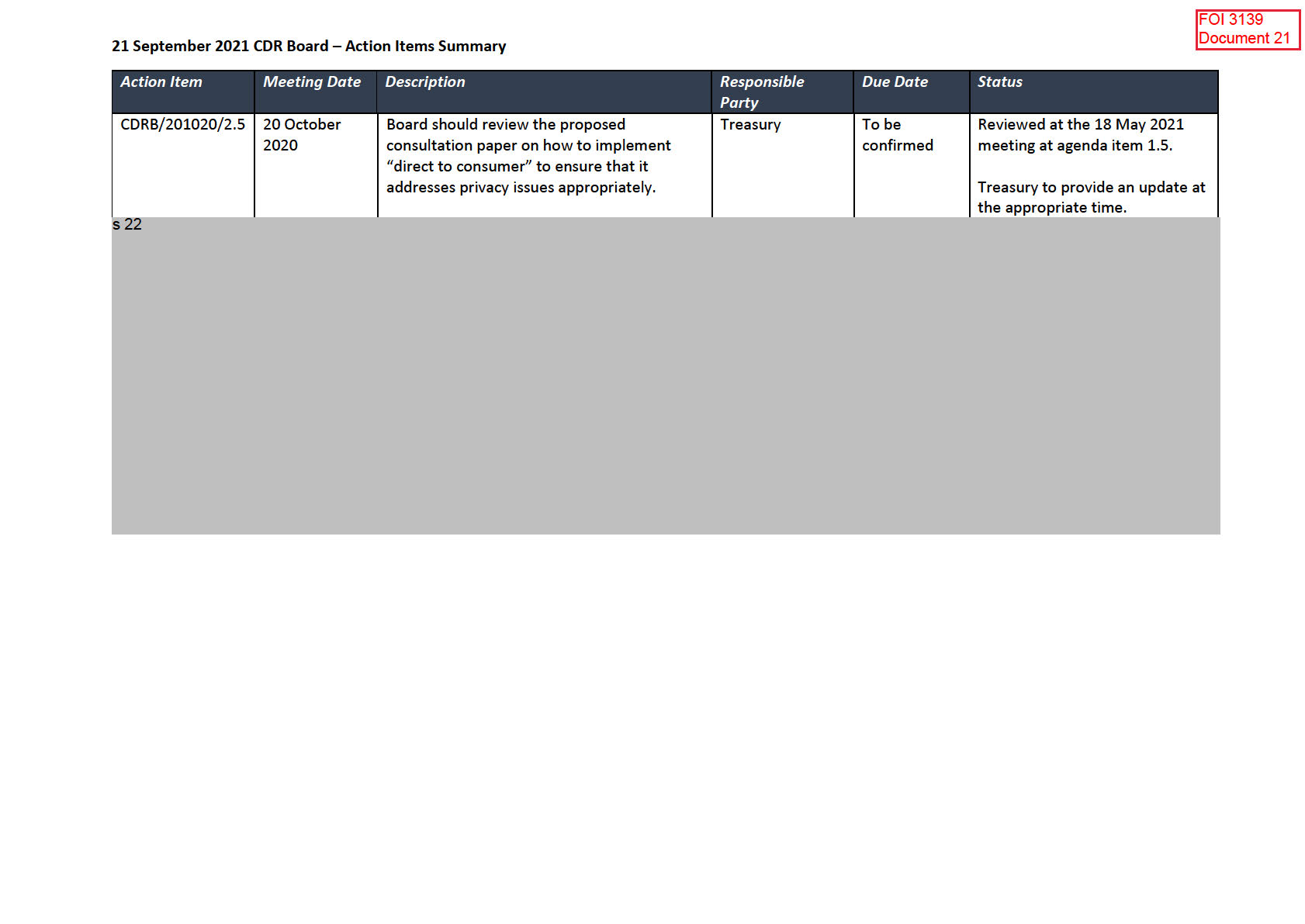

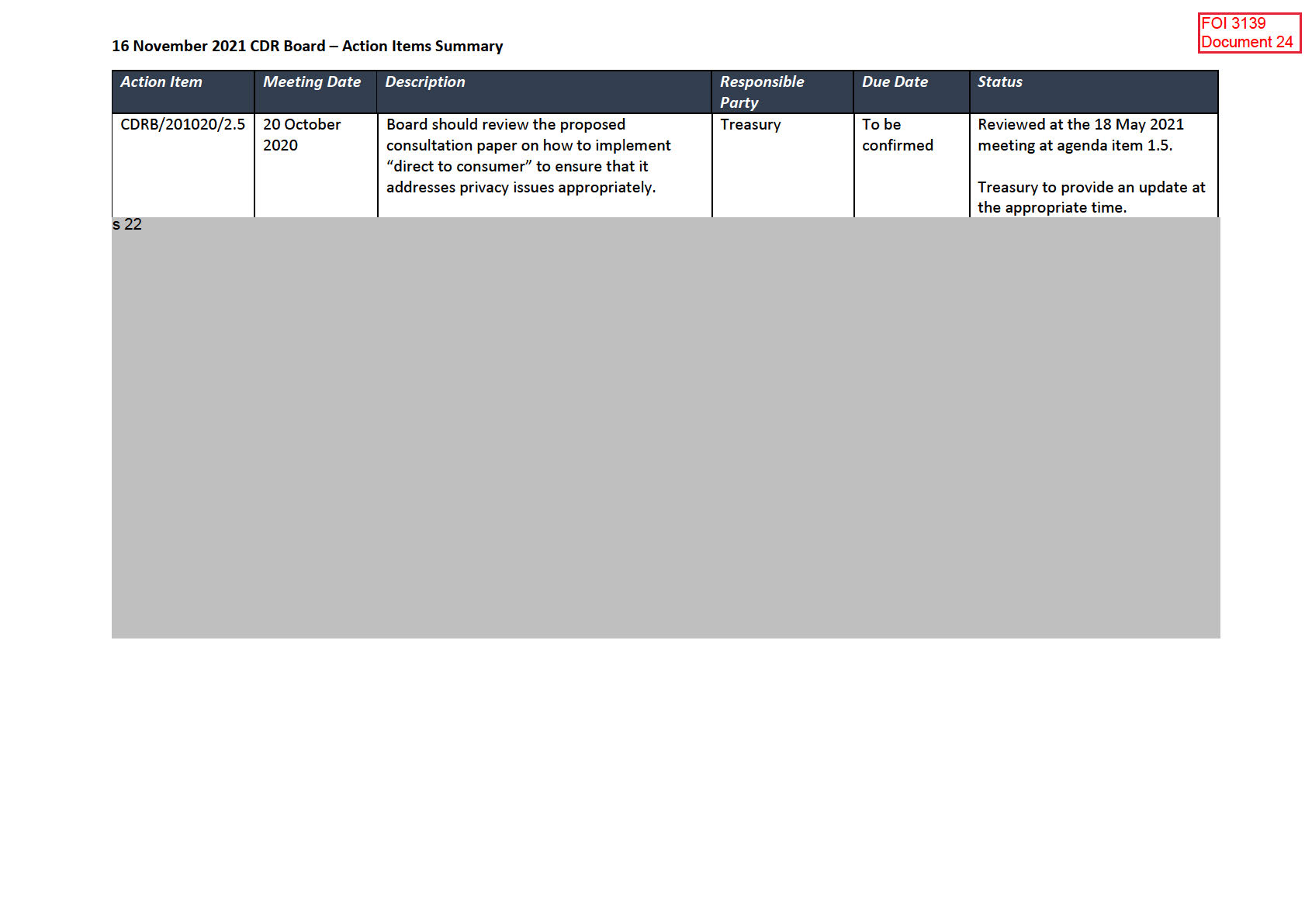

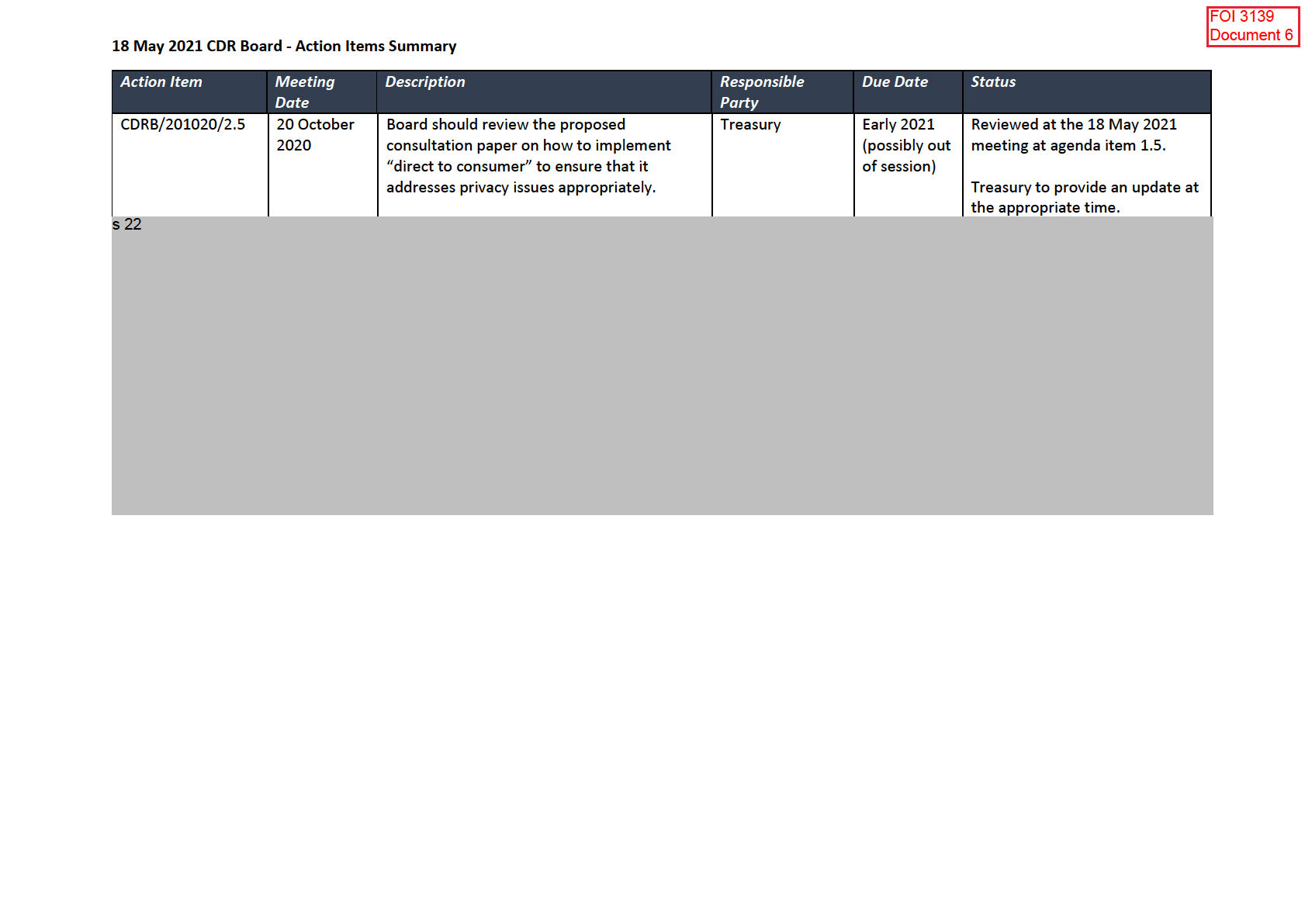

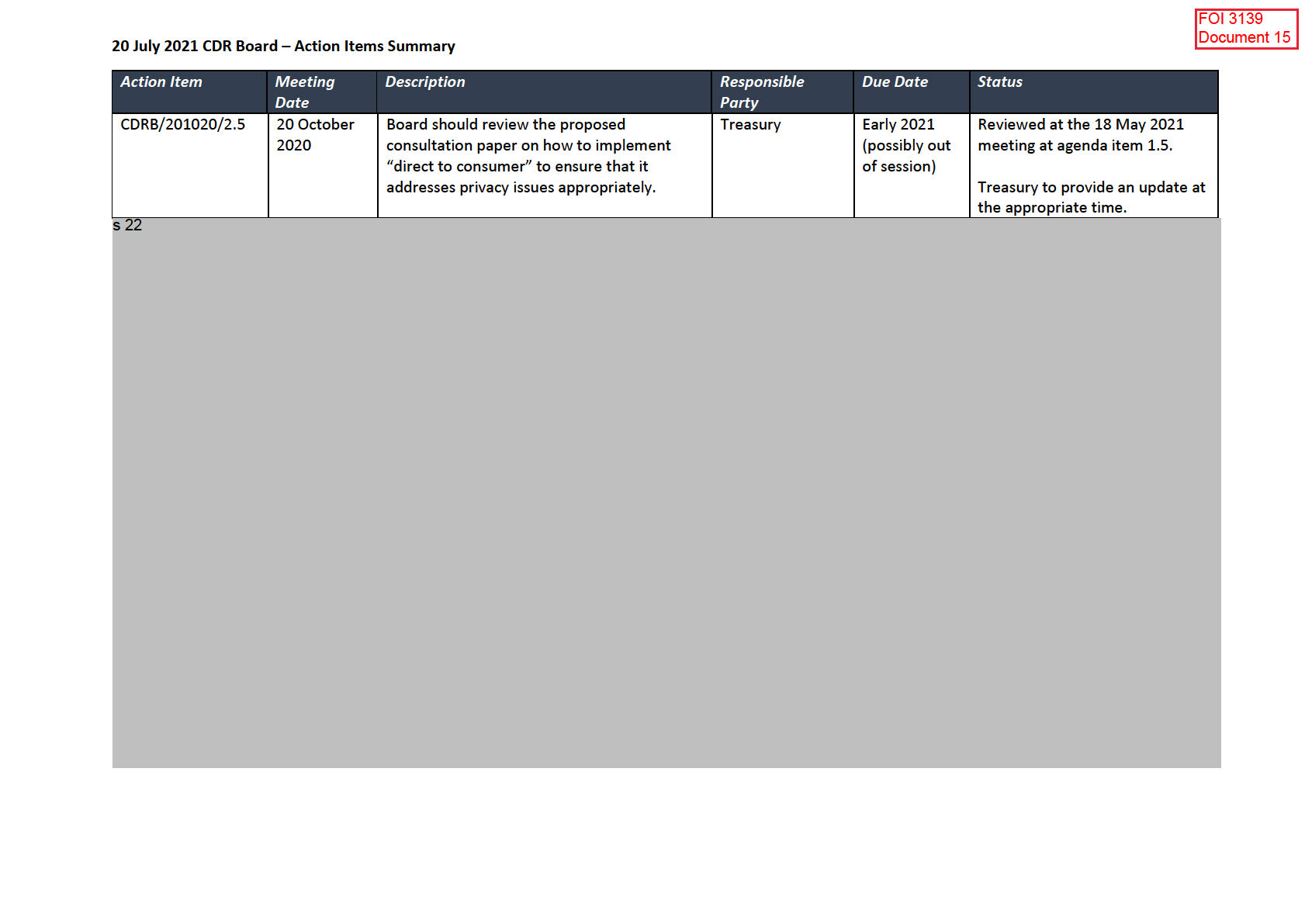

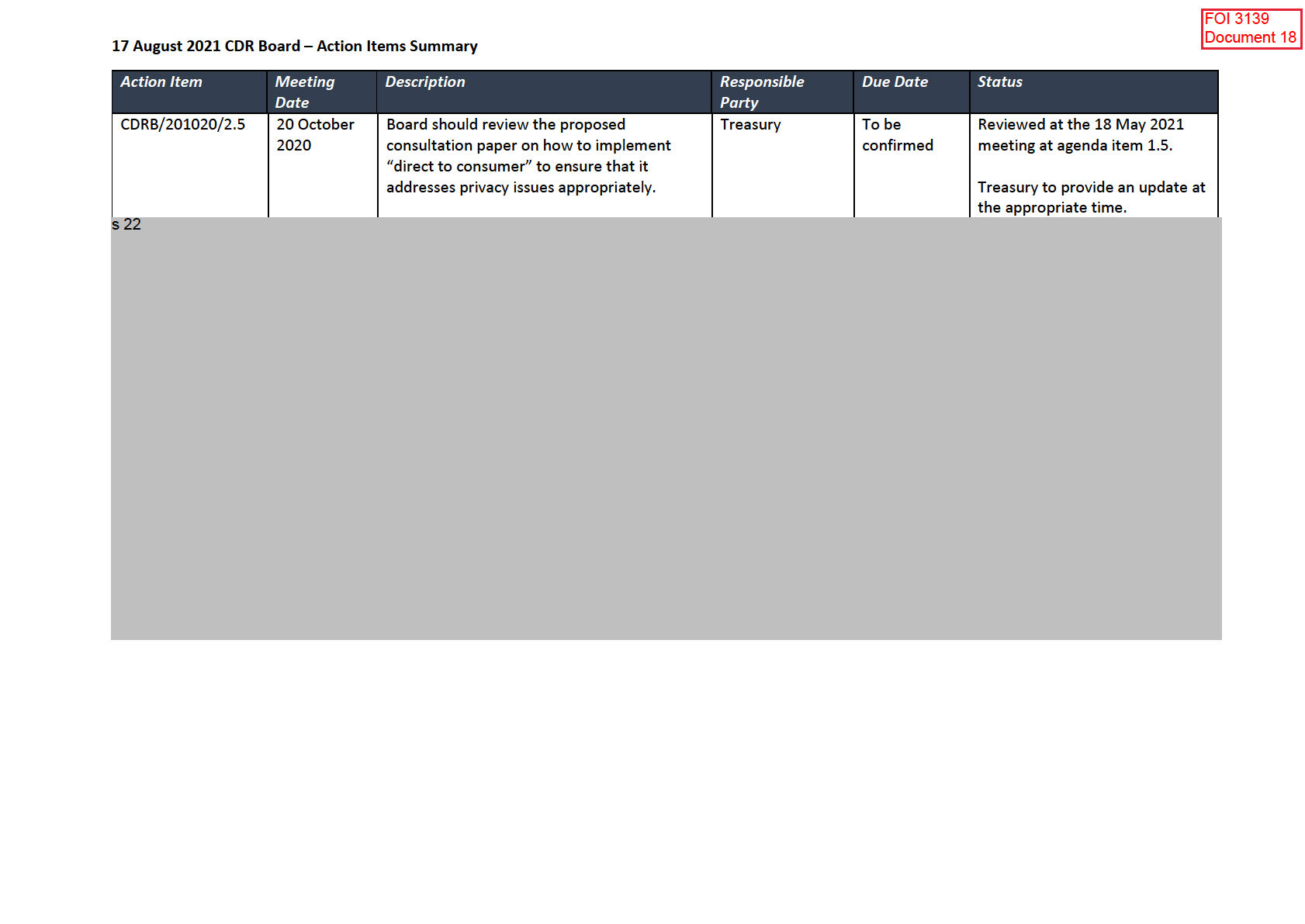

Action item CDRB/201020/2.5 (Direct to consumer,

assigned to Treasury) remains open.

s 22

The remainder of this document is outside

the scope of the request and has been

deleted

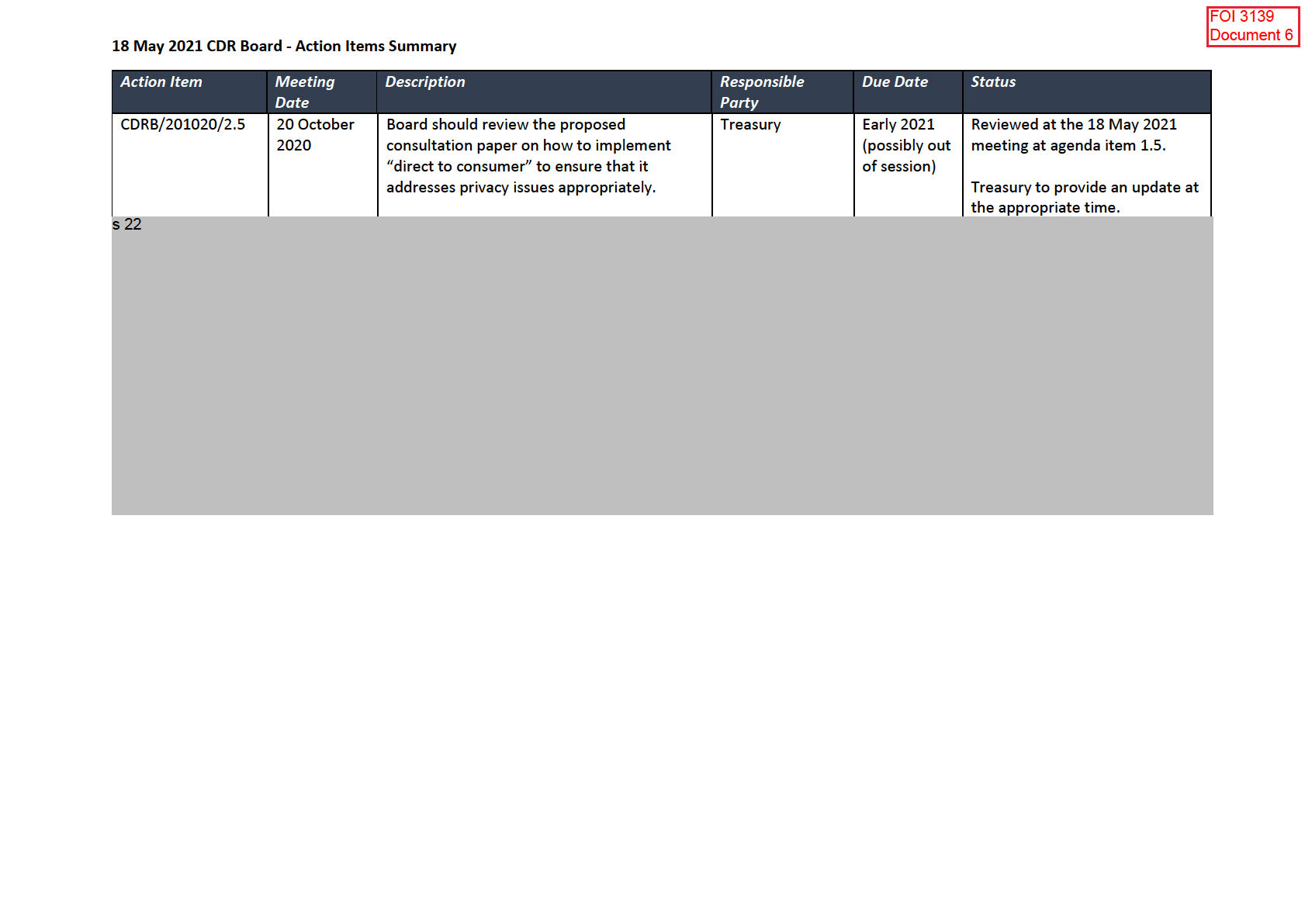

Consumer Data Right Board

s 22

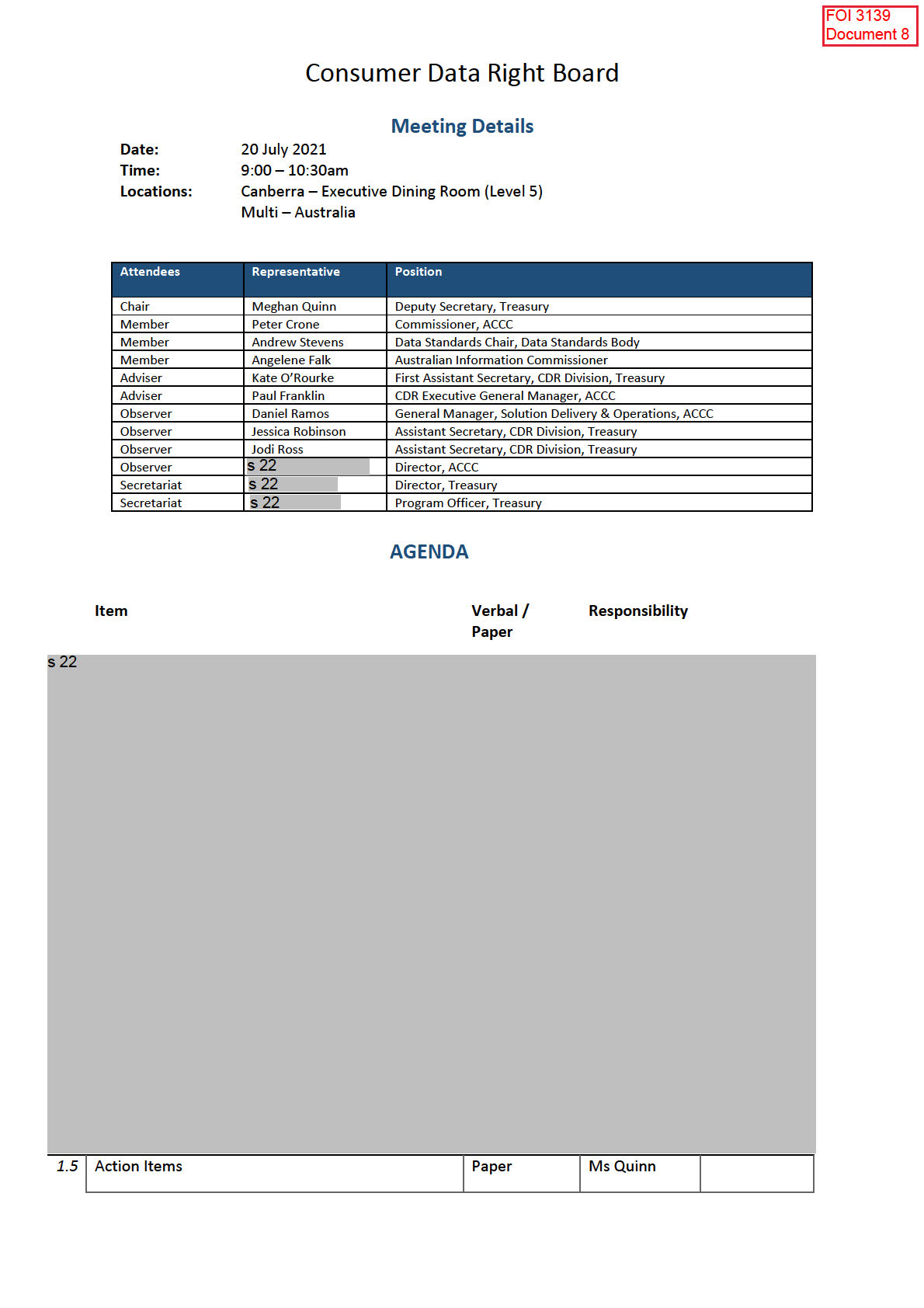

1.5 Action Items

Paper

Ms Quinn

s 22

The following action items remain open:

• CDRB/201020/2.5 (Direct to consumer,

assigned to Treasury).

s 22

The remainder of this document is outside

the scope of the request and has been

deleted

FOI 3139

PROTECTED

Document 7

s 22

Deferral of direct to consumer obligations

•

The rules currently contain a requirement, that would apply from 1 November 2021, on data

holders to transfer data directly to consumers on request in a ‘human-readable form’ in

accordance with the data standards. Significant concerns were raised about the utility and cost

to provide data in human-readable form during consultation on a draft standard during late

2019.

•

On 16 April you agreed to defer data holder ‘direct to consumer’ obligations indefinitely,

pending a future consultation process to review the appropriate model for providing direct

access to data by consumers. This decision was announced on 30 April on the Treasury

website.

PROTECTED

The remainder

of this document is outside

the scope of the request and has been

deleted

Consumer Data Right Board

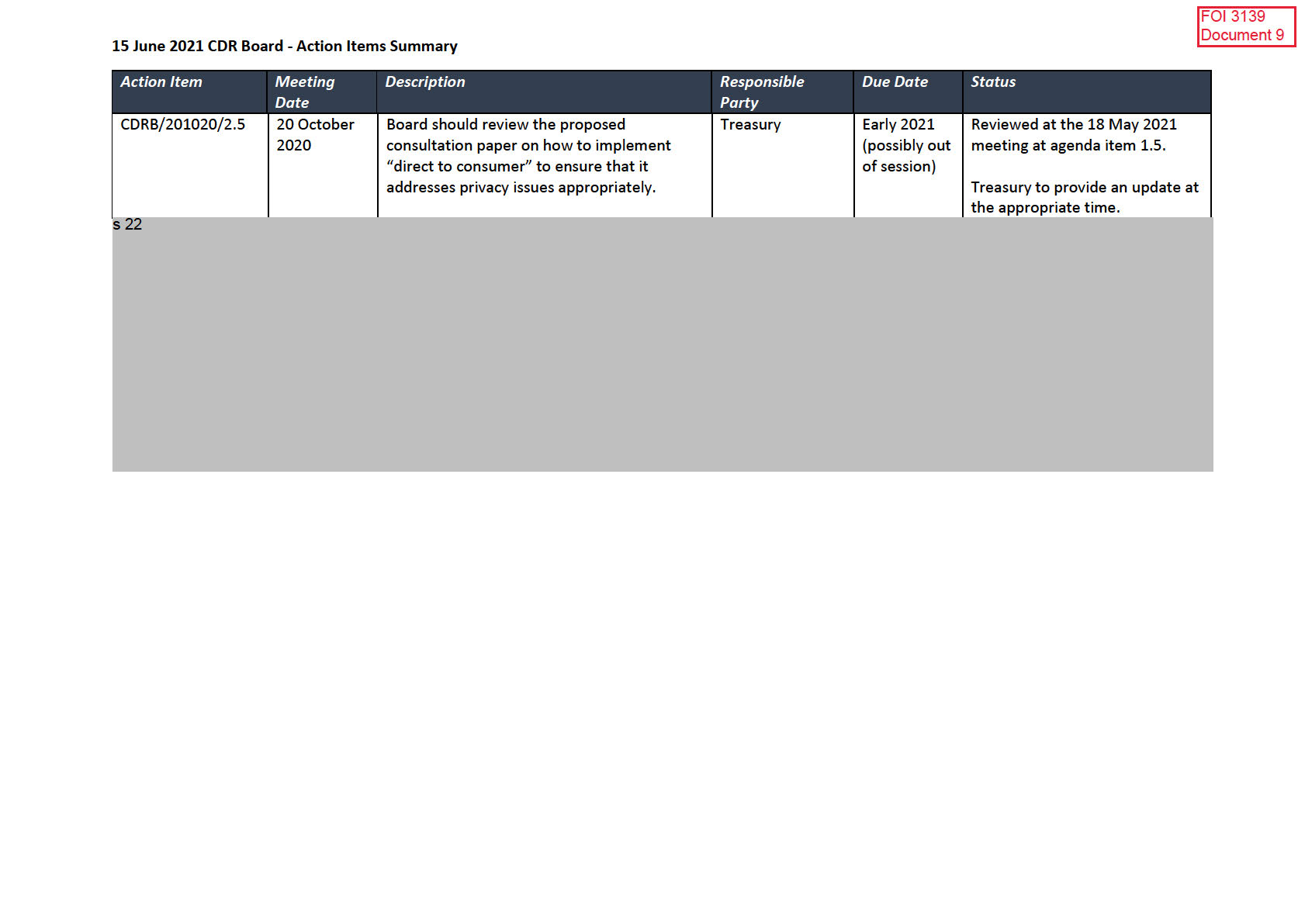

s 22

The following action items remain open:

• CDRB/201020/2.5 (Direct to consumer,

assigned to Treasury).

s 22

The remainder of this document is outside

the scope of the request and has been

deleted

FOI 3139

Document 10

‘Direct to consumer’ obligations

Background on position on ‘direct to consumer’ obligations in the banking sector

•

On 16 April (MS21-000864 refers) the Minister agreed to defer data holder ‘direct to

consumer’ obligations indefinitely for the banking sector, pending a future consultation

process to review the appropriate model for providing direct access to data by

consumers. These obligations would have required banking data holders to offer this

service to consumers on request in a ‘human-readable form’ in a matter prescribed by

the data standards, with effect from 1 November 2021. The deferral was announced on

30 April on the Treasury website.

s 22

•

The exposure draft rules do not apply ‘direct to consumer’ obligations for energy data

holders at this time. Treasury considers that any consultation on the future application

of these obligations should explicitly address the overlap with existing energy

regulation, and any consultation should first occur with State, Territory and

Commonwealth Energy Ministers.

s 22

4

The remainder of this document is outside

the scope of the request and has been

deleted

FOI 3139

Document 11

From:

s 22

To:

s 47F

Cc:

s 22

; s 22

s 22

s 22

Subject:

Questions from last week"s CDR rules v3 presentation [SEC=OFFICIAL]

Date:

Wednesday, 28 July 2021 2:52:00 PM

Attachments:

image001.gif

OFFICIAL

Hi s 47F

Thanks for attending the presentation on the CDR Rules consultation at the implementation call last Thursday. I

hope you found it useful.

We wanted to follow up on your questions to close off on that call:

s 22

Direct to consumer under v3 seems to be deferred, is there any date in mind for when this will be introduced?

There is not currently a date in mind for the direct to consumer obligations. As noted on the CDR

Support Portal, the intention is for consultation to occur at a future time on an API-based model for

direct to consumer obligations and part of that process would involve consideration of compliance

dates for these obligations.

s 22

Kind regards

s 22

s 22

Director (a/g) Rules Unit

Consumer Data Right Division | Markets Group | The Treasury

Level 16, 530 Collins Street, Melbourne

Ph: s 22

|

M: s 22

|

E: s 22

cdr.gov.au | Subscribe to receive CDR updates

The Treasury acknowledges the traditional owners of country throughout Australia, and their continuing connection to land, water

and community. We pay our respects to them and their cultures and to elders both past and present.

OFFICIAL

link to page 21 link to page 24 link to page 29 link to page 30 link to page 34 link to page 37 link to page 44 link to page 45

FOI 3139

Document 12

Data Standards Body

Consumer Experience and Technical Working Groups

Noting Paper 207: Draft v3 Rules Analysis | Anticipated Data Standards

Contact: Michael Palmyre and Mark Verstege

Publish Date: 9 August 2021

Feedback Conclusion Date: 24 August 2021

Context

A draft version 3 of the Consumer Data Right (CDR) Rules (draft v3 rules) was published for consultation from 1 July – 30 July 2021. This

Noting Paper

considers potential data standards changes using the draft v3 rules as reference.

The purpose of this Noting Paper is to consult on the scope and intent of the anticipated data standards changes by reference to the draft v3 rules that

were published for consultation.

This paper includes anticipated changes to t

he Consumer Data Standards relating to Consumer Experience, Information Security, Technical API Standards

and t

he CDR Register to support alignment with the propos

ed draft v3 rules. The major areas include:

1.

Sponsored Accreditation

2.

The CDR Representative Model

3.

Unaccredited OSPs

4.

Trusted Advisers

5.

CDR Insights

6.

Joint Accounts

7.

Direct to Consumer

8.

ADR Representation

1 | P a g e

Targeted decision proposal consultations will occur separately to this Noting Paper for the specific areas listed in this document, in light of the final rules

made by the Minister. The DSB invites the community to provide feedback on timings, content, and obligations.

The draft v3 rules published for consultation are subject to change. If, or where, the rules change from the draft version 3 of the CDR Rules, impacts to

anticipated changes will be addressed as part of ongoing consultation. Standards not currently authorised in the rules cannot be made. As such, the

creation of v3 rules-dependent standards will necessarily follow the making of the final rules.

Decision To Be Made

Decide the scope and intent of the changes to the Data Standards based on the draft v3 rules. Whi

le a Noting Paper is not part of a formal decision proposal

consultation, the DSB strongly encourages feedback to help inform data standards development in relation to these key items.

Identified Options

This Noting Paper contains a brief description of the anticipated standards changes in relation to specific topics. Each change discussed in this paper will be

consulted on separately, where necessary, but CDR participants should use this consultation to raise any concerns or impacts. Suggestions for alternatives

for any topics are welcome and should be raised in the consultation process.

The structure of this section aligns with the headings in the draft v3 rules explanatory materials.

Each section contains a table with descriptions of the expected obligations and timing for Accredited Data Recipients (ADR, also referred to as Accredited

Persons) and Data Holders (DH).

2 | P a g e

Sponsored Accreditation

The sponsored level of accreditation is for persons with or who intend to have an arrangement with an unrestricted accredited person who is willing to act

as their sponsor in the CDR regime. A person accredited to the sponsored level and in a sponsorship arrangement would be known as an affiliate of its

sponsor. An affiliate is an accredited person and is required to fulfil the obligations of an accredited person in the CDR regime.

Affiliate

Sponsor

Consumer

Data Holder

(ADR)

(ADR)

CDR

Register

Further analysis and consultation needs to be conducted to understand if/how an affiliate may appear to the consumer throughout the consent model,

particularly in the DH’s authorisation flow and authorisation management dashboard.

3 | P a g e

link to page 45 link to page 45 link to page 24 link to page 45 link to page 45

Table 1. Sponsored Accreditation

#

Issue

Entity

Rules

Proposed

Standards description

Standards made:

Comply:

Obligation

1. ADR representation in

ADR

1.14(3)(ha)

ADR: MAY

The DSB will consult on additional consent-related fields to

TBD

TBD

DH authorisation flow

DH

1.15(ba) and

DH: MUST

determine if or how these fields could support more

and dashboards

(bb)

complex accreditation models. Additional details on this

4.23(2)

proposal can be found in t

he Table 8. ADR Representation

issue. Further analysis will need to be conducted to understand

how affiliates will or will not surface in DH authorisation

flows and dashboards.

This issue is reflected in:

Table 2. CDR Representative Model

Table 8. ADR Representation

Purpose: Achieve comprehensible and contextually

appropriate presentation of ADRs during authentication,

authorisation, and on consumer dashboards.

2. Consumer Data

N/A

N/A

N/A

No additional CX Data Standards are anticipated for this

N/A

N/A

Standards (CX)

item.

3. Consumer Data

N/A

N/A

N/A

No technical standards are currently anticipated for this

N/A

N/A

Standards (Technical)

specific item.

However, the outcome of t

he ADR representation issue may

require technical standards. This will be consulted on in a

separate consultation.

The rules allow for the transfer of CDR data between ADRs

as long as appropriate consent is obtained. While the rules

define obligations that ADRs must meet in order to make

4 | P a g e

link to page 45

Table 1. Sponsored Accreditation

#

Issue

Entity

Rules

Proposed

Standards description

Standards made:

Comply:

Obligation

these transfers there is no requirement for the DSB to make

standards for this transfer. The DSB has not sought to

impose technical standards on the transfer of data between

accredited persons.

4. CDR Register Standards

N/A

N/A

N/A

No technical standards are currently anticipated for this

N/A

N/A

(Technical)

specific item.

However, the outcome of t

he ADR representation issue may

require technical standards. This will be consulted on in a

separate consultation.

The CDR Register APIs are designed for trusted information

sharing between Accredited Data Recipients and Data

Holders. Affiliates collect CDR data through a sponsor rather

than directly connecting to Data holders. Since the sponsor is

themselves an existing ADR, the CDR Register APIs contain

the necessary metadata to facilitate the trusted connection

of the sponsor to the Data Holder.

5. CDR Register (Participant

ADR

N/A

N/A

The rule changes associated with the introduction of

TBD

TBD

Portal)

Sponsored Accreditation and Sponsorship arrangements will

require additional functions to be added to the CDR

Participant Portal and additional accreditation onboarding

requirements. These functions will enable:

• Prospective accredited persons to:

o Apply for accreditation and be assessed

against the criteria at the sponsored level

• Unrestricted accredited data recipients to:

5 | P a g e

Table 1. Sponsored Accreditation

#

Issue

Entity

Rules

Proposed

Standards description

Standards made:

Comply:

Obligation

o Notify the Data Recipient Accreditor when

a sponsorship arrangement has been

established;

o Manage the status of these arrangements

by providing updated information as

needed.

Sponsored accredited persons will appear on t

he find-a-

provider page. Where sponsorship arrangements exist,

details of the relationships between sponsors and affiliates

will be available.

6 | P a g e

link to page 45 link to page 45

The CDR Representative Model

The CDR representative model enables unaccredited persons to provide goods and services to consumers using CDR data in circumstances where they are in a CDR

representative arrangement with an unrestricted accredited person who is liable for them.

An unaccredited person who is in a CDR representative arrangement would be known as the CDR representative of the principal accredited person.

Representative

Principal

Consumer

Data Holder

(unaccredited)

(ADR)

CDR

Register

Table 2. CDR Representative Model

#

Issue

Entity

Rules

Proposed

Standards description

Standards

Comply:

Obligation

made:

6.

ADR representation

ADR

1.14(3)(ha)

ADR: MAY

The DSB will consult on additional consent-related fields to

TBD

TBD

in DH authorisation

DH

1.15(ba) and

DH: MUST

determine if or how these fields could support more complex

flow and dashboards

(bb)

accreditation models. Additional details on this proposal can

4.23(2)

be found in t

he Table 8. ADR Representation issue. Further analysis will need to be conducted to understand

how CDR Representatives will or will not surface in DH

authorisation flows and dashboards.

This issue is reflected in:

7 | P a g e

link to page 21 link to page 45 link to page 45

Table 2. CDR Representative Model

#

Issue

Entity

Rules

Proposed

Standards description

Standards

Comply:

Obligation

made:

Table 1. Sponsored Accreditation

Table 8. ADR Representation

Purpose: Achieve comprehensible and contextually

appropriate presentation of ADRs during authentication,

authorisation, and on consumer dashboards.

7.

Consumer Data

N/A

N/A

N/A

No additional CX Data Standards are anticipated for this

N/A

N/A

Standards (CX)

item.

8.

Consumer Data

N/A

N/A

N/A

No technical standards are currently anticipated for this

N/A

N/A

Standards (Technical)

specific item.

However, the outcome of t

he ADR representation issue may

require technical standards. This will be consulted on in a

separate consultation.

The rules allow for the transfer of CDR data between ADRs as

long as appropriate consent is obtained. While the rules

define obligations that ADRs must meet in order to make

these transfers there is no requirement for the DSB to make

standards for this transfer. The DSB has not sought to impose

technical standards on the transfer of data between

accredited persons.

9.

CDR Register

N/A

N/A

N/A

No technical standards are currently anticipated for this

N/A

N/A

Standards (Technical)

specific item.

A principal may enter into many arrangements with separate

CDR representatives (representatives). In this situation, the

representatives provide goods or services to consumers, at

least in part, using CDR data. It is possible that a principal

may represent:

8 | P a g e

Table 2. CDR Representative Model

#

Issue

Entity

Rules

Proposed

Standards description

Standards

Comply:

Obligation

made:

(a) these arrangements under a common brand and

software product of the principal, or

(b) each arrangement under separate software products

and/ or data recipient brands.

The CDR Register GetDataRecipients API supports the

disclosure of the representative arrangement using existing

metadata where the accredited persons that have entered

into the representative arrangement make it known to the

consumer. This can be achieved in one of two ways:

(a) The brand of the principal would be used in a

brandName of the data recipient. The software

product of the principal would be used in the

softwareProductName of the data recipient. The

software product would be onboarded by the

principal. An example may include an online

accounting platform that provides its own

marketplace of vendors that offer additional goods

and services. The brand and software product

presented during the consent flow would be the

brand and software product of the accounting

platform. The consumer would see consent

arrangements in their data holder dashboard under

the brand and software product of the accounting

platform.

(b) The brand of the representative may be used in the

brandName of the data recipient. The software

product of the representative would be used in the

softwareProductName. The software product may

be on-boarded for the representative by the

principal operating under the representative

9 | P a g e

Table 2. CDR Representative Model

#

Issue

Entity

Rules

Proposed

Standards description

Standards

Comply:

Obligation

made:

arrangement. An example may include a large

mortgage broker utilising a bank's common

mortgage broking platform. The consumer may be

more familiar with or seek to do business with a

particular mortgage broker firm but the platform is

offered by the bank. The brand name may include

something like a "powered by" label in the brand

name, software product name or software product

description.

The draft rules do not require additional metadata to be held

or exposed via the CDR Register APIs.

10.

CDR Register

ADR

Sch. 1, clause

N/A

Participant Portal changes are required.

TBD

TBD

(Participant Portal)

2.3(2) and

2.3(3)

The rule changes associated to the introduction of CDR

5.15(a)(vi)

Representative Arrangements will require additional

5.24(bc)

functions to be added to the CDR Participant Portal. These

functions will enable the principal (accredited person) to:

• notify the Data Recipient Accreditor when a CDR

representative arrangement has been established;

and

• manage these arrangements by providing updated

information as needed.

The details of these CDR Representative arrangements will

also be made available on the public CDR Register via links

from t

he find-a-provider page.

10 | P a g e

Unaccredited OSPs

In December 2020, the Act was amended to allow the CDR Rules to authorise the collection of CDR data by parties who are not accredited on behalf of an

accredited person. It is now possible for the CDR Rules to allow unaccredited intermediaries to collect CDR data on behalf of an ADR.

Outsourced

Principal

Consumer

Service Provider

Data Holder

(ADR)

(unaccredited)

CDR

Register

Table 3. Unaccredited OSPs

#

Issue

Entity

Rules

Proposed

Standards description

Standards

Comply:

Obligation

made:

11.

Consumer Data Standards

N/A

N/A

N/A

No additional CX Data Standards are anticipated for this item. N/A

N/A

(CX)

12.

Consumer Data Standards

N/A

N/A

N/A

No technical standards changes required.

N/A

N/A

(Technical)

The draft rules changes allow for unaccredited OSPs to collect

data on behalf of their accredited principal. Where the OSP

collects data on behalf of the principal, in continues to do so in

accordance with the existing technical standards. The OSP is

not known to the consumer and does not have a consumer-

facing relationship it simply provides the technical integration

between the principal and the data holder.

11 | P a g e

Table 3. Unaccredited OSPs

#

Issue

Entity

Rules

Proposed

Standards description

Standards

Comply:

Obligation

made:

13.

CDR Register Standards

N/A

N/A

N/A

No technical standards changes required.

N/A

N/A

(Technical)

The OSP is not an accredited person but instead acts under the

principal's accreditation held by the CDR Register. The Register

APIs currently expose all data related to the accredited person

(the principal) to facilitate registration and integration with the

Data Holder.

14.

CDR Register (Participant

ADR

N/A

N/A

Accreditation changes required.

TBD

TBD

Portal)

The collection arrangement question in the accreditation

application form will become redundant when this rule change

is made and, accordingly, it will be removed. Additionally,

features introduced to establish a relationship between a

provider’s Brand and a principal’s Software Product during on-

boarding will also become redundant and will be removed.

12 | P a g e

Trusted Advisers

Schedule 3 amends the CDR Rules to allow a consumer to consent to an accredited person disclosing a consumer’s CDR data to a person within a specified class

(referred to as ‘trusted advisers’). The intention is to facilitate current consumer practices of sharing their data with trusted third parties in order to receive advice

or a service, and increase convenience and control for consumers by enabling them to use the CDR to share their data with their chosen trusted advisers. The

accredited person cannot make the nomination of a trusted adviser or the giving of a TA disclosure consent a condition for the supply of goods and services

requested by the CDR consumer.

Trusted Advisor

Consumer

ADR

Data Holder

(unaccredited)

CDR

Register

Given the importance of CDR consumers understanding the effect of consenting to the disclosure of their CDR data to non-accredited persons, disclosures are

subject to CX standards to be made by the Data Standards Body (rule 8.11(1)). This will ensure the CDR consumer is provided with adequate information to give

informed consent, for example, information that the use of the data by the recipient will not be covered by the CDR regime and the recipient may not have

obligations under the

Privacy Act 1988.

Rule 7.5A(2) provides that disclosure of CDR data under a TA disclosure consent is not a permitted use or disclosure until the earlier of a date to be determined or

when the Data Standards Chair makes consumer experience data standards for disclosure of CDR data to trusted advisers. The specified date is expected to be

three months after the commencement of the rules.

13 | P a g e

Table 4. Trusted Advisers

#

Issue

Entity Rules

Proposed

Standards description

Standards made: Comply:

Obligation

15.

TA Disclosure

ADR

8.11(1)(c)(iv)

MUST

CX standards are proposed that would require ADRs to ensure that

TBD in accordance

TBD in accordance

consent:

CDR consumers are able to make informed decisions about the

with the date

with the date

Disclosure

disclosure of data outside the CDR system.

specified in the

specified in rules,

notification

rules, which is

which is expected

This item will feature alongside the equivalent insight disclosure

expected to be

to be three

notification in an overall ‘disclosure to non-accredited persons’

three months after

months after the

standard.

the

commencement

commencement of

of the rules

the rules

16.

Disclosure

ADR

4.10(1)(a)(i)

MUST

T

he existing CX standards for disclosure consent are expected to

The existing

The existing

consent:

SHOULD

apply to TA disclosures.

standards were

standards were

Collection source

made in June 2021. made in June

An amendment to the standards is proposed to clarify this

Timing of

2021. Timing of

application.

clarification TBD in

clarification TBD in

accordance with

accordance with

the rules.

the rules.

17.

Disclosure

ADR

4.10(1)(a)(i)

MUST

T

he existing CX standards for disclosure consent are expected to

The existing

The existing

consent:

apply to TA disclosures.

standards were

standards were

Descriptions of

made in June 2021. made in June

data to be

An amendment to the standards is proposed to clarify this

Timing of

2021. Timing of

collected and

application.

clarification TBD in

clarification TBD in

disclosed

accordance with

accordance with

the rules.

the rules.

18.

Withdrawal:

ADR

4.10(1)(a)(i)

MUST

T

he existing CX withdrawal standard for disclosure consent is

The existing

The existing

Disclosure

expected to apply to TA disclosures.

standards were

standards were

consent

made in June 2021. made in June

An amendment to the standards is proposed to clarify this

Timing of

2021. Timing of

application.

clarification TBD in

clarification TBD in

accordance with

accordance with

the rules.

the rules.

14 | P a g e

Table 4. Trusted Advisers

#

Issue

Entity Rules

Proposed

Standards description

Standards made: Comply:

Obligation

19. Consumer Data

N/A

N/A

N/A

No additional CX standards are anticipated in relation to this item.

N/A

N/A

Standards (CX)

20. Consumer Data

N/A

N/A

TBD

Technical changes may be required.

TBD

TBD

Standards

(Technical)

No data standards changes are required where consumers consent

to share data with an ADR they have a direct relationship with.

Disclosure of data to a trusted advisor is done so at the discretion of

the ADR through services offered by the ADR. For example, a small

business consumer performs regular account reconciliation with an

online accounting solution but uses an accountant for end of year

financial statement. The accounting software is an ADR and the

small business is the eligible consumer that has a customer

relationship with the ADR. The ADR discloses the consumer’s data to

the trusted advisor through a mechanism provided by the ADR.

Where the consumer does not have a direct relationship with the

ADR but instead only has a relationship with the trusted advisor, a

separate consultation will be developed to consider the streamlined

secure sharing of data using an ADR and onward disclosure of data

to the trusted advisor under a consumer's full consent. For example,

an individual who at tax return time engages an accountant (the

trusted advisor) to perform all account reconciliation and tax return

activities on their behalf using an online accounting software (the

ADR), who is not themselves required to be a customer of the ADR.

21. CDR Register

N/A

N/A

N/A

No technical standards changes required.

N/A

N/A

Standards

(Technical)

The draft v3 rules do not require additional metadata to be held or

exposed via the CDR Register APIs.

15 | P a g e

Table 4. Trusted Advisers

#

Issue

Entity Rules

Proposed

Standards description

Standards made: Comply:

Obligation

22. CDR Register

ADR

N/A

N/A

Reporting changes required.

TBD

TBD

(Participant

Portal)

The draft v3 rules change Reporting obligations under Rule 9.4.

These additional reporting obligations require the collection of

additional values in the CDR Participant Portal

Rule 9.4 Report function.

CDR Insights

Rule 1.10A(3) defines an insight disclosure consent as a consent given by a CDR consumer for an accredited data recipient to disclose particular CDR data (the CDR

insight: see rule 1.7(1)) to a specified person for a specified purpose, which are to:

• identify the consumer

• verify the consumer’s account balance

• verify the consumer’s income, or

• verify the consumer’s expenses

For these purposes, ‘verify’ means to confirm, deny or provide some simple information about the consumer’s identity, account balance, income or expenditure

based on their CDR data. These CDR insights would allow consumers to securely provide and confirm relevant factual information about themselves, while giving

the recipient comfort in its authenticity and accuracy. These purposes are intended to support the sharing of information that the consumer could themselves

confirm and understand.

16 | P a g e

Consumer

Other ADR

ADR

Person

CDR insight

Consumer

(unaccredited)

CDR data

ADRs would be responsible for ensuring that the CDR insights they disclose align with the purpose consented to by the consumer. For example, CDR insights could

be used to:

• confirm with a ‘yes’ or ‘no’ that the personal information provided in an application matches the information held by a bank

• confirm with a ‘yes’ or ‘no’ that the consumer’s account balance is or is not sufficient to meet a particular payment

• provide a consumer’s actual account balance at a specific point in time

• provide an alert to a merchant if a direct debit payment will fail, or

• provide the consumer’s average income over a specific period of time

Rule 4.11(3)(ca) requires an accredited person to give an explanation of the CDR insight to the CDR consumer when seeking the insight disclosure consent that will

make it clear what the CDR insight would reveal or describe. The CDR Rules do not require a CDR insight to be shown to a consumer prior to it being disclosed.

However, where practical, this step could be taken to assist the consumer’s understanding of what the CDR insight would reveal or describe and help meet the

accredited person’s obligation under rule 4.11

Rule 7.5A(4) provides that disclosure of CDR data under an insight disclosure consent is not a permitted use or disclosure until the earlier of a date to be

determined in the rules or when the Data Standards Chair makes consumer experience data standards for disclosure of CDR insights.

Rule 8.11(1A) states that the standards that relate to obtaining insight disclosure consents must include provisions that cover the following:

(a) how the accredited person can meet the requirement to explain a CDR insight in accordance with paragraph 4.11(3)(ca);

(b) ensuring that the CDR consumer is made aware that their data will leave the CDR system when it is disclosed.

17 | P a g e

Rule 8.11(1)(c)(v) contains new requirements for data standards to be made about disclosure and security of CDR data that is disclosed in a CDR insight, and the

processes by which insight disclosure consents are obtained, including ensuring the consumer understands their data will leave the CDR system and explaining the

CDR insight in accordance with rule 4.11 (rule 8.11(1A).

Table 5. Insight Disclosure

#

Issue

Entity Rules

Proposed

Standards description

Standards made:

Comply:

Obligation

23.

Insight Disclosure

ADR

1.14(3)(ea),

MUST

Standards are proposed that will cover how accredited persons

TBD in accordance

TBD in accordance

consent: Insight

4.11(3)(ca),

can meet the requirement to explain a CDR insight in

with the date

with the date

descriptions

7.9(4),

accordance with rule 4.11(3)(ca).

specified in the rules,

specified in rules,

8.11(1A)

which is expected to

which is expected

This is expected to include requirements in relation to how to

be three months after

to be three months

make clear to the CDR consumer what the CDR insight would

the commencement

after the

reveal or describe.

of the rules

commencement of

the rules

It is expected that this requirement will need to be reflected on

the dashboard.

24.

Insight Disclosure

ADR

8.11(1A)

MUST

Standards are proposed that would ensure that CDR consumers

TBD in accordance

TBD in accordance

consent:

are able to make informed decisions about the disclosure of

with the date

with the date

Disclosure

data outside the CDR system when it is disclosed.

specified in the rules,

specified in rules,

notification

which is expected to

which is expected

This item will feature alongside the equivalent TA disclosure

be three months after

to be three months

notification in an overall ‘disclosure to non-accredited persons’

the commencement

after the

standard.

of the rules

commencement of

the rules

25.

Disclosure

ADR

4.10(1)(a)(i)

MUST

T

he existing standards for disclosure consent are expected to

The existing standards

The existing

consent:

SHOULD

apply to insight disclosures.

were made in June

standards were

Collection source

2021. Timing of

made in June 2021.

An amendment to the standards is proposed to clarify this

clarification TBD in

Timing of

application.

accordance with the

clarification TBD in

rules.

accordance with

the rules.

18 | P a g e

Table 5. Insight Disclosure

#

Issue

Entity Rules

Proposed

Standards description

Standards made:

Comply:

Obligation

26.

Disclosure

ADR

4.10(1)(a)(i)

MUST

T

he existing standards for disclosure consent are expected to

The existing standards

The existing

consent:

apply to insight disclosures.

were made in June

standards were

Descriptions of

2021. Timing of

made in June 2021.

data to be

An amendment to the standards is proposed to clarify this

clarification TBD in

Timing of

collected and

application.

accordance with the

clarification TBD in

disclosed

rules.

accordance with

the rules.

27.

Withdrawal:

ADR

4.10(1)(a)(i)

MUST

T

he existing withdrawal standard for disclosure consent is

The existing standards

The existing

Disclosure consent

expected to apply to insight disclosures.

were made in June

standards were

2021. Timing of

made in June 2021.

An amendment to the standards is proposed to clarify this

clarification TBD in

Timing of

application.

accordance with the

clarification TBD in

rules.

accordance with

the rules.

28. Consumer Data

N/A

N/A

N/A

No additional CX standards are anticipated in relation to this

N/A

N/A

Standards (CX)

item.

29. Consumer Data

N/A

N/A

N/A

No technical standards changes required.

N/A

N/A

Standards

(Technical)

The technical standards do not currently control the transfer of

data between an accredited person to other persons.

The rules allow for the transfer of CDR insights data between an

accredited person (ADR) and other persons as long as

appropriate consent is obtained. While the rules define

obligations that ADRs must meet in order to make these

transfers there is no requirement for the DSB to make technical

standards for this transfer.

19 | P a g e

Table 5. Insight Disclosure

#

Issue

Entity Rules

Proposed

Standards description

Standards made:

Comply:

Obligation

30. CDR Register

N/A

N/A

N/A

No technical standards changes required.

N/A

N/A

(Technical

Standards)

The rules do not require additional metadata to be held or

exposed via the CDR Register APIs.

31. CDR Register

ADR

N/A

N/A

Reporting changes required.

TBD in accordance

TBD in accordance

(Participant Portal)

with the date

with the date

The draft rules change Reporting obligations under Rule 9.4.

specified in the rules,

specified in the

These additional reporting obligations require the collection of

which is expected to

rules, which is

additional values in the CDR Participant Portal

Rule 9.4 Report

be three months after

expected to be

function.

the commencement

three months after

of the rules

the

commencement of

the rules

Joint Accounts

The proposed draft v3 rules include a change to a ‘single consent’ model for joint accounts. CDR data that relates to a joint account can be disclosed under the Rules

only in accordance with the disclosure option that applies to the account. Division 4A.2A sets out:

• the three disclosure options, with the default option being the pre-approval option;

• an obligation for data holders to provide a disclosure option management service (DOMS) for all joint accounts through which joint account holders can

change the disclosure option that applies to the account, or propose a change to the other account holders;

• when one joint account holder proposes to change the disclosure option―a process by which the other joint account holders can either agree with or reject

the proposal; and

• some associated notification requirements.

20 | P a g e

Data holders must offer the pre-approval option and non-disclosure option on joint accounts, and may offer the co-approval option on an optional basis (rules

4A.4(2) and (3)). If the pre-approval option applies, any joint account holder can choose that the co-approval option will apply.

Consumer A

is owned by

Bank Account

is owned by

Consumer B

Consumer B

Consumer B

A change from the non-disclosure option to another option, or a change from the co-approval option to the pre-approval option (if offered by the data holder),

requires the agreement of all the joint account holders.

If the co-approval option is offered by the data holder and applies to the joint account—the data holder must ask the requesting account holder to authorise the

disclosure of the requested data, seek the other account holders’ approval for the disclosure, then disclose the data in accordance with the request.

On 30 April 2021, Treasury announced that requirements for banks to implement the joint account requirements that would have applied from November 2021

would be deferred, with new compliance dates to be set following consultation. The draft v3 rules amend the commencement table in rule 6.6 of Schedule 3 to the

CDR Rules and set 1 April 2022 as the new compliance date for joint account data sharing in the banking sector.

Draft v3 rule 4A.6 requires data holders to notify joint account holders of the following matters in relation to the account (for new accounts, when the account is

opened, or for existing accounts, at least 7 days prior to joint accounts being in scope for sharing under the Rules). This notification must be made, in accordance

with any data standards and via the ordinary method for contacting each joint account holder.

21 | P a g e

Draft v3 rule 4A.16 requires data holders to allow joint account holders to set certain notification preferences. If data standards are in place, this must be done in

line with those standards. This would allow consumers to set preferences such that they would not receive certain notifications that data holders would otherwise

be required to provide.

The draft v3 rules also include transitional provisions that:

• require relevant data holders to continue to comply with the former joint account transitional provisions until 1 April 2022, when they must begin to

comply with the draft v3 rules;

• require data holders to notify consumers with joint accounts of the change to the default setting to share at least a week before the commencement date;

and

• provide that joint accounts that are currently set to the ‘no disclosure option’ are not switched to the pre-approval option on the commencement date.

The joint account items below have been informed by the Consumer Policy Research Centre’s recent

community sector engagement on joint accounts, CX research,

a public workshop on joint accounts, and issues highlighted by the CDR community. The use of the term ‘requestor’ in this section aligns with Division 4.3, rule

4.9(a), meaning the person on whose behalf the consumer data request is being made.

Table 6. Joint Accounts

#

Issue

Entity Rules

Proposed

Standards description

Standards made:

Comply:

Obligation

32.

Notification

DH

4A.6(3)

TBD

Standards will be consulted on in relation to Rule 4A.6, where joint account

Expected in Q4

Expected to be 1

standard: Pre-

holders will be notified about matters relating to joint account sharing

2021 to allow for a

April 2021. Actual

sharing notice

when a new joint account is opened or, for existing accounts, 7 days prior

6-month

date TBD in

for joint

to joint accounts being in scope for sharing.

implementation

accordance with

accounts

timeframe. Actual

the finalised rules.

date TBD in

accordance with

the date the rules

are made.

33.

Notification

DH

4A.16(3)

TBD

Standards will be consulted on to allow notification preferences to be set

Expected in Q4

Expected to be 1

standard: Joint

based on consumer preference. This would allow consumers to choose to

2021 to allow for a

April 2021. Actual

account

not receive certain notifications and could consider the granularity of

6-month

date TBD in

notification preference controls.

implementation

22 | P a g e

Table 6. Joint Accounts

#

Issue

Entity Rules

Proposed

Standards description

Standards made:

Comply:

Obligation

notification

timeframe. Actual

accordance with

management

Purpose: Allow consumers to manage and set notifications related to joint

date TBD in

the finalised rules.

accounts based on their preferences.

accordance with

the date the rules

are made.

34.

Notification

DH

4A.5(8),

MUST

Standards will be proposed to require DHs to alert a joint account holder

Expected in Q4

Expected to be 1

standard: Alerts

existing

when they are about to take an action that will result in a notification being 2021 to allow for a

April 2021. Actual

sent to other the

rules

sent to the other joint account holder(s).

6-month

date TBD in

joint account

1.15(1)(ba),

implementation

accordance with

holder(s)

4.22(a)

For example, when changing a disclosure option via DOMS; when removing

timeframe. Actual

the finalised rules.

an approval related to a specific authorisation; or during the authorisation

date TBD in

flow when selecting to share data from a joint account.

accordance with

the date the rules

Purpose: Facilitate safe and informed joint account sharing and

are made.

management.

35.

Notification

Existing

SHOULD

This item will propose that, where DHs treat a joint account like an

Expected in Q4

Expected to be 1

standard: Joint

rule 4.22(a)

individual account to prevent physical or financial harm or abuse, DHs

2021 to allow for a

April 2021. Actual

account holders

should notify that joint account holder (the ‘requestor’) that the other

6-month

date TBD in

flagged as

account holder(s) will

not be alerted when that authorisation is initiated.

implementation

accordance with

vulnerable

timeframe. Actual

the finalised rules.

Purpose: Reduce cognitive barriers to data sharing for consumers

date TBD in

experiencing vulnerability

accordance with

the date the rules

are made.

36.

Notification

Existing

MUST/SHO

DHs may indicate that a joint account is ‘pending’ further approval in the

Expected in Q4

Expected to be 1

standard:

rule 4.22(a)

ULD

authorisation flow and include explanatory information about what this

2021 to allow for a

April 2021. Actual

Pending approval

means. This could apply where a ‘co-approval’ option has been chosen by

6-month

date TBD in

status

the joint account holder(s) to indicate that the requestor’s authorisation

implementation

accordance with

will not result in the disclosure of data from that joint account until the

timeframe. Actual

the finalised rules.

other joint account holder(s) approve.

date TBD in

accordance with

23 | P a g e

Table 6. Joint Accounts

#

Issue

Entity Rules

Proposed

Standards description

Standards made:

Comply:

Obligation

This standard will be considered for broader application, such that data

the date the rules

holders can introduce additional information of this nature to the

are made.

authorisation flow for other account types where required.

Purpose: Increas

e system status visibility to help users understand when

further action is needed to successfully share data.

37.

Withdrawal:

DH

4A.13(2);

MUST

This will propose that DHs advise joint account holders of the

Expected in Q4

Expected to be 1

Joint accounts

4A.15(1)(d)

consequences of the withdrawal.

2021 to allow for a

April 2021. Actual

(v)

6-month

date TBD in

This is expected to approval to the removal of a disclosure option, i.e.

implementation

accordance with

changing to a non-disclosure option, and the removal of an approval.

timeframe. Actual

the finalised rules.

date TBD in

accordance with

the date the rules

are made.

38. Consumer Data

N/A

N/A

N/A

No additional CX Data Standards are anticipated for this item.

N/A

N/A

Standards (CX)

39. Consumer Data

N/A

N/A

N/A

No technical standards changes required.

N/A

N/A

Standards

(Technical)

The rules change the disclosure options for joint account data.

However, the technical standards do not define obligations that Data

Holders must meet to obtain the disclosure consent of secondary account

holders. The proposed draft v3 rules change the way in which consent is

provided for joint accounts but does not include requirements for technical

standards. Similar to the Joint Account Management Service, the way in

which Data Holders implement these proposed draft v3 rules is left to the

implementation Data Holders. Joint Accounts continue to be shareable

through the existing standards framework for selection of accounts to be

associated with the consumer's authorised consent that is held by the data

24 | P a g e

Table 6. Joint Accounts

#

Issue

Entity Rules

Proposed

Standards description

Standards made:

Comply:

Obligation

holder. Further, joint account data is currently covered by the existing

technical APIs.

40. CDR Register

N/A

N/A

N/A

No technical standards changes required.

N/A

N/A

(Technical

Standards)

The draft v3 rules do not require additional metadata to be held or

exposed via the CDR Register APIs.

41. CDR Register

ADR,

9.4

N/A

Reporting changes required.

TBD in accordance

TBD in accordance

(Participant

DH

with the date

with the date

Portal)

The draft v3 rules change Reporting obligations. These additional reporting

specified in the

specified in the

obligations require the collection of additional values in the CDR Participant rules

rules

Portal

Rule 9.4 Report function.

25 | P a g e

Direct to Consumer Request Service

Under Part 3 of the CDR Rules, data holders are required to implement an online service that allows consumers to directly request their CDR data in a human

readable form and in accordance with the data standards.

In order to allow further consultation about the way in which direct to consumer obligations should be provided for and in machine-readable form via APIs (and the

way in which the data standards should provide for this), the Rules amend clause 6.6 of Schedule 3 to remove the compliance date for the Part 3 obligations in the

banking sector.

Table 7. Direct to Consumer

#

Issue

Entity Rules

Proposed

Standards description

Standards

Comply:

Obligation

made:

42. General

N/A

Part 3

N/A

As proposed i

n DP089 a

nd DP167, no CX Data Standards are anticipated for this

N/A

N/A

issue and

any technical standards consultation will be deferred in line with the

rules.

If Direct To Consumer obligations are re-introduced at a later date, options for

standards will be considered at that time.

26 | P a g e

link to page 21 link to page 24

ADR Representation

This topic covers the presentation of ADRs by DHs in the authorisation flow and DH dashboard. The genesis of this issue can be found i

n issue 222, where a range of

possibilities were raised to achieve consistent and comprehensible presentation of ADRs in DH spaces. The proposal outlined in the below table progresses this

thinking and proposes a new field to accommodate concurrent consents and the newly proposed access arrangement models, such as affiliates and CDR

representatives.

Table 8. ADR Representation

#

Issue

Entity Rules

Proposed

Standards description

Standards

Comply:

Obligation

made:

43. ADR representation

ADR

1.15(ba)

ADR: MAY

This issue is reflected in:

TBD

TBD

in DH authorisation

DH

and (bb),

DH: MUST

Table 1. Sponsored Accreditation

flow and dashboards

4.23(2)

Table 2. CDR Representative Model

This issue relates to the provision of CX standards to support consistent ADR

presentation in dashboards, authentication, and authorisation spaces.

ADRs are currently represented inconsistently, and the current requirement to

display an ADR’s legal entity name in the authorisation flow may not correspond

with the entity the consumer interacts with as the CDR begins to see more complex

accreditation models.

This consultation will propose that DHs display the ADR’s brand name in

authentication and authorisation related artefacts where appropriate. This proposal

will rely on the existing rules requiring DHs to display specified information that the

Register holds in relation to an accredited person.

This consultation will also explore if these same fields should be required on

dashboards, including DH dashboards and ADR dashboards in relation to AP

disclosures.

The proposal will also query if additional consent-related fields are warranted for

concurrent consents and complex sharing models, such as affiliates and CDR

representatives. Consultation will be conducted to determine if or how these fields

27 | P a g e

Table 8. ADR Representation

#

Issue

Entity Rules

Proposed

Standards description

Standards

Comply:

Obligation

made:

could be facilitated through technical standards – such as the authorisation request

– or the Register.

Purpose: Achieve comprehensible and contextually appropriate presentation of

ADRs during authentication, authorisation, and on consumer dashboards.

44. Consumer Data

N/A

1.15(ba)

N/A

Changes may be required.

N/A

N/A

Standards (Technical)

and (bb),

4.23(2)

If the disclosure of additional data relating to the representation of ADR

relationships is required to be communicated through the authorisation flow and on

consumer dashboards, changes to the authorisation request may be required to

facilitate this.

45. CDR Register

N/A

1.15(ba)

N/A

Changes may be required.

N/A

N/A

(Technical Standards)

and (bb),

4.23(2)

If the disclosure of additional data relating to the representation of ADR

relationships is required to be communicated through the authorisation flow and on

consumer dashboards, changes to the authorisation request may be required to

facilitate this.

46. CDR Register

ADR

9.4

N/A

Changes may be required.

TBD in

TBD in

(Participant Portal)

accordance

accordance

If CDR Register (Technical Standards) are required, as mentioned in point

Error!

with the

with the

Reference source not found. it will flow on to the Participant Portal in order for

date

date

ADRs to provide additional details during the on-boarding process.

specified in

specified in

the rules

the rules

28 | P a g e

Implementation Considerations

The specific items raised in this paper will be consulted on separately, along with the implementation considerations. CDR participants are encouraged to raise any

concerns or impacts ahead of those targeted consultations.

Whi

le a Noting Paper is not part of a formal decision proposal consultation, the DSB strongly encourages CDR participants to provide feedback to help inform data

standards development in relation to these key areas of work.

29 | P a g e

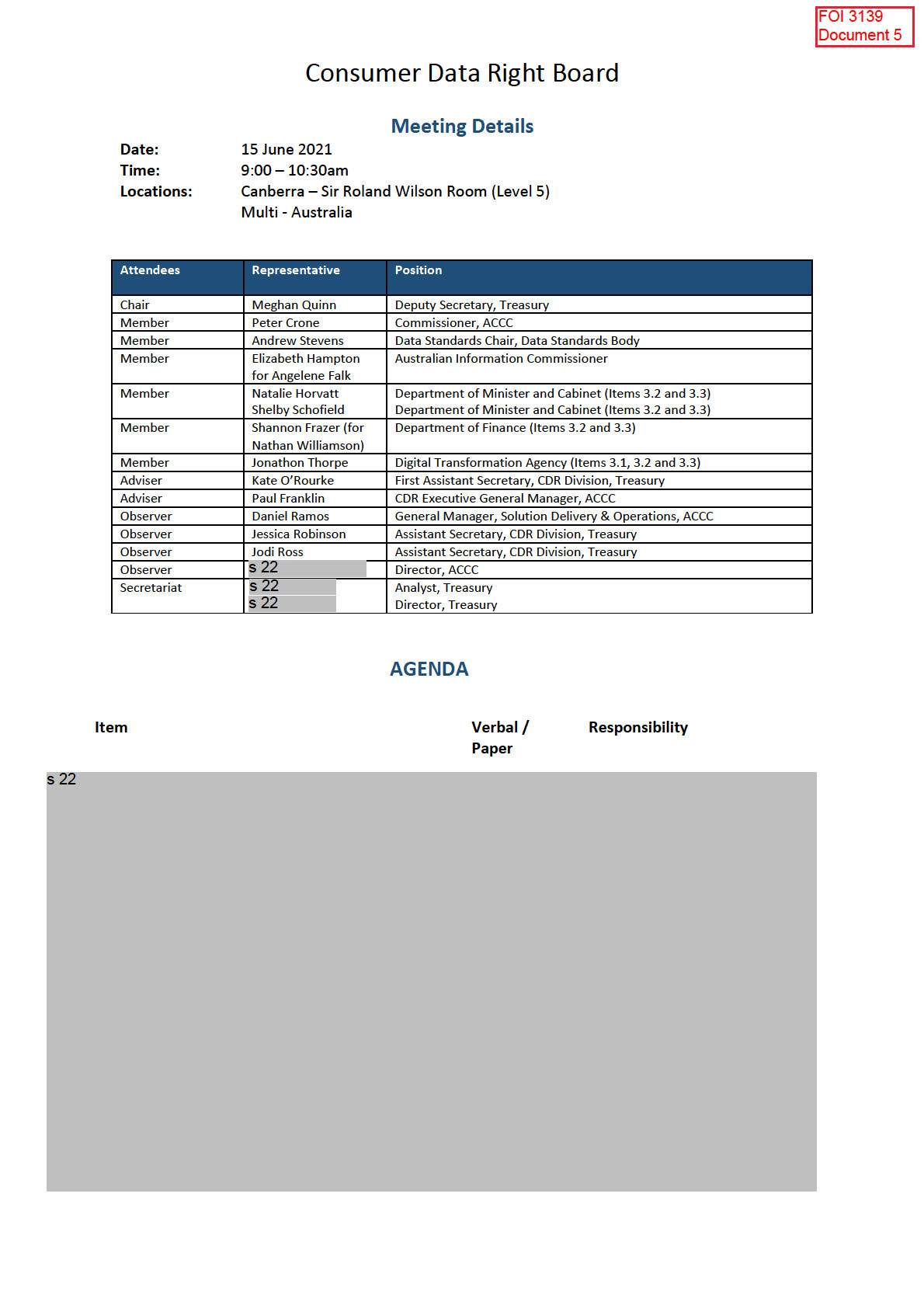

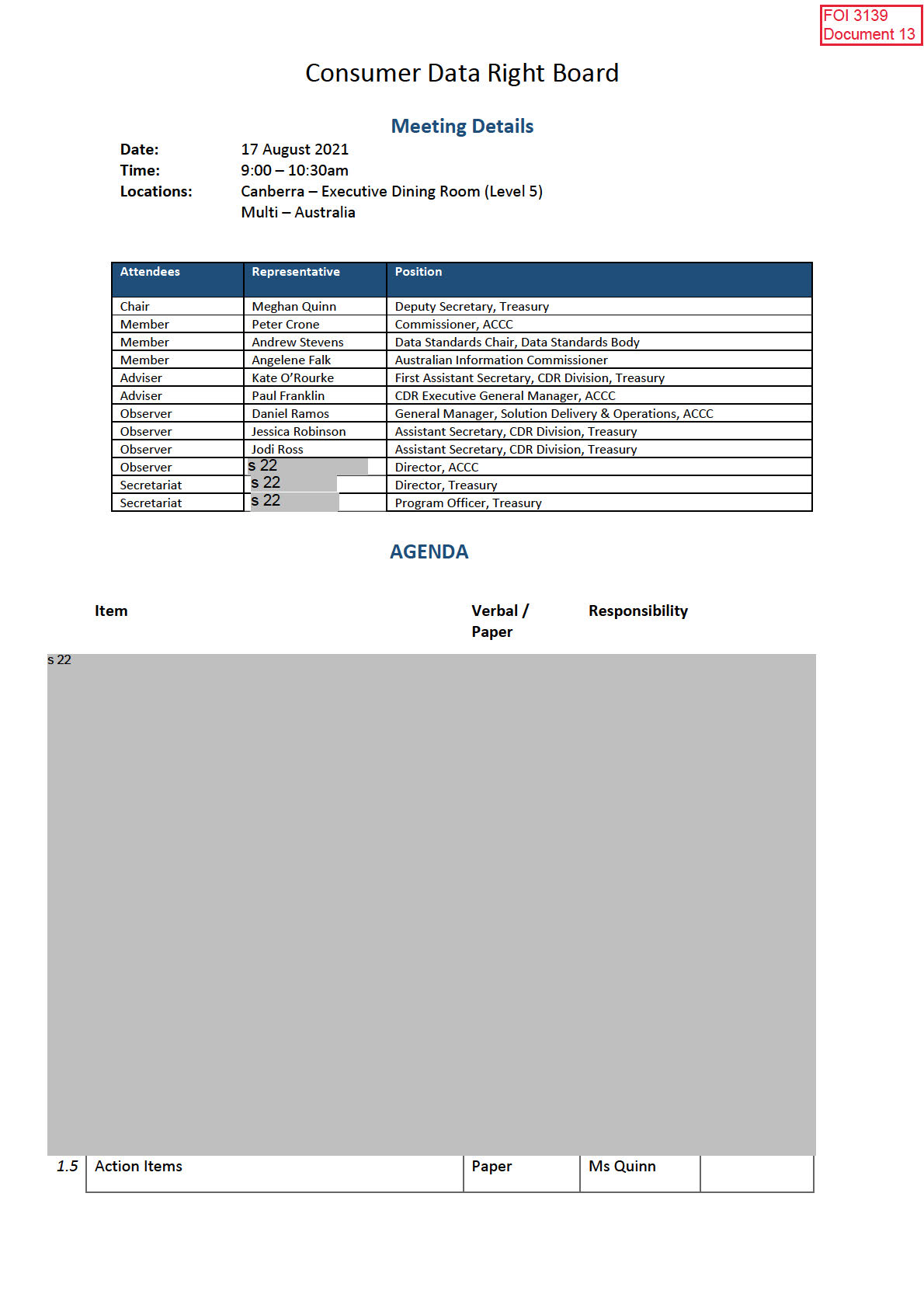

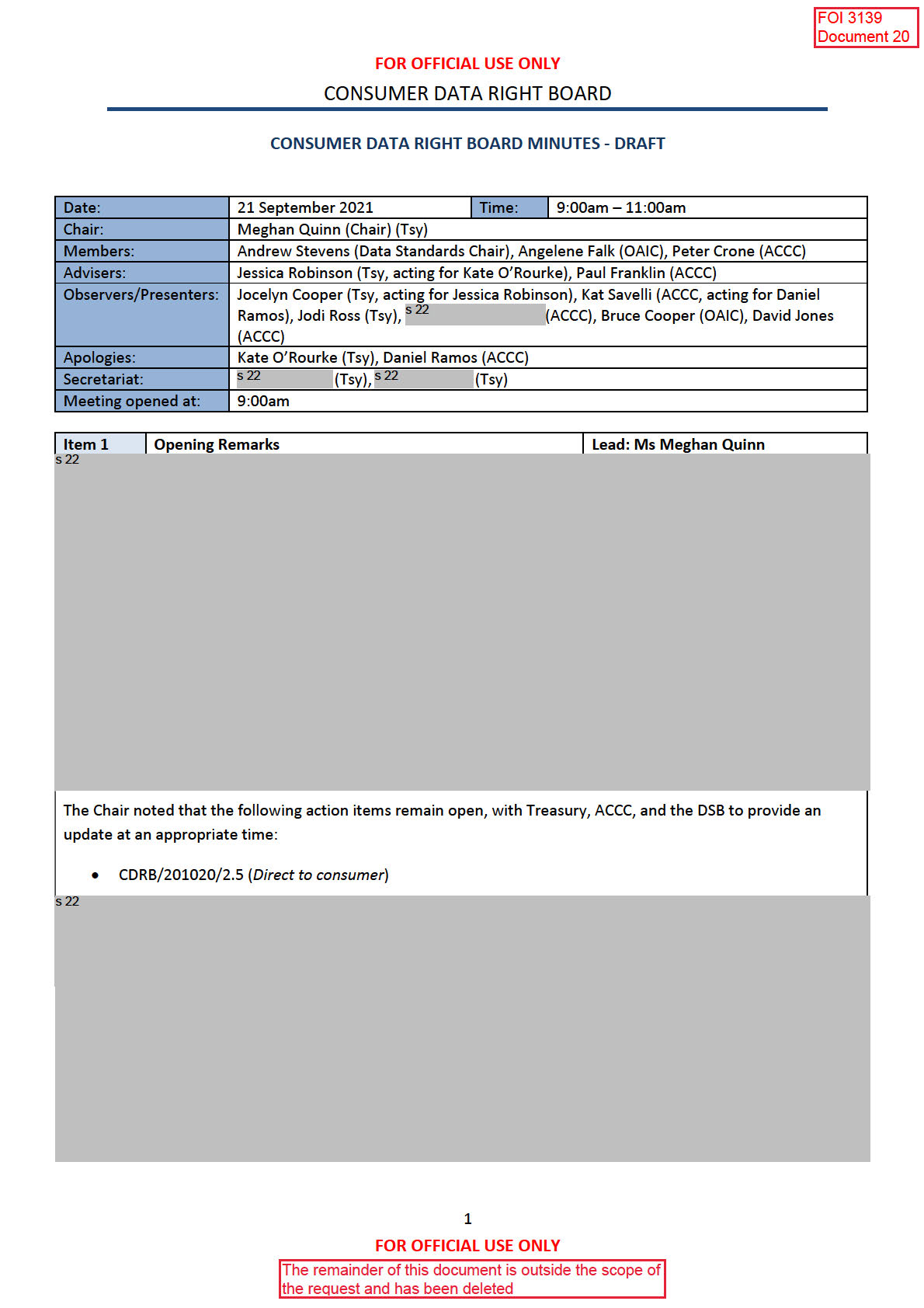

Consumer Data Right Board

s 22

The following action items remain open:

s 22

• CDRB/201020/2.5 (Direct to consumer,

assigned to Treasury).

s 22

The remainder of this document is

outside the scope of the request and has

been deleted

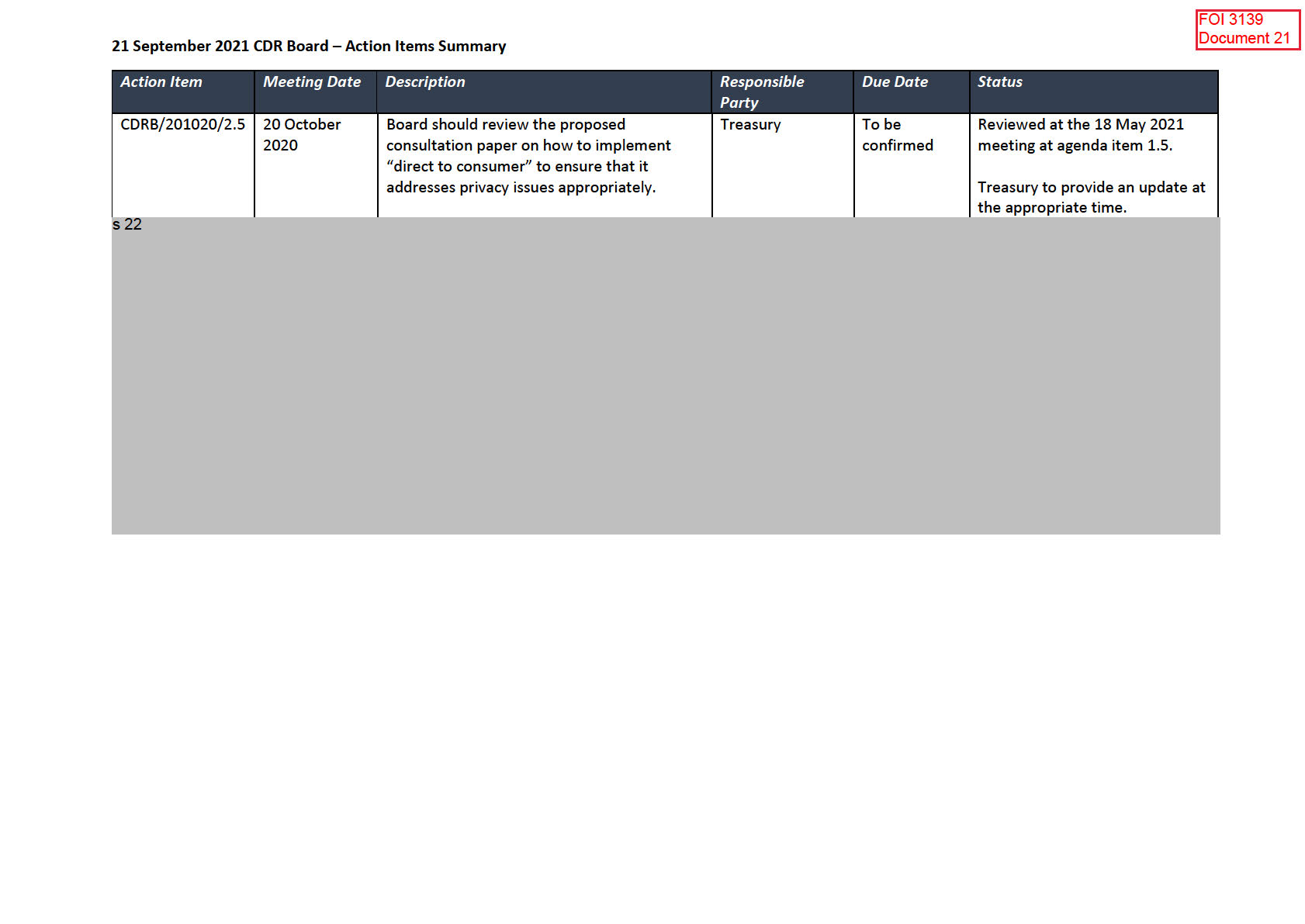

Consumer Data Right Board

s 22

1.5 Action Items

Paper

Ms Quinn

s 22

The following action items remain open:

• CDRB/201020/2.5 (

Direct to consumer).

s 22

The remainder of this document is outside

the scope of the request and has been

deleted

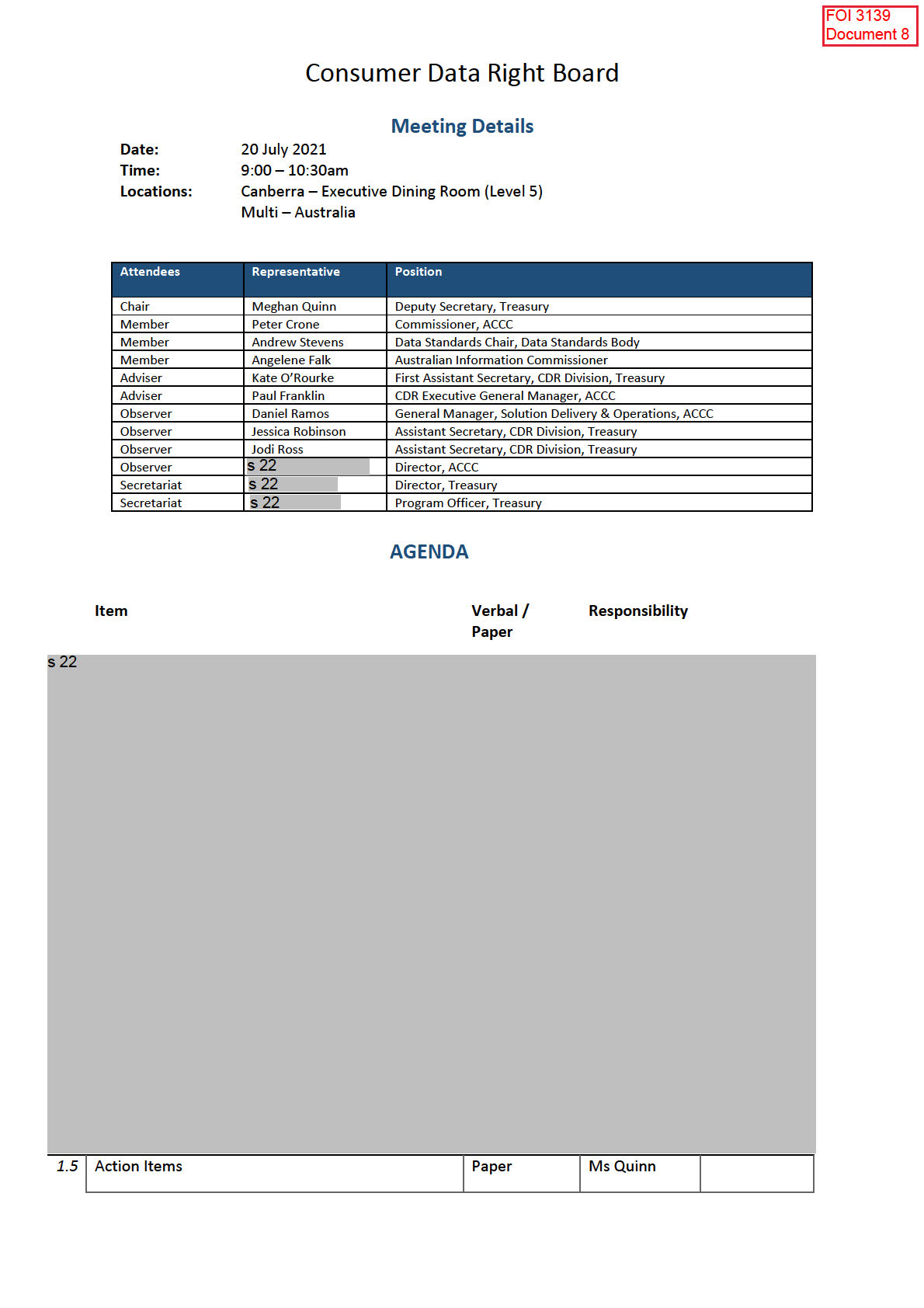

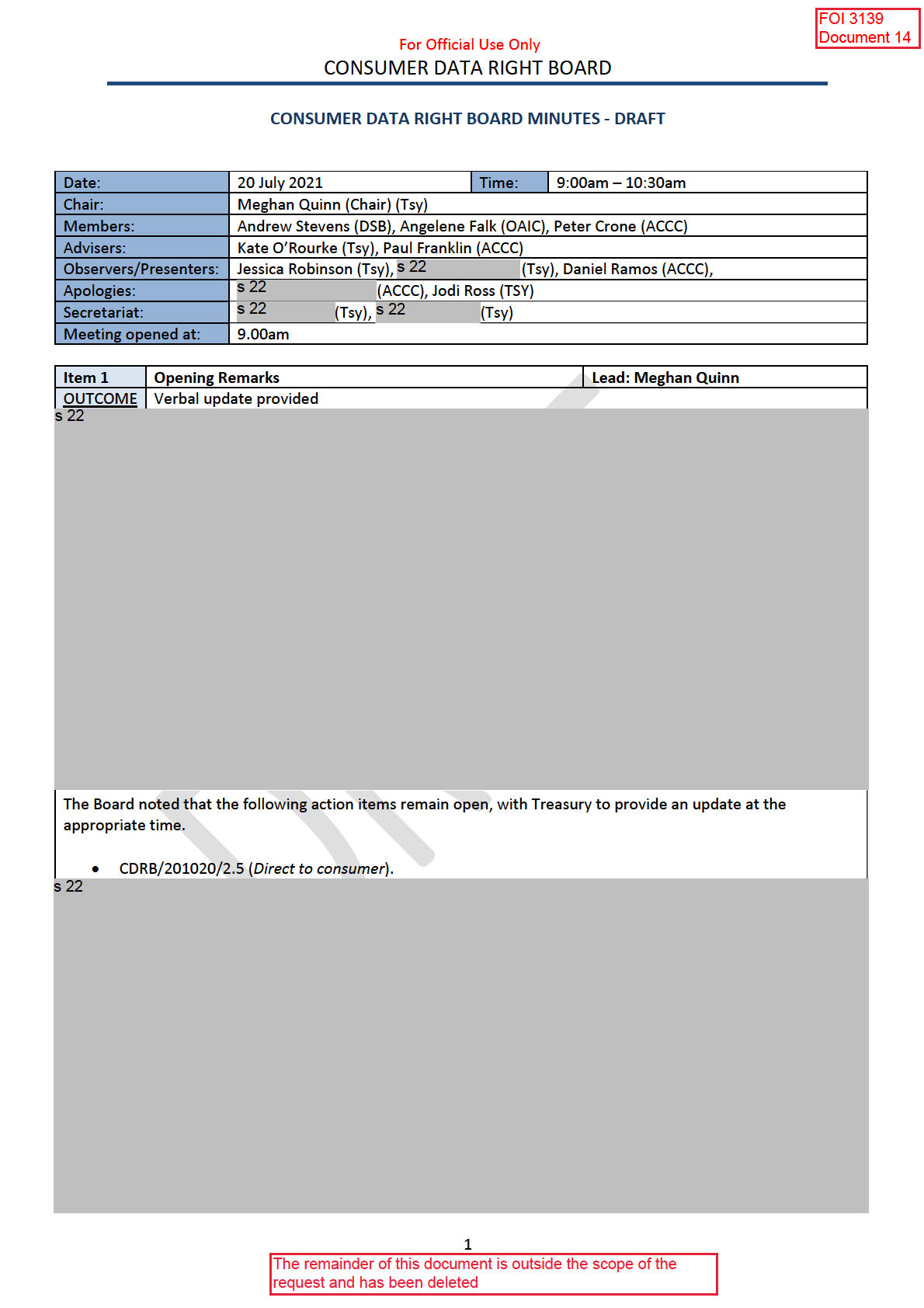

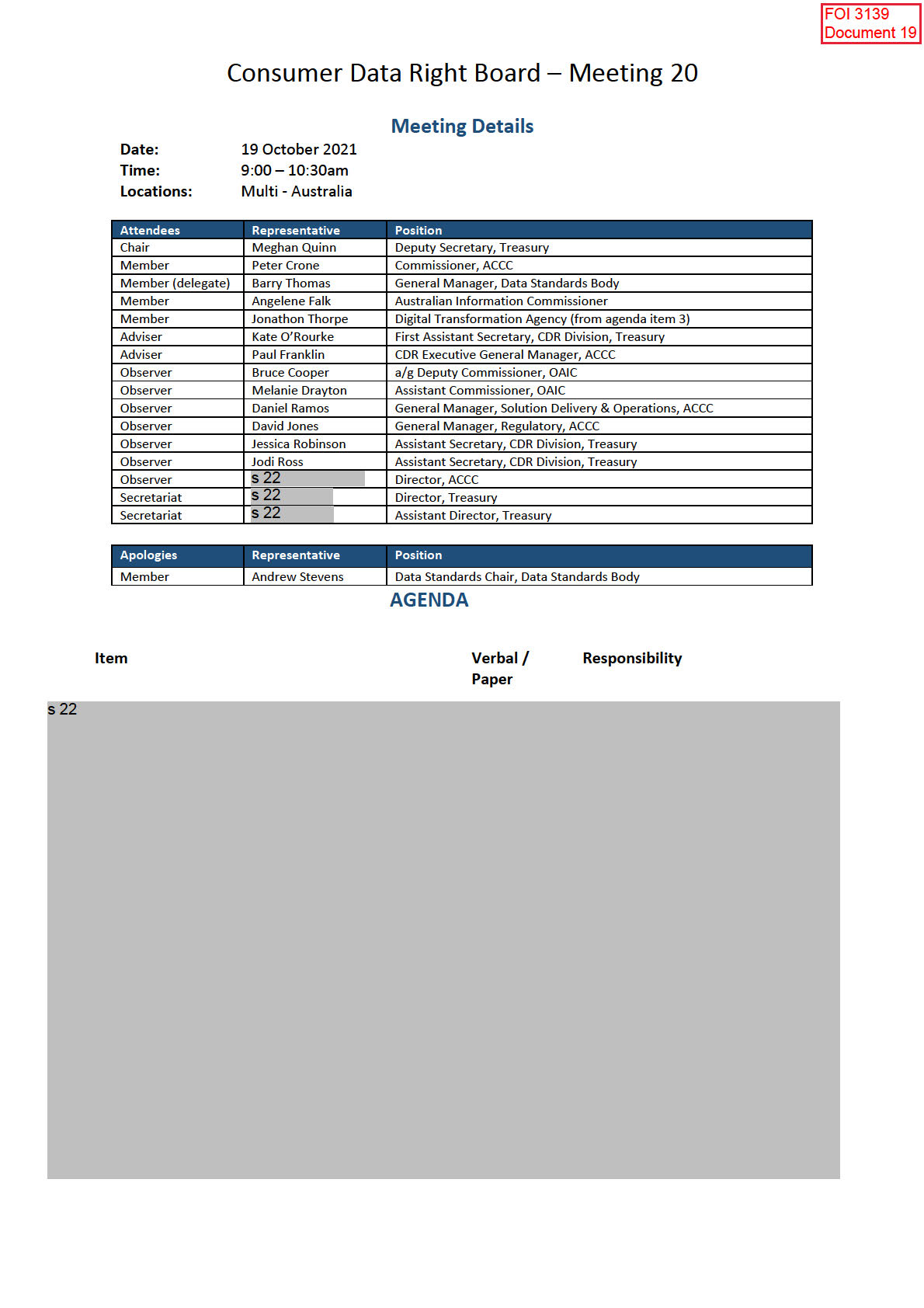

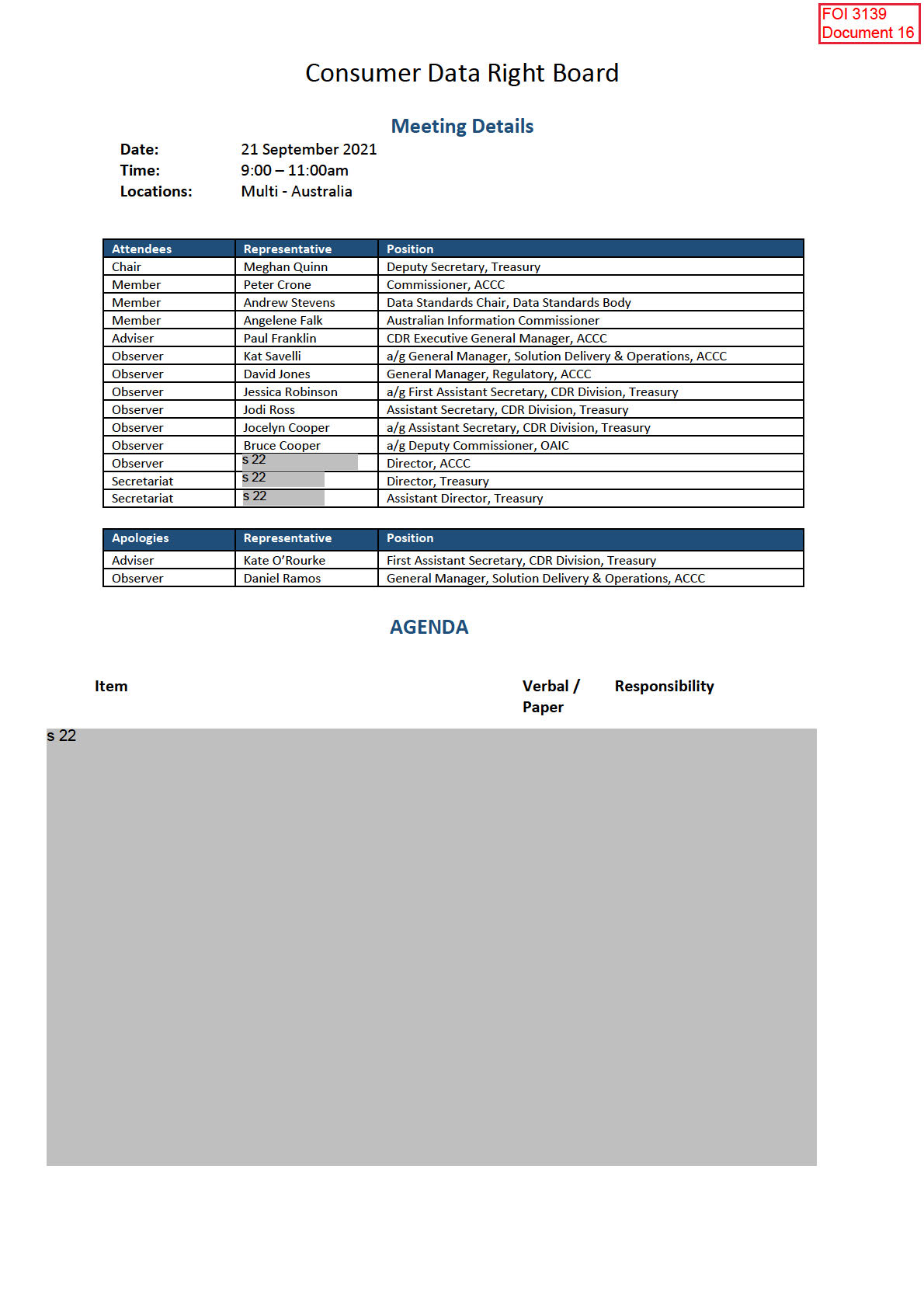

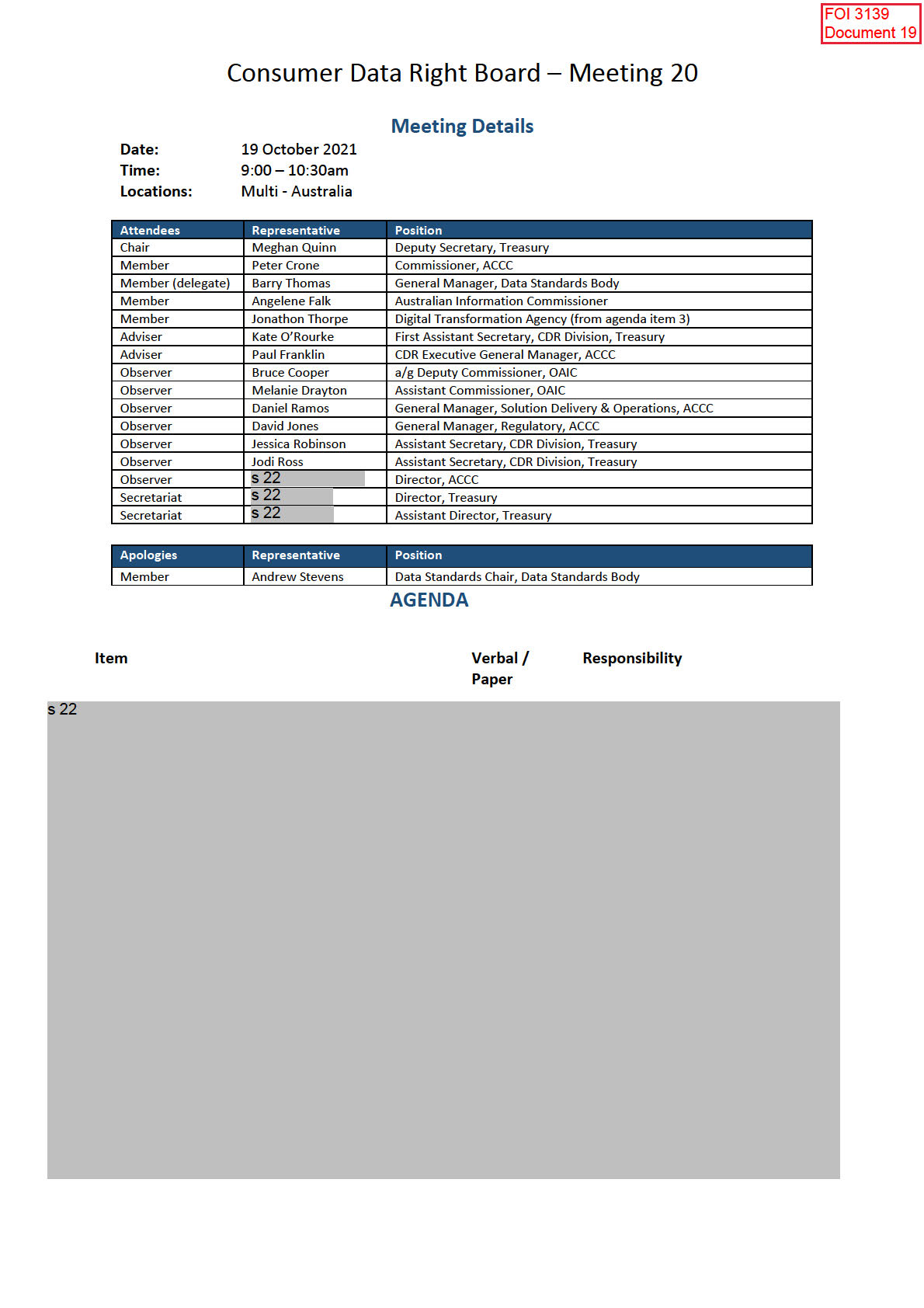

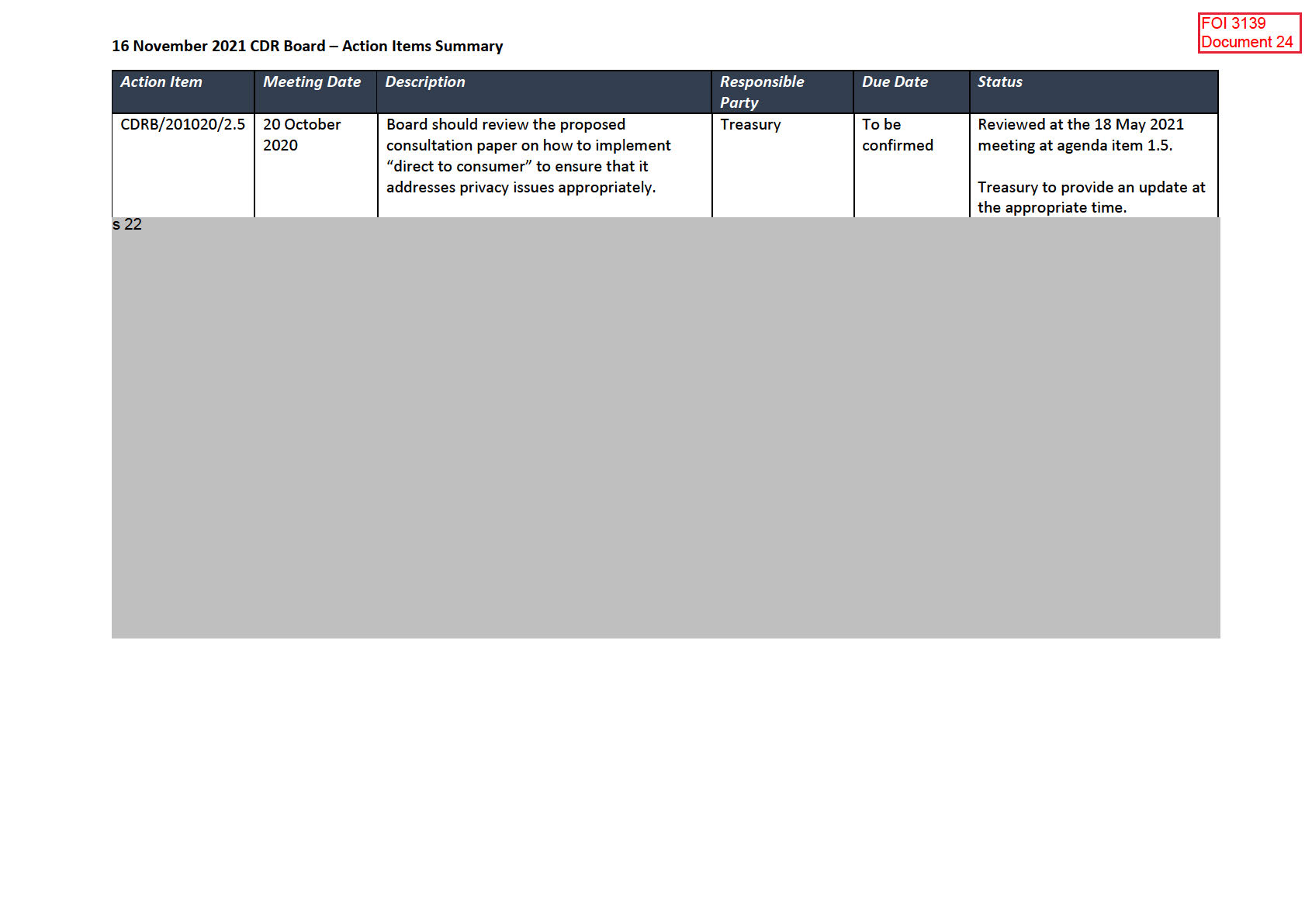

Consumer Data Right Board – Meeting 20

s 22

1.5 Action Items

Paper

Ms Quinn

s 22

The following action items remain open:

• CDRB/201020/2.5 (

Direct to consumer).

s 22

The remainder of this document is outside

the scope of the request and has been

deleted

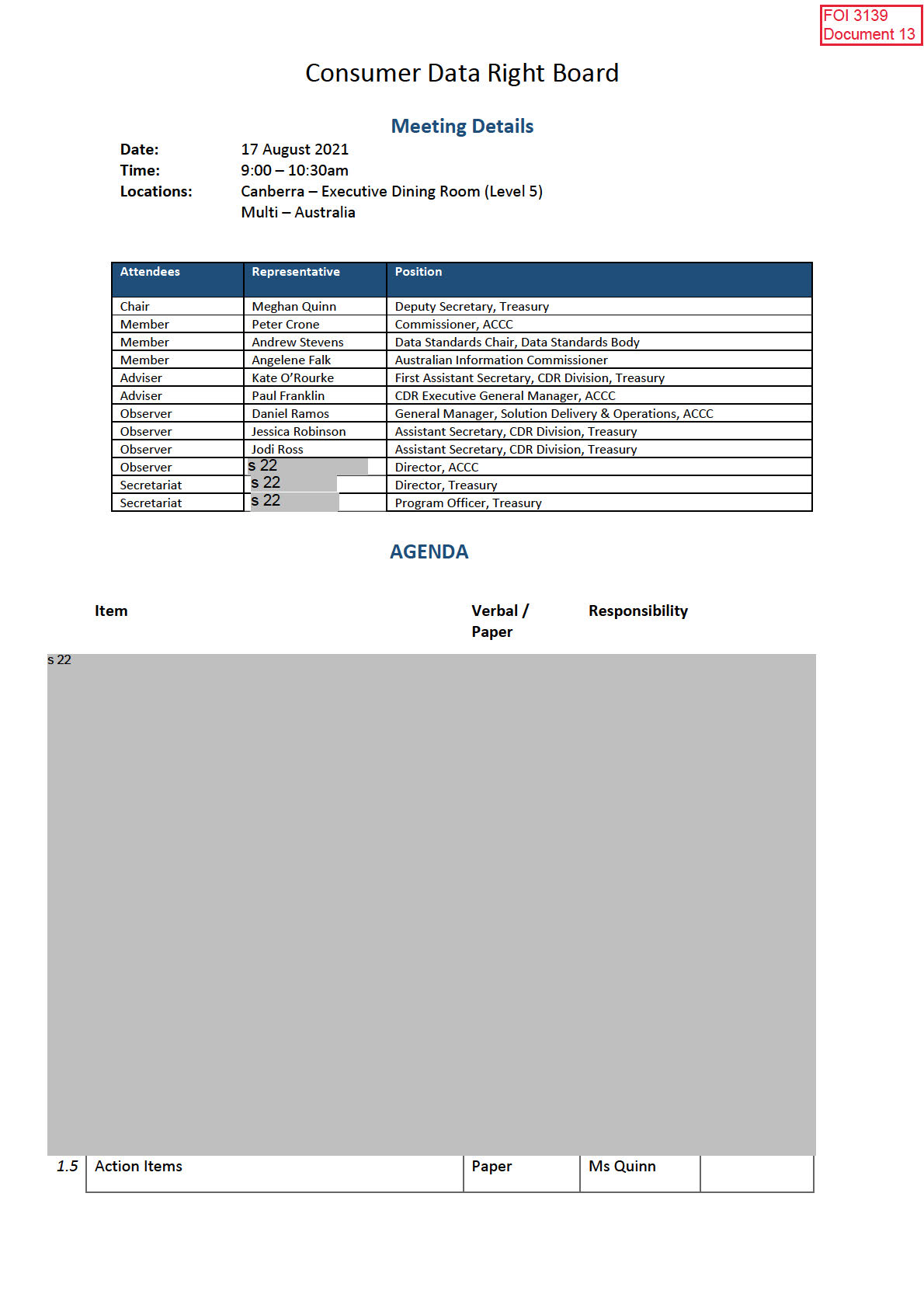

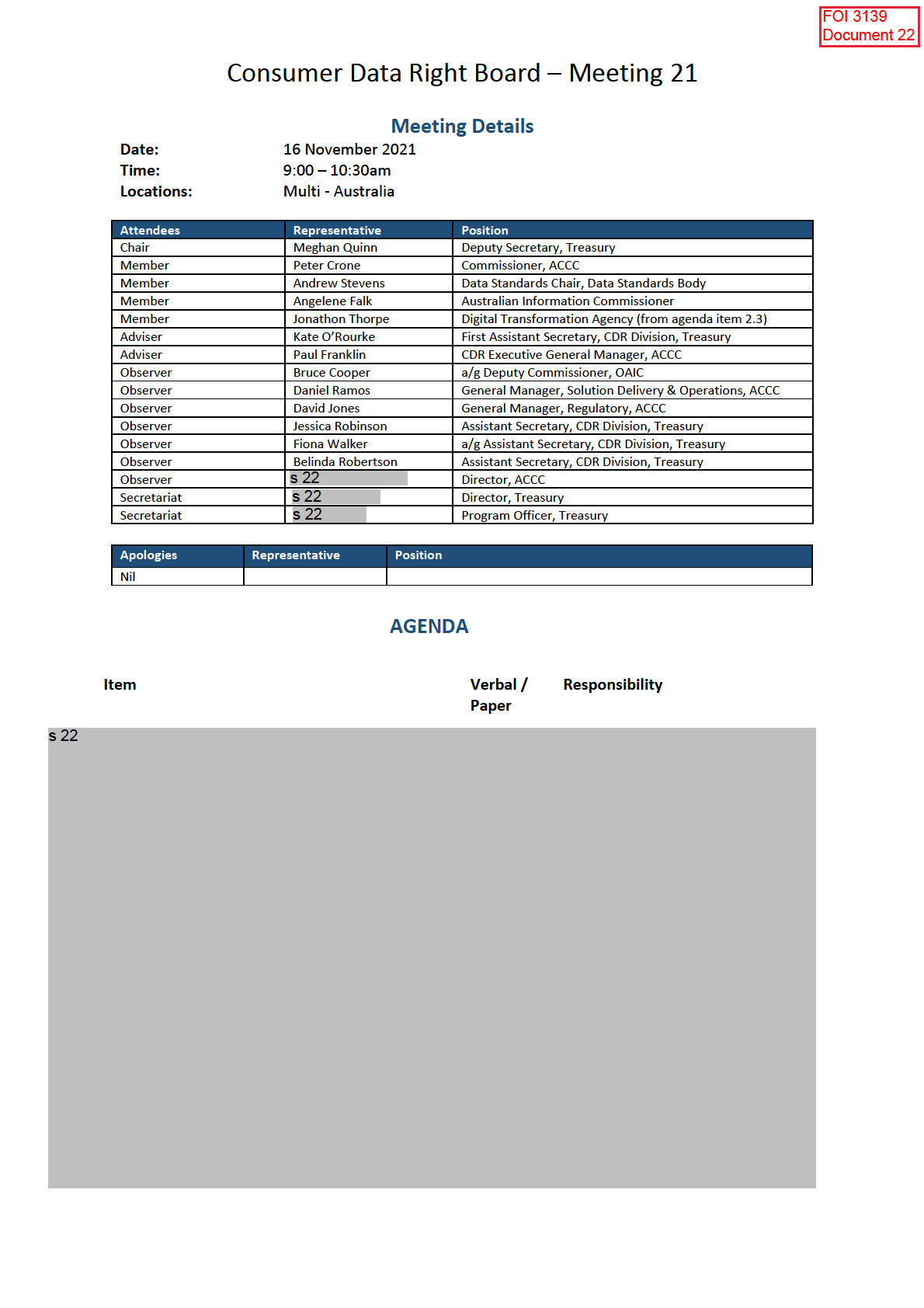

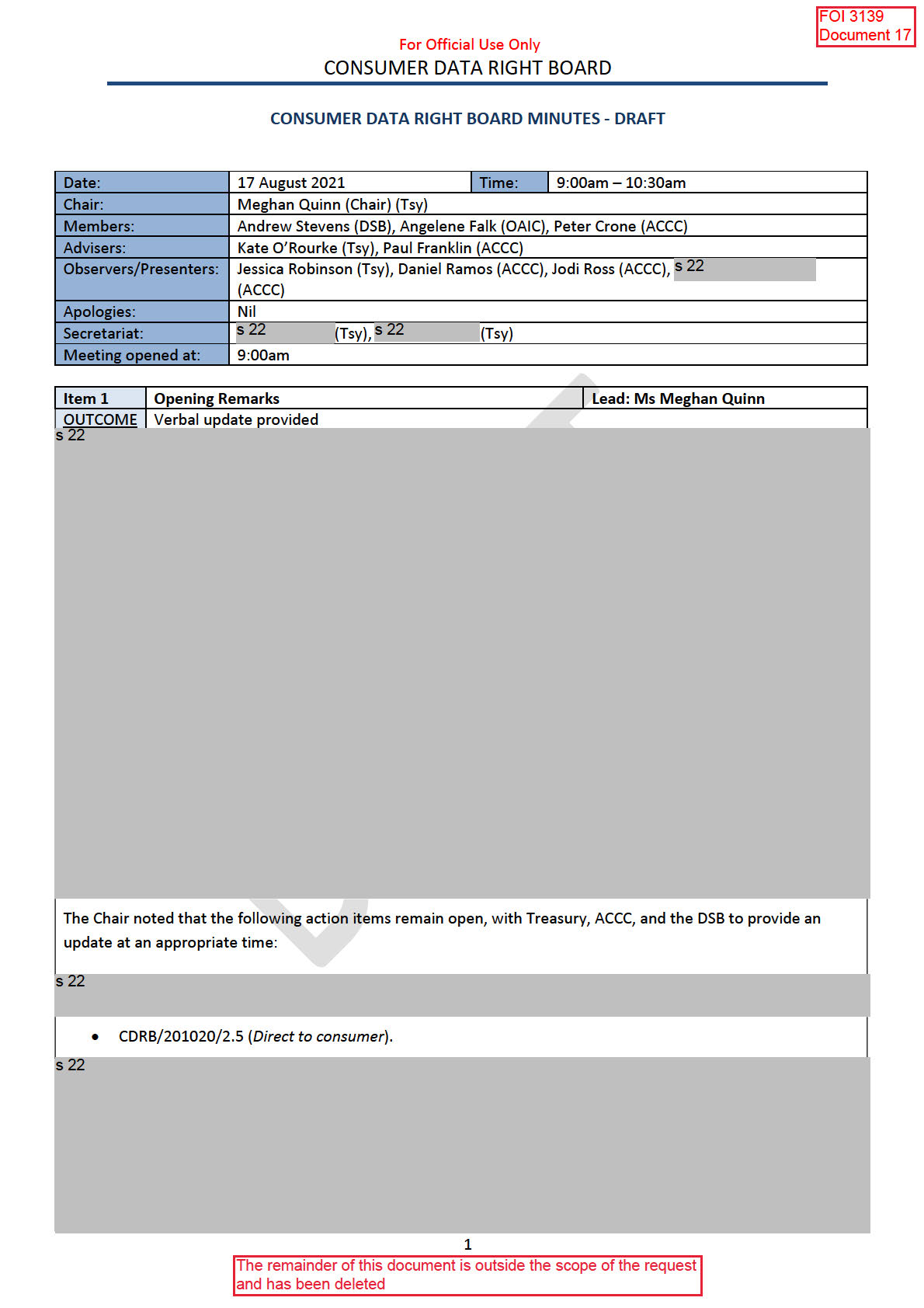

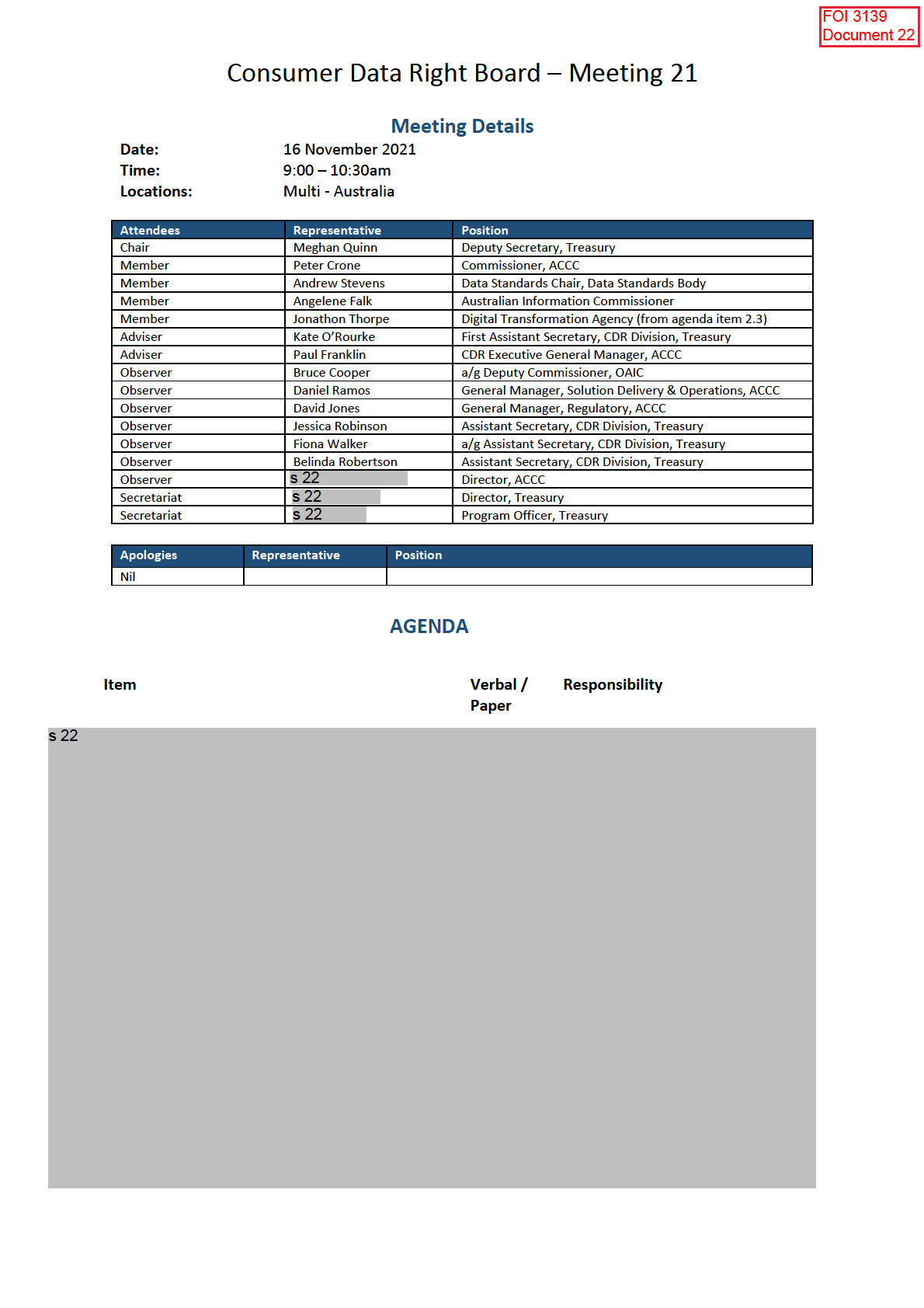

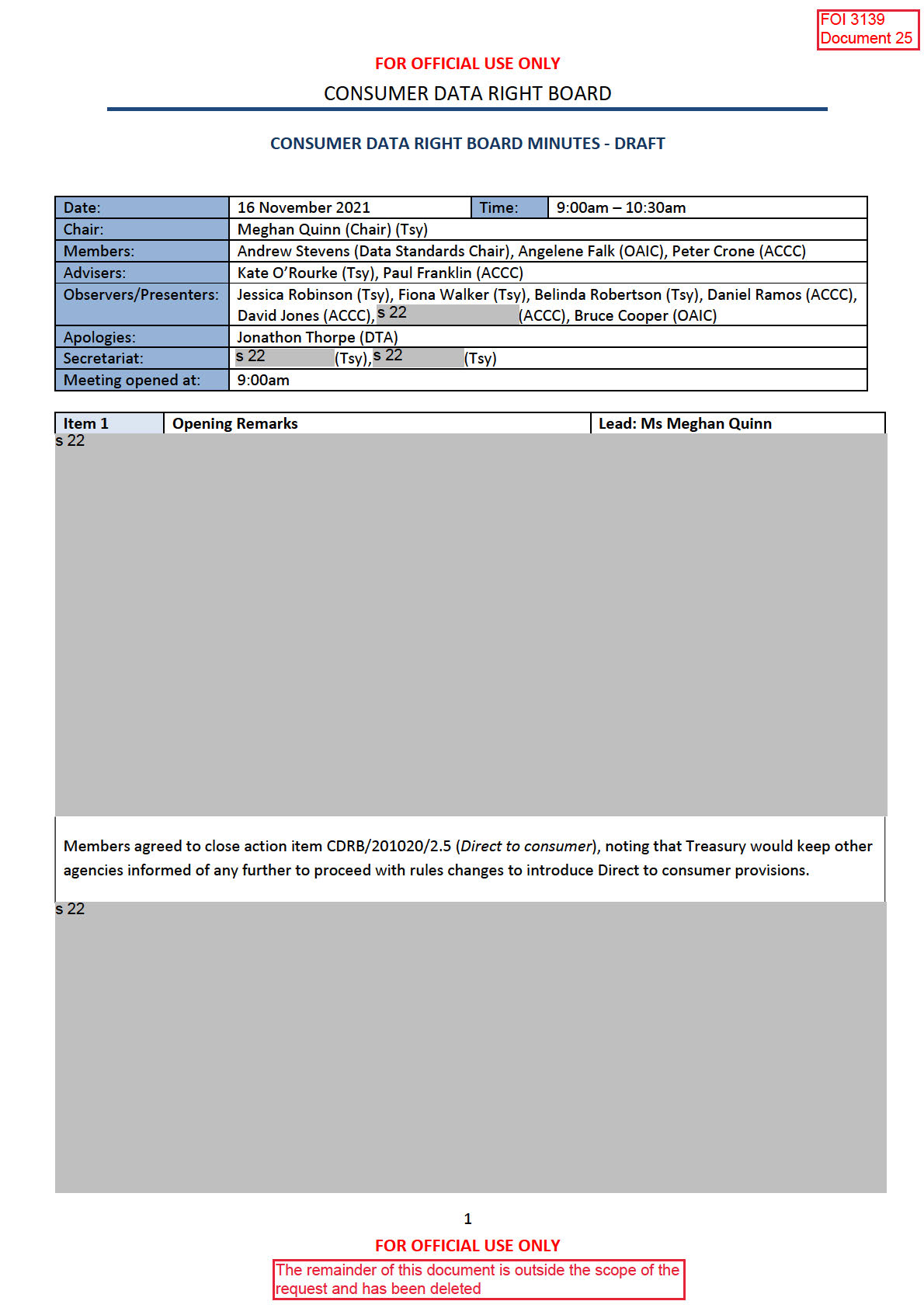

Consumer Data Right Board – Meeting 21

s 22

1.5 Action Items

Paper

Ms Quinn

Recommend that action item CDRB/201020/2.5

(

Direct to consumer) is moved to be closed, noting

that the inclusion of direct to consumer provisions

in the rules has been indefinitely deferred. The

item was first raised in October 2020.

s 22

The remainder of this document is outside

the scope of the request and has been

deleted

FOI 3139

Document 26

s 22

From: CX <xx@xxxxxxxxxxxxxxxxxxxxx.xxx.xx>

Date: Monday, 28 February 2022 at 12:58 pm

To: s 47F

Cc: s 22

Subject: Re: Attn: s 22

Hey s 47F

Great to chat just then.

Here are the links I promised:

Direct to Consumer – data standards consultation

The most recent Direct to consumer deferral announcement

The direct to consumer exemption – which I believe you have already seen;

The direct-to-consumer exemption link may not be the most up to date as it refers to Nov 2021.

There are exemptions for individual DHs that defer to July 2022, but I’m certain it’s deferred

indefinitely. It’s notoriously hard to find these details so I’ve just put out a request for the most

up to date info.

Hope the above helps.

Best,

s 22

Consumer Experience Lead

Data Standards Body | Consumer Data Right Division

E s 22

T s 22

W www.consumerdatastandards.gov.au

Consumer Data Standards acknowledges the Traditional Owners of the lands that we live and work on across

Australia and pays its respect to Elders past and present.

PLEASE NOTE

The information contained in this email may be confidential or privileged. Any unauthorised use or disclosure is

prohibited. If you have received this email in error, please delete it immediately and notify the sender by return

email. Thank you. To the extent permitted by law, Consumer Data Standards does not represent, warrant

and/or guarantee that the integrity of this communication has been maintained or that the communication is

free of errors, virus, interception or interference.

This email (including attachments) is confidential and intended for the addressee(s) named above. If you have

received it by mistake, please inform us by an email reply and then delete it from your system, destroy all

copies, and do not disclose as our policy is that it is not permissible to reproduce, adapt, copy, forward, or in

any way reveal this message without the senders consent.

FOI 3139

Document 27

From:

s 22

To:

s 22

Cc:

s 22

; s 22

Subject:

FW: Zendesk Question 1608 - Direct to Consumer Obligations [ACCC-ACCCANDAER.FID2815417]

[SEC=OFFICIAL]

Date:

Friday, 22 July 2022 3:11:00 PM

Attachments:

image001.png

image002.png

image004.png

image006.png

OFFICIAL

From: s 22

Sent: Friday, 15 July 2022 1:47 PM

To: s 22

; s 22

s 22

s 22

Subject: RE: Zendesk Question 1608 - Direct to Consumer Obligations [ACCC-

ACCCANDAER.FID2815417] [SEC=OFFICIAL]

Hi s 22

,

Yes, I think this is definitely one for us. Thank you for sharing!

s 22

and s 22

For info - the ACCC has received a Zendesk enquiry about timeframes for

consultation re expanding Open Banking to direct-to-consumer sharing. One for next week, but I

assume we will want to refer them to the CDR statutory review.

Previous ACCC advice: Response to queries:...~https://cdr-support.zendesk.com/hc/en-

us/articles/360004343516-Response-to-queries-Deferral-of-joint-account-and-direct-to-

consumer-obligations

Rules for direct-to-consumer sharing are established under Part 3 of the CDR Rules

(Consumer data requests made by eligible CDR consumers)

Right now direct-to-consumer sharing under Part three is not included in the Banking

(Schedule 3, Rule 6.6) or energy (Schedule 4) commencement schedules.

Cheers,

s 22

CDR Policy Issues Unit |s 22

From: s 22

Sent: Friday, 15 July 2022 11:52 AM

To: s 22

Subject: FW: Zendesk Question 1608 - Direct to Consumer Obligations [ACCC-

ACCCANDAER.FID2815417] [SEC=OFFICIAL]

OFFICIAL

Hi s 22 – I think this one might be for your team? Let me know if you agree and/or if we can

help!

s 22

s 22

Consumer Data Right Division | Markets Group | The Treasury

Langton Crescent, Parkes ACT 2600

Ph: s 22

|

M: s 22

cdr.gov.au | Subscribe to receive CDR updates

Consumer Data Right acknowledges the traditional owners of country throughout Australia, and their continuing

connection to land, water and community. We pay our respects to them and their cultures and to elders both

past and present.

LGBTIQ+ Ally

OFFICIAL

From:s 22

Sent: Friday, 15 July 2022 11:35 AM

To: s 22

Cc: s 22

; s 22

s 22

Subject: Zendesk Question 1608 - Direct to Consumer Obligations [SEC=OFFICIAL] [ACCC-

ACCCANDAER.FID2815417]

OFFICIAL

Hi s 22

The ACCC Regulatory Guidance team has received the below Zendesk query (ZQ

1608) regarding the deferral of direct to consumer obligations:

I was wondering if any updated timelines were available regarding the deferral of

‘direct to consumer’ obligations. I see in your latest article that a consultation was

planned to occur before November 2021. I was wondering if this consultation

occurred and if not what the current timeline if any is?

As the question relates to CDR policy, we would be grateful for your team’s input.

Thanks very much and please let us know if you would like to discuss further.

Warm regards,

s 22

Graduate – Regulatory Guidance | Regulatory Branch | Consumer Data Right Division

Australian Competition & Consumer Commission

Level 29M, 135 King Street, Sydney NSW 2000

T:s 22

www.accc.gov.au

The ACCC acknowledges the traditional owners and custodians of Country throughout

Australia and recognises their continuing connection to the land, sea and community. We pay

our respects to them and their cultures; and to their Elders past, present and future.

---

IMPORTANT: This email from the Australian Competition and Consumer Commission

(ACCC), and any attachments to it, may contain information that is confidential and may

also be the subject of legal, professional or other privilege. If you are not the intended

recipient, you must not review, copy, disseminate, disclose to others or take action in

reliance on, any material contained within this email. If you have received this email in

error, please let the ACCC know by reply email to the sender informing them of the

mistake and delete all copies from your computer system. For the purposes of the Spam

Act 2003, this email is authorised by the ACCC www.accc.gov.au